China, where next for maize and soyabean demand? Grain market daily

Wednesday, 1 February 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £232.45/t, up £1.55/t over the session. New crop futures (Nov-23) closed at £225.90/t, up £0.60/t over the same period.

- Domestic and European futures followed strength in US markets yesterday, supported by weather risk for US winter wheat, as well as new global demand. Jordan’s state buyer purchased 60Kt of milling wheat on Tuesday, with Romanian origin expected to be supplied. Egypt also called a wheat import tender for Thursday.

- Despite above average rainfall this month, the US winter wheat crop conditions have not yet made a significant recovery as drought remains in many areas. Released yesterday, top grower Kansas had 21% of winter wheat rated ‘good to excellent’, up 2 percentage points (pp) from the start of January. In Texas the ‘good to excellent’ rating is 14%, up 3pp from last week. Whereas Oklahoma ‘good to excellent’ ratings were at 17%, down from 38% a month ago.

- Paris rapeseed (May-23) futures closed yesterday at €545.00/t, near unchanged (up €0.25/t) over the session.

Carbon Markets Webpages

The AHDB have now launched our new Carbon Markets webpages. Below you can find the link to these, providing you with the latest information, guidance, and analysis of emerging developments in carbon markets to help you navigate through this rapidly developing area.

China, where next for maize and soyabean demand?

Weather concerns in South America has been a key factor driving soyabean and maize markets higher. Over the past couple of weeks, nearby Chicago soyabean futures have been hitting highs not seen since last August/September time. Chicago maize futures have been climbing too, regaining strength last seen in November.

South American weather key driver

Drought in Argentina continues to support markets. Following cuts to forecasted soyabean production across consultancies, yesterday the USDA attaché post in Buenos Aires cut the Argentinian soyabean production forecast to 36Mt, 9.5Mt below the official USDA estimate, and more in line with Argentinian agricultural consultancies.

Rain has been falling in Argentina, helping soyabean plants to develop as well as finish those final plantings for soyabeans and more significantly, maize plantings. Though more rain is needed considering the level of drought.

In Brazil, soyabean harvest has started but seeing some delay from recent rainfall as mentioned in yesterday’s Grain Market Daily. Though it is still early days, and a record Brazilian crop is still due, so why are we seeing market react to the news?

Chinese demand returning?

Markets are hoping demand will pick up form China after a week-long Lunar New Year holiday, arguably one of the world’s most significant importer of maize and soyabeans. Despite higher COVID-19 cases, with easing restrictions, demand is expected to rebound from China after more subdued demand from the country over the past 2 years

This is an added support into the market, especially considering South American weather concerns.

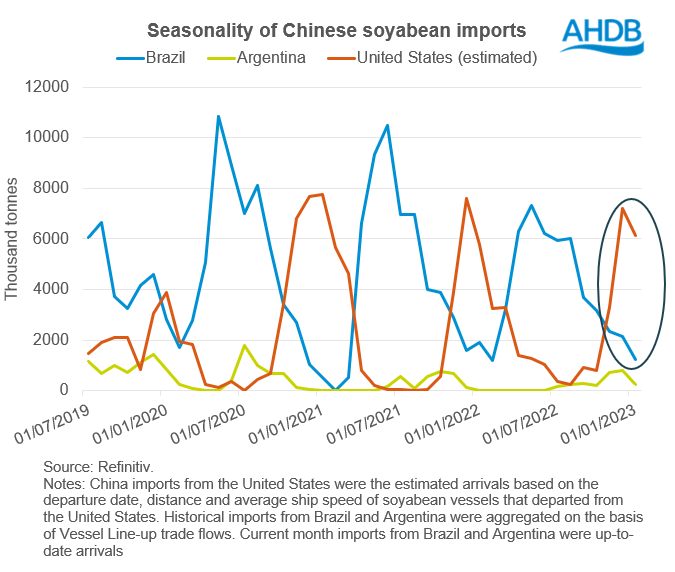

Soyabean markets – who are supplying China?

As seen in the graph below, supply to China of soyabeans between key exporters the US and Brazil, is seasonal. Now is the time where origins see a switch from US to Brazilian, considering the start of harvest. With Brazil due a large crop, Refinitiv are expecting Brazil’s harvest to bring some pressure to US soyabean prices and sales, March to August. It is also expected China may import a record amount of soyabeans in March and April to build depleted Chinese inventories.

Season to date (Jul – Jan), US origin imports of soyabeans have been stronger than the same period last season by 6%, according to Refinitiv data. With US soyabean stocks tighter this season and with market talk that Chinese demand may rebound, the delay in Brazilian soyabean harvest may be playing into current market support in soyabeans despite this being very early in the harvest window. Plus, with the added concerns surrounding a reduced Argentinian supply.

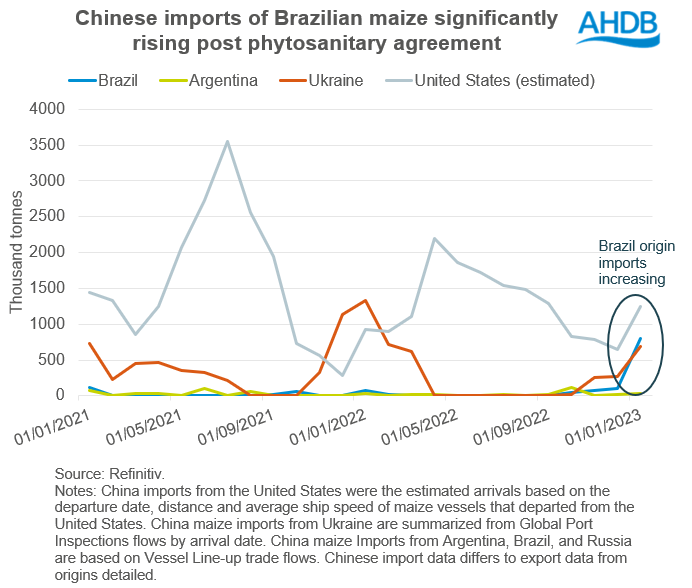

Strong Chinese imports of Brazilian maize forecast

Maize markets too will be sensitive to the news that Chinese demand could start to rebound.

In November, Brazil and China agreed phytosanitary standards for Brazilian maize into China. Since then, Brazilian maize has started to flow into China (Soybean & Corn Advisor). Using Refinitiv data, we can see that Brazilian exports to China have increased dramatically. Though key to note there are some differentials between datasets for Chinese imports vs Brazilian exports, the key thing to note is the trend upwards.

In the release yesterday, the USDA attaché states that some analysts believe Chinese maize imports in 2023 from Brazil could reach 18Mt, which would ‘severely’ impact trade with the US. With full season Chinese maize imports currently forecast by the USDA official figures at 18Mt, will this figure move?

What does this mean?

Global soyabean and maize markets are likely to continue to react to weather news in South America, as well as news on Chinese demand. When the Brazilian soyabean harvest arrives, we could feel some global soyabean price pressure. As such, this will filter through into the wider grain and oilseed markets, impacting domestic values.

More rain is due in Brazil over the next two weeks which could continue to delay harvest in some areas. Argentina too is due some rain in the next 7 days but this is below average.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.