Argentina soyabean plantings still a critical watchpoint: Grain market daily

Friday, 6 January 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £241.50/t, up £0.50/t on Wednesday’s close. New crop (Nov-23) closed at £231.10/t, up £1.95/t over the same period.

- Our domestic market followed the Paris market up yesterday with a weaker euro adding to support. Further global support was from bargain buying. However large supplies from the Black Sea put a cap on the gains.

- Paris rapeseed futures (May-23) closed at €587.75/t, down €4.75/t on Wednesday’s close. This movement followed pressure in soyabean markets from worries of a global recession and weakening demand for commodities across the board.

Argentina soyabean plantings still a critical watchpoint

Since the start of November last year, there has been an element of support for nearby Chicago soyabean prices. Part of this support has been from the on-going drought in Argentina. The last four months of 2022 in Argentina were the driest in 35 years, about 44% below normal and 34% drier than last year (Soybean & Corn Advisor). This has had huge implications for their wheat crop and plantings for their soyabean and maize crops.

Based on yesterday’s close, nearby Chicago soyabeans are down 3.5% this week (Fri to Thurs). This downward drift is from spill over pressure in crude oil and the general uncertainty for commodities with recessional fears and rising COVID-19 cases in China.

However, we are nearing the end of Argentina’s soyabean planting window and if additional rains do not come before the middle of this month we could see revisions to the planted area, which will ultimately mean a revision in production. This has the potential to keep an element of support in the oilseed complex which will ultimately to some extent keep wider oilseed values supported.

What is currently happening in Argentina?

Latest updates from Buenos Aires Grain Exchange estimate (until 04 Jan) that Argentina’s soyabean plantings are at 81.8% complete, 11% behind the previous five-year average.

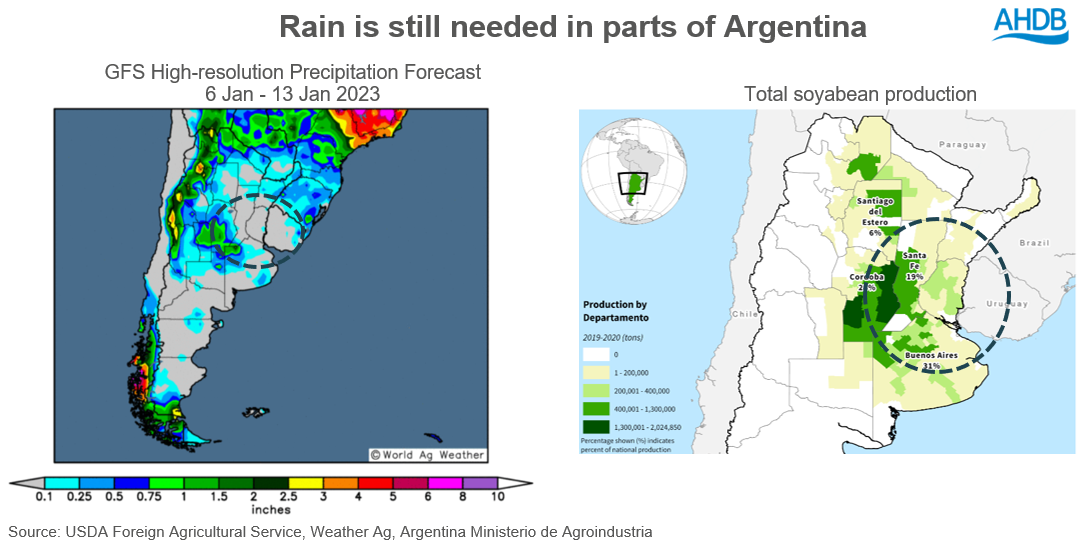

It is reported that rains over the central and south agricultural areas in recent days has aided planting progression. However, it is reported that over 100Kha of planned area for soyabean plantings are at risk as soils are still too dry in northern-central part of Santa Fe (a productive soyabean region) (Refinitiv).

Forecasts over the next seven days show that some rains are forecast in this region, is it enough? Large parts of productive regions in Cordoba and Buenos Aires are going to receive rains which will aid crop development.

With soyabean markets to some extent pricing in the risk premium from this La Niña impact, markets now await further information on the impact to soyabean crop production. But what’s critical to note, is that the large Brazilian crop prospects have not been impacted by this weather, with conditions considered favourable. Brazil is expected to produce a record soyabean crop, so will South American production overall still be large?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.