Argentina is keeping rapeseed prices supported: Grain market daily

Tuesday, 7 March 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £218.00/t, down £3.50/t on Friday’s close. New crop futures (Nov-23) closed at £224.75/t, down £2.60/t over the same period.

- Our domestic market followed both the Paris and Chicago market down yesterday. Expectations of the renewal of the Black Sea grain export deal is pressuring the market. With Turkish Foreign Minister saying that Turkey is working to extent the U.N-backed initiative.

- The Australian Bureau of Agricultural and Resource Economics (ABARES) increased their estimate for 2022/23 wheat production to a record of 39.2Mt.

- Paris rapeseed futures (May-23) closed yesterday at €529.75/t, down €8.75/t on Friday’s close. ABARES also upped Australia’s 2022/23 record canola crop from 7.3Mt to now be estimated at 8.3Mt.

- Despite pressure on rapeseed prices, Chicago soyabean markets felt support yesterday, following the rallying support in soyameal markets. This is from global supply concerns over the ongoing drought in Argentina and their share of soyameal exports to the world – read more on this below.

Argentina is keeping rapeseed prices supported

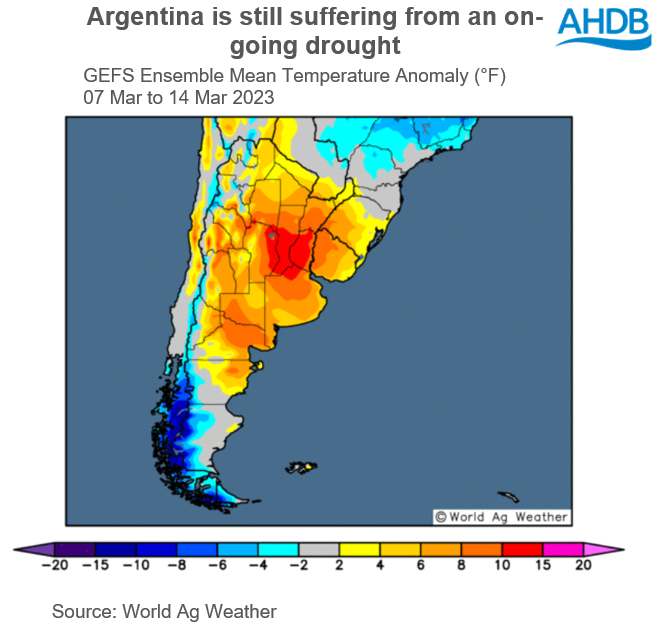

Argentina has been hit by the worst drought in 60 years, which has been ongoing since last year. To start, it severely impacted their wheat crop for this marketing year (2022/23). Currently, it is having significant implications on their spring cropping which is being hit hard by the ongoing drought.

We’ve been discussing for a while that the impacting risk of the La Niña weather event has been priced into the soyabean market. That combined with other factors, such as demand for biofuels, has kept soyabean prices elevated. Which to some extent has provided the fundamental supporting floor to domestic rapeseed prices.

According to Buenos Aires Grain Exchange (BAGE) 67% of the soyabean crop (up until 02 Mar) is rated “poor / very poor”, up from 60% estimated the week before and up from 23% estimated at the same point last year. The crop is currently forecast at 33.5Mt by BAGE, further revisions are expected to this crop. Oilworld predict that the crop could be somewhere between 25Mt to 28Mt, significantly down from the potential of 48Mt which was expected at the start of the growing cycle (oilworld.biz).

Over the next seven days, temperatures are going to be abnormally high in Argentina’s agricultural region, which will further add stress, we are awaiting further revisions for this soyabean crop.

Predicting the USDA

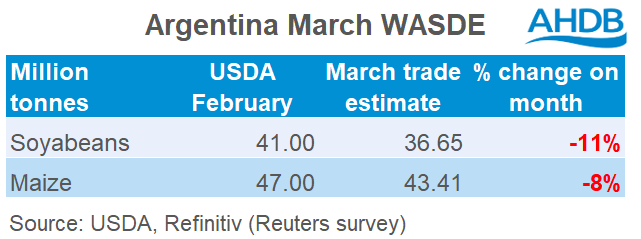

Tomorrow the latest USDA March World Agricultural Supply & Demand Estimate (WASDE) is going to be released, with revisions expected to Argentina’s maize and soyabean crops.

Average analysts’ estimates are pegging Argentina’s soyabean production at 36.65Mt, with anticipations of 4.35Mt being trimmed in one hit. However, production is still higher than other agricultural consultancies such as BAGE (33.5Mt) and Rosario Grain Exchange (34.5Mt).

With the WASDE being a large source of driving market sentiment, if this prediction is greater than expectations, could we see further support for soyabean prices? I’d argue if they slash further than it wouldn’t be much of a surprise, unless it goes under 30Mt.

But where now for prices?

Has the market really priced in the extent of the damage to this soyabean crop? At first the market was very concerned on the marginal trims. However, since then we have seen very large cuts to the initial estimate.

This is going to have implications to the global market, especially for soyameal markets. With Argentina’s processing capacity of soyabeans, if that reduces, this will have knock-on implications for soyameal and Argentina’s ability to meet export expectations.

Despite all this bullish news, there is still a large Brazilian soyabean crop due with Conab (Brazilian government) currently estimating the crop at 152.9Mt, increasing by 21.8% year-on-year. This is being harvested right now, albeit slightly delayed, but it is progressing. This slight delay, combined with disruptions in inland transportation in Brazil, has limited exports of soyabeans and soyameal recently. This has the potential to bring back some demand to US origin soyabeans, which could then reduce their ending stocks further, which currently are the tightest since 2015/16.

In the short term, as adverse weather prevails in Argentina there is going to be an underlying market support for soyabeans, which will inherently feed into domestic rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.