Mid-week market drivers: Grain market daily

Wednesday, 18 January 2023

Market commentary

- UK feed wheat (May-23) futures closed yesterday at £230.00/t, down £2.05/t from Monday’s close. New crop futures (Nov-23) closed at £222.50/t, down £3.80/t over the same period.

- UK wheat futures followed European markets down yesterday, despite strength in US wheat futures.

- Paris rapeseed (May-23) futures closed at €560.00/t yesterday, down €6.75/t from Monday’s close. Rapeseed prices followed weakness in palm oil yesterday, more on this below.

- Nearby brent crude oil futures closed yesterday at $85.92/barrel, up $1.46/barrel from Monday’s close (+1.7%).

Mid-week market drivers

Continued concern surrounding the ongoing drought in Argentina trimming the supply outlook, as well as strong US demand, continues to support Chicago maize and soyabean prices.

Yesterday, Chicago soyabeans (May-23) futures closed at $564.88/t, up $3.77/t from the day before. This is the highest point since June 2022. Chicago maize (May-23) futures closed at $268.80/t, up $3.54/t over the same period. This is the highest point since early-November 2022.

After trims to forecast production for Argentinian soyabeans last week, how much rain falls in Argentina remains a key market driver. Some rain is due over the next week but looks below average for many areas.

Strong demand supported US maize and soyabean markets yesterday too, with the USDA reporting private sales of 150Kt of maize to Columbia and 119Kt of soyabeans to unknown destinations. Weekly export inspections were higher than trade expectations for maize (774.5Kt) and soyabeans (2,075.2Kt) for week ending 12 Jan.

Wheat easing, but could we see some support today?

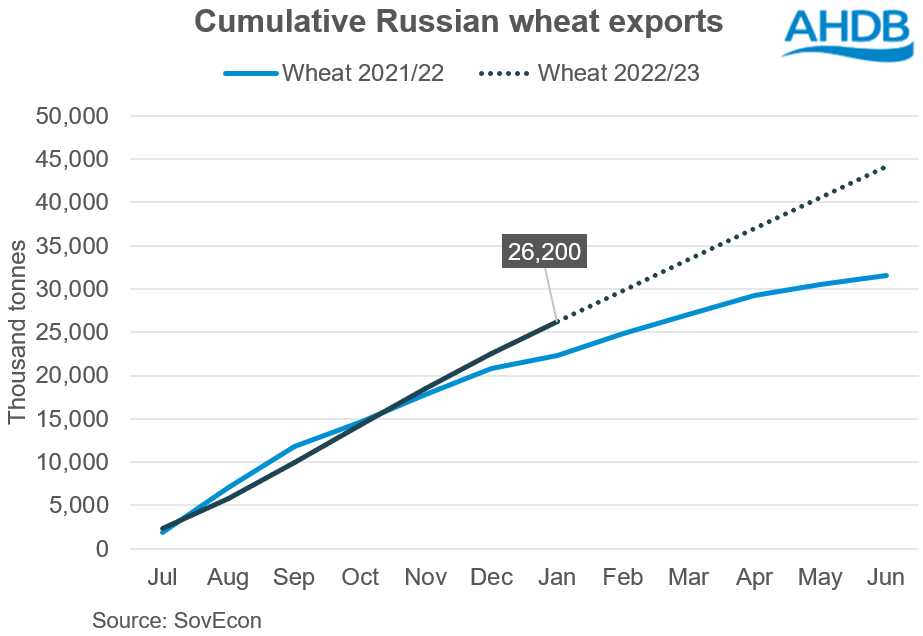

US wheat benefited from strong performance of maize especially yesterday. Whereas European wheat futures continue to feel some pressure from competitive Black Sea supplies, leading domestic futures down slightly too.

Could we see an uptick today? Well, considering Algeria’s tender purchase yesterday, initially thought between 500-600Kt, traders are optimistic the EU could pick up this demand considering high freight costs from Russia (Refinitiv).

Yesterday too, Russian President Vladimir Putin said Russia needs to maintain stable food reserves which, if necessary, may restrict exports. With large wheat export forecast for this season, something to consider on whether Russia meet these expectations.

China

Markets too remain optimistic about Chinese demand growth moving forward, with an ease of restrictions and New Year celebrations closing in.

However, as reported yesterday, China’s population has fallen for the first time in 60 years due to a falling birth rate and large deaths than births last year. Something to consider for future demand.

Wider oil complex

Looking to the wider oil and vegetable oil picture, Malaysian palm oil futures (Apr-23) fell 1.5% yesterday, pressuring Paris rapeseed too. Rapeseed prices continue to move closely with wider vegetable oil and oil markets.

However today, the contract is reportedly up on wider crude oil and soy oil strength on the factors discussed above, as well as some bargain buying. Could Paris rapeseed follow this today?

Domestic inflation figures

Finally, official figures from the Office for National Statistics (ONS) show that domestic rate of inflation has eased from 10.7% in November, to 10.5% in December (from a year earlier levels). A fall in this overall headline figure is reportedly down to lower prices for petrol at pumps, clothing, and recreation and culture.

Though prices remain to be rising for restaurants and hotels, and food and non-alcoholic beverages.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.