USDA trims Argentinian production more than expected: Grain market daily

Thursday, 9 March 2023

Market commentary

- Old crop UK feed wheat futures (May-23) closed yesterday at £220.00/t, down £2.50/t from Tuesday’s close. New-crop futures (Nov-23) fell just £0.75/t over the same period, to close at £223.75/t.

- Domestic new crop futures are retaining a premium over old crop futures once more.

- UK wheat followed US and European markets down yesterday, on expectations of the renewal of the Black Sea Initiative (Ukraine export corridor), as talks take place to extend the deal. Ample cheap Russian supplies on the global market also continue to pressure prices.

- Paris rapeseed futures (May-23) fell €6.25/t yesterday, to close at €513.25/t. This followed pressure in nearby brent crude oil futures and Malaysian palm oil futures (Jun-23).

- Chicago soyabean futures (May-23) closed up $0.83/t yesterday, to settle at $557.62/t.

USDA trims Argentinian production more than expected

Yesterday, the USDA released their latest World Agricultural Supply and Demand Estimates (WASDE). The latest report was not expected by the market to bring any big changes, and this in many ways has rung true.

The focus of this report has been, as expected, on South American production of maize and soyabeans, considering the worst drought conditions in Argentina for 60 years.

The USDA has trimmed production forecasts for maize and soyabeans in Argentina in this recent report. Though, how does this compare to trade expectations and other consultancy forecasts? Furthermore, what does this mean for world ending stocks? All these questions are answered below.

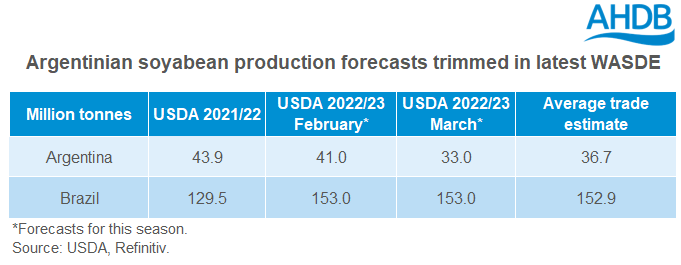

Soyabeans

This month’s WASDE estimates show reduced global production and domestic consumption, with increased trade forecast, resulting in smaller global ending stocks.

Cuts to the Argentinian crop are the key reason for reduced global production this month, as the crop is reduced by 8Mt to 33Mt. This is unsurprising following cuts in forecasts across many different Argentinian consultancies in recent weeks/months, though this drop is larger than expected by trade. This is a large revision for the USDA to make, considering movements in numbers are often small.

Is this number low enough? Well, yesterday the Rosario Grain Exchange trimmed its Argentinian soyabean forecast for 2022/23 from 34.5Mt to 27Mt. So, we could see further revisions to the crop potentially.

However, it’s important to note, the Brazilian soyabean crop is still forecast at a record 153Mt.

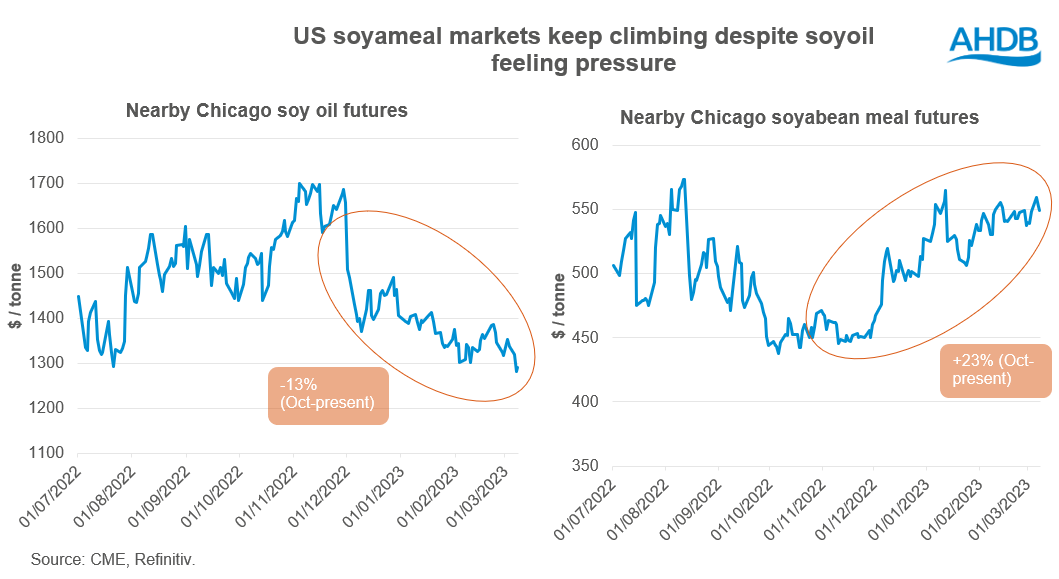

Nevertheless, the reduction in Argentinian output tightens the balance for global oilseed supply. It also tightens supply of global soyameal too, as shown in yesterday’s WASDE, with cuts to Argentina’s soyameal production and export estimates. Argentinan soyameal exports over the past five seasons has accounted for c.40% of global exports. Considering the strength seen in US soyameal prices over recent months despite some weakness in US soyoil prices, this could add further support overall to the soyameal market.

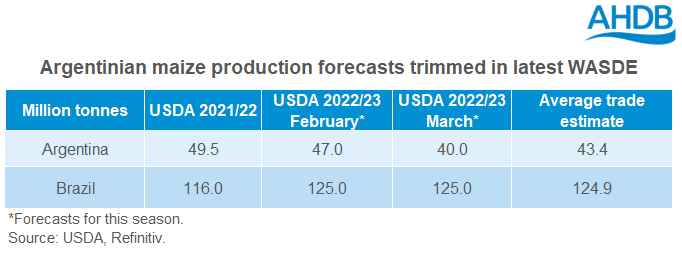

Maize

The latest WASDE for maize shows reduced production, consumption and trade, resulting in higher ending stocks for this season.

The Argentinian maize crop was cut back 7Mt, to a new forecast of 40Mt. This trim is larger than expected by trade. For overall global production, the downward revision to Argentinian production was offset slightly by an increased outlook for maize in India and Paraguay.

Brazilian production forecasts remained unchanged at 125Mt, a record crop.

However, much like soyabeans, the question remains is Argentina’s production number low enough? Well, yesterday the Rosario Grain Exchange trimmed its Argentinian maize forecast for 2022/23 from 42.5Mt to 35Mt. Could that mean there are more trims to the USDA forecast to come?

I believe the direction for maize prices heading forward will also lie with demand. Can ethanol demand hold firm going forward, in the US especially?

Wheat

Finally, following the latest WASDE report, a note on wheat. Despite an increased global production forecast, smaller beginning stocks are the key reason for seeing global ending stocks lower this month. Global ending stocks are pegged at 267.2Mt, down 2.1Mt from last month. Lower beginning stocks are down to revised data for China. Therefore, excluding China, global ending stocks are higher month-on-month by 2.9Mt, at 127.6Mt.

Global production for 2022/23 has been revised higher on increases in Kazakhstan, Australia and India.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.