Strong demand for soyabeans, what does that mean for rapeseed? Grain market daily

Friday, 27 January 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £231.15/t, gaining £5.15/t on Wednesday’s close. New crop futures (Nov-23) closed at £225.05/t, gaining £3.15/t over the same period.

- Our domestic wheat market followed both Chicago and Paris up yesterday. Chicago wheat futures were supported by signs of rising demand following the latest USDA export sales figures, and concerns about reduced production out of the Black Sea region.

- The Ukraine Grain Association project that Ukraine’s 2023 wheat crop will not exceed 16Mt, as plantings reduce due to the on-going conflict.

- Paris rapeseed futures (May-23) closed yesterday at €544.50/t, gaining €15.25/t on Wednesday’s close. Support filtered from both crude oil and Chicago soyabeans, which were up from strong U.S. export data.

Strong demand for soyabeans, what does that mean for rapeseed?

The U.S. Department of Energy (DOE) yesterday announced $118 million in funding to expand U.S. biofuels production in 17 different projects, which will be designed to accelerate the production of biofuels. An announcement like this and the direction of the Biden administration on cutting greenhouse gas emissions suggest that demand for soyabean oil is likely to remain strong.

Over the last year soyabean oil has had a momentous growth in biofuel feed stock in the U.S. and has led to the premium that we are currently seeing in the vegetable oil complex.

However, rapeseed prices still have the ability to drop despite the strong demand for soyabean crush in the U.S.

Strong crush margins

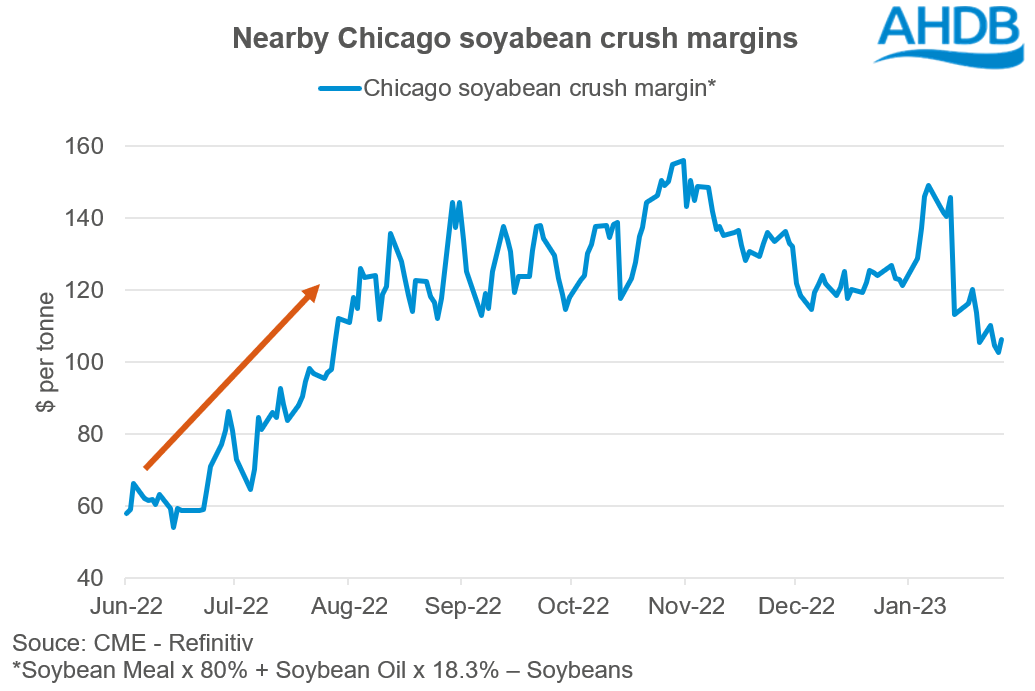

Currently in the U.S. soyabean crush margins are strong. Since June 2022 crush margins have grown as the price of soyabeans has been on an upward trend, which has been climbing off the back of the demand from the U.S. biofuel industry and to some extent the Argentinian drought has elevated prices too.

Chicago soyabean oil prices dropped with crude oil in late November, though stronger meal prices have meant that margins have remained strong despite dropping back slightly.

However, margins are so strong currently that soyabean prices still have the ability to drop and for margins to remain positive.

Soyabeans keeping rapeseed elevated?

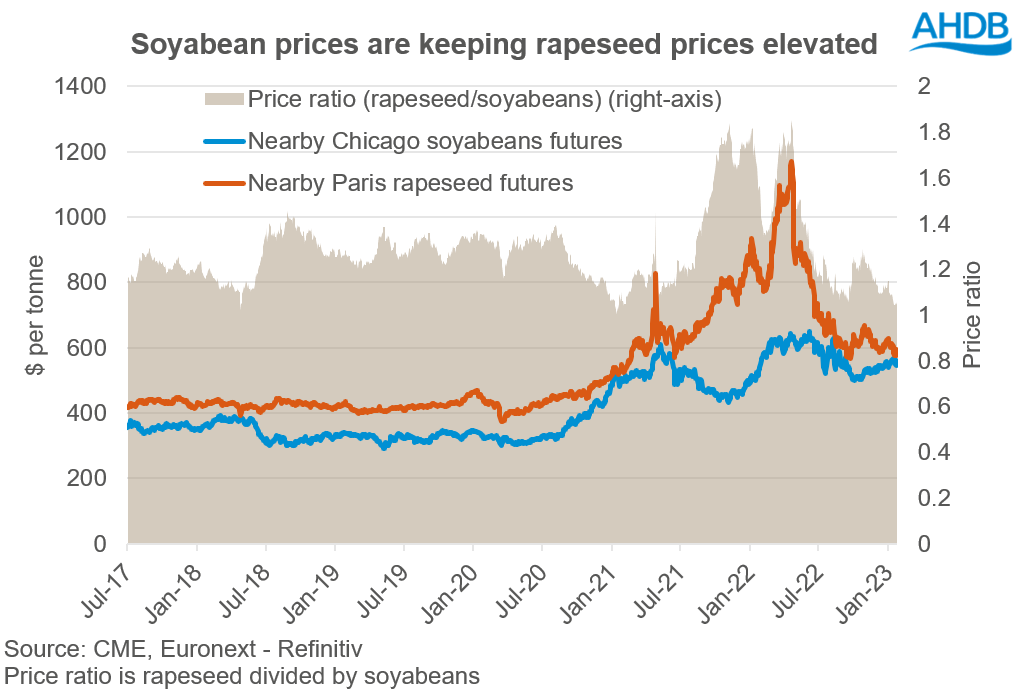

Historically, Paris rapeseed futures have been at a premium to Chicago soyabean futures (in US dollar terms). However, the price ratio between the two commodities has been touching near parity. To some extent the price of soyabeans has been keeping rapeseed prices elevated in recent weeks.

Global supply of rapeseed for this marketing year (2022/23) has significantly improved, and rapeseed’s premium has diminished.

Currently keeping rapeseed prices supported is the high price of soyabeans on the back of strong soyabean oil demand in the US, and the generally supported oilseed complex from the Russia Ukraine war.

However, what is critical to note is that we have a large Brazilian soyabean crop coming to market in the coming months with harvest just starting now. Further to that, as mentioned in the introduction, the perceived US demand for soyabean oil is going to remain strong going forward, which to some extent will keep soyabean oil prices elevated. If realised, this will keep crush margins strong meaning that the price of soyabeans will have the ability to drop when this large Brazilian soyabean crop comes to market, which could have the potential to weigh on domestic UK rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.