Short term bullish news supports rapeseed: Grain market daily

Tuesday, 31 January 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £230.90/t, gaining £1.10/t from Friday’s close. New crop futures (Nov-23) closed at £225.30/t, also gaining £1.10/t over the same period.

- Our domestic market firmed with both the Chicago and Paris markets yesterday. Support was from concerns over winter kill, as temperatures in the US plains are expected to drop this week. However, going into the weekend, temperatures along the plains are going to warm up.

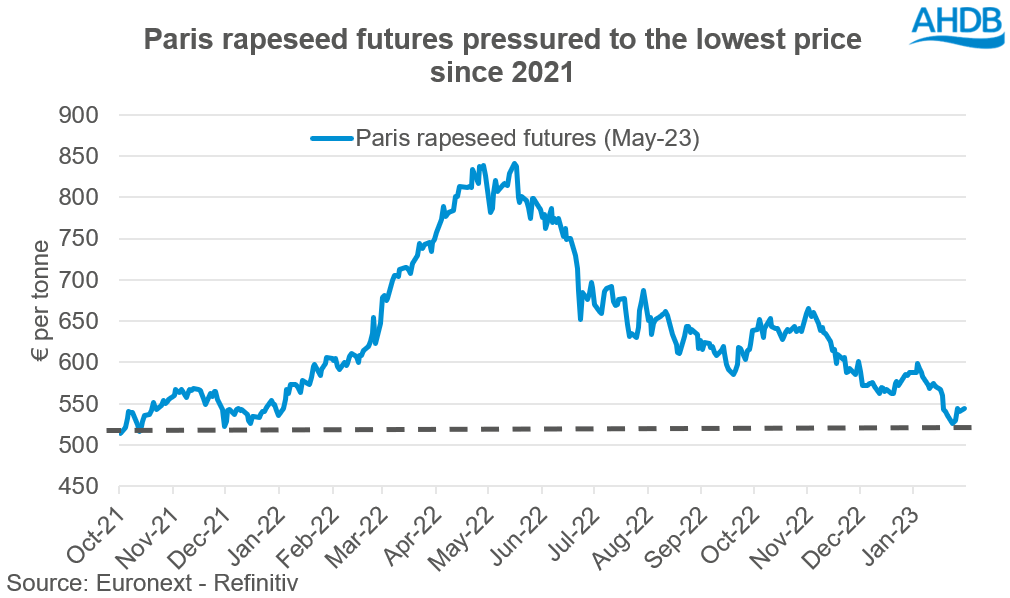

- Paris rapeseed futures (May-23) closed yesterday at €544.75/t, gaining €4.25/t from Friday’s close. Rapeseed prices are riding off the back of support in soyabeans at the moment, with dry conditions persisting across parts of Argentina – find out more below.

Short term bullish news supports rapeseed

At the beginning of last week Paris rapeseed futures (May-23) closed at their lowest price since the middle of December 2021. As the week progressed, the contract recovered some ground, but remains at levels last seen at the start of 2022. The downward pressure on rapeseed futures has also been seen in UK delivered prices, which have been below the £500/t mark now for the past couple of weeks (spot delivery, Erith).

There has been an array of bearish news which has really weighed on rapeseed prices over these last few months. Some of the main causes of pressure have been downward movements in crude oil prices, the continuation of the Black Sea corridor and the German environment minister proposing an end to production of crop-based biofuels in stages, by 2030.

Since the low recorded last Monday (23 Jan), Paris rapeseed futures have gained 4%, with the May-23 contract closing yesterday at €544.75/t.

Driving this support over recent days is further dry conditions across parts of Argentina’s soyabean growing regions, as well as flooding in parts of Malaysia, which has the potential to impact palm oil yields.

Will this continue?

With rapeseed’s premium converging with soyabean futures and trading at near parity to them, any support to soyabean prices will inherently filter into rapeseed prices. Momentarily, the persistent dry weather in Argentina will likely keep prices elevated, with rains looking patchy over the next week in areas that need it.

However, what is critical to note and are key watchpoints for domestic rapeseed prices over the next month are:

- Brazilian harvesting their record soyabean crop, with 5.2% harvested (as of 28 Jan), down from 11.6% from the same point last year (Conab). The market seems very fixated on these marginal losses to the Argentinian soyabean crops. However, Brazil is estimated to produce an extra 27.2Mt on the year, with several consultancies estimating their crop at over 150Mt. With Brazil’s soyabean harvest now underway, the demand origin will switch from US to Brazil. Brazilian prices of soyabeans are being quoted at a consistent discount to US origin. When Brazil’s export campaign starts, this could weigh on prices and give rapeseed the room to move lower.

- There is a virtual OPEC+ meeting being held tomorrow at 11:00GMT to discuss output. The last meeting was in October when OPEC+ agreed to cut its production target by 2 million barrels per day, c.2% of world demand, from November 2022 until the end of 2023. In the coming meeting, there will be discussions over the economic outlook and the scale of Chinese demand. However, these discussions aren’t anticipated to change the policy in place. The outcome and decisions made in this meeting will likely influence crude oil prices and in turn have an impact on the oilseed complex, including rapeseed.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.