Argentinian rains to bear on the market? Grain market daily

Friday, 20 January 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £227.50/t, down £3.00/t on Wednesday’s close. New crop futures (Nov-23) closed at £220.75/t down £2.70/t over the same period.

- The domestic market followed both the Paris and Chicago wheat market down yesterday. Chicago wheat was down from spill over weakness from maize and soyabeans, as well as lacklustre export demand for US supplies given strong global competition. Paris wheat futures fell as competition from cheaper Black Sea supplies continues to weigh on the market.

- Russia’s Agriculture Ministry has estimated that Russia will export 55-60Mt of grain in the 2022/23 season, and that there is no plans to lower the grain export quota. (Interfax, Refinitiv). But given the current situation around logistics and insurance, there are questions to whether export pace will reach these forecasts.

- Paris rapeseed futures (May-23) continued their weekly pressure, closing yesterday at €540.25/t, down €3.25/t on Wednesday’s close. Following the pressure on the Canadian canola market from the reduction in US soyabean oil prices, which dampened crushers demand for oilseeds. Further to that, much improved weather in Argentina weighed on oilseeds markets – read more below.

Argentinian rains to bear on the market?

Both Chicago maize and soyabean futures (May-23) have been pressured from their multi-month highs set on Tuesday this week. Keeping the market elevated has been the drought in Argentina from the successive third La Niña weather event.

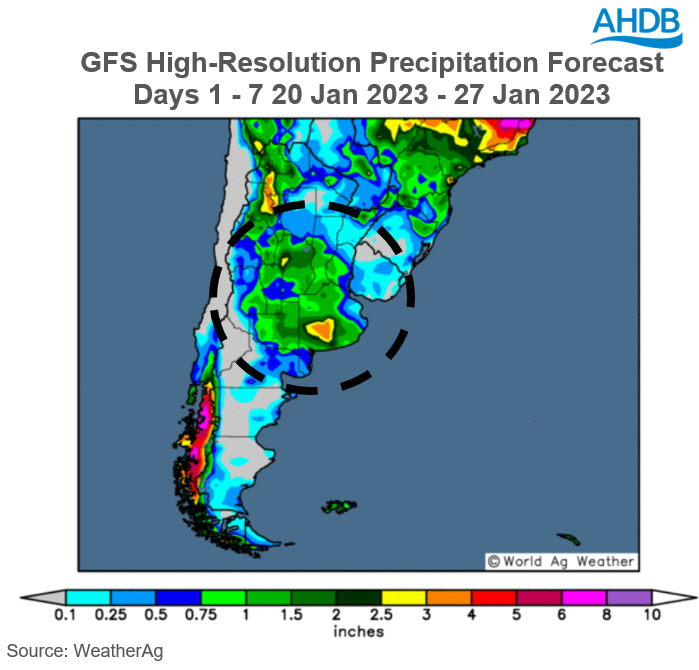

However, widespread rains are now forecast in the coming 7 days over Northern Argentina which will benefit or even potentially salvage some of the production for these two respective crops.

As shown in the graph above, parts of the Buenos Aires region (which accounts for respectively 31% and 27% of Argentinian soyabean and maize production) are going to receive up to 4 inches of rain. With much of the agricultural region getting rain in some quantity over the next week if the forecast is realised. Further to that, weather forecasts further ahead show that rains are going to continue in this region into February, which could potentially constrain any further downwards revisions, which we have recently seen. Though how much falls will be closely followed by the market.

What does this mean?

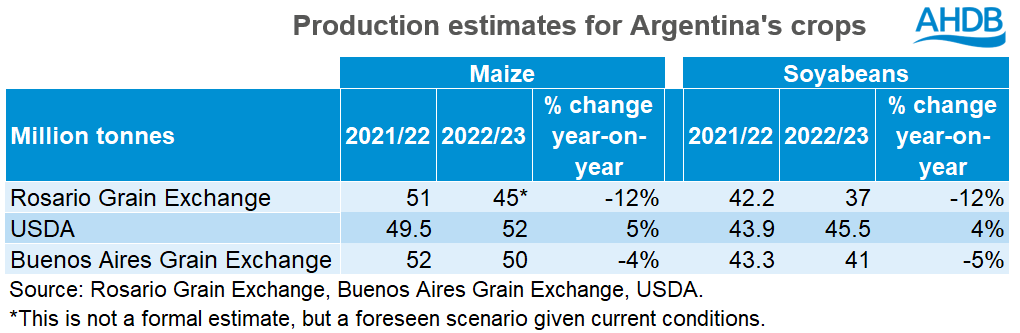

There has been a series of revisions to Argentinian crops recently, with the largest cuts made to soyabeans. The largest cut was from the Rosario Grain Exchange last week, slashing their 2022/23 soyabean production estimate from 49Mt to 37Mt in one hit. The USDA made more conservative trims in their latest World Agricultural Supply and Demand Estimates, cutting the respective Argentinian crops inline mostly with analyst expectations.

Although rains are expected, over the next month if drought like conditions continue, we could see further revisions to this crop, tightening global supply further.

But what is critical to note, although Argentinian crops have had damaging production prospects from this drought, Brazil is still expecting a record maize and soyabean going into 2023, which could weigh on the market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.