Vegetable oil market roundup: Grain market daily

Wednesday, 25 January 2023

Market commentary

- UK feed wheat futures (May-23) closed at £223.00/t yesterday, down £0.25/t on Monday’s close. New crop futures (Nov-23) gained £1.80/t over the same period, closing at £219.30/t yesterday.

- New crop futures tracked Paris and Chicago futures up off the back of bargain buying and investor optimism. This is after being pressured from prospects of rain in both Argentina (for maize) and the U.S. (for winter wheat).

- Paris rapeseed futures (May-23) closed yesterday at €529.00/t, up €3.25/t on Monday’s close.

Vegetable oil market roundup

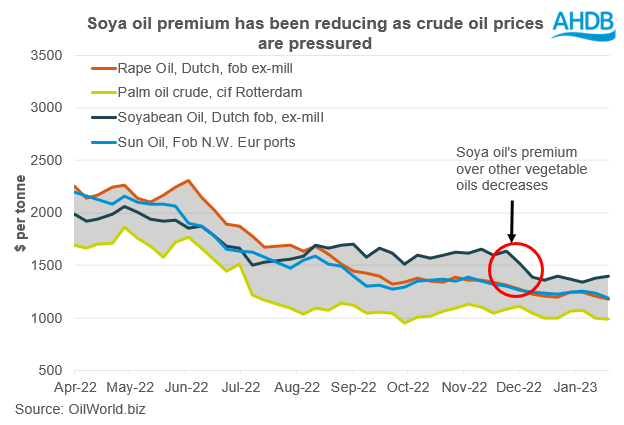

Since November 2022, vegetable oil prices in general have been drifting down from the highs recorded in the first half of 2022. The relationship between these vegetable oils in Europe has started to converge and trade within a tighter range.

The US and Brazil’s demand for soyabean oil in biodiesel production has been driving soyabean oil’s premium, moving this to the top of the vegetable oil complex. Though this premium has reduced recently, as shown in the graph below.

To some extent the pressure on crude oil over this period has pressured soyabean oil prices, to reduce this premium, to trade slightly more in line with other vegetable oils in the complex. Large supplies of rape, sun and palm oil are all being offered at competitive prices, which have also brought soyabean oil down.

Palm oil prices, the floor to the vegetable oil complex, have been tracking sideways recently. This is due to a lack of market direction with output lower due to seasonality (in major producers Malaysia and Indonesia), and large ending stocks. In Malaysia, ending stocks are historically high at 2.19Mt, as of December 2022. Further to that, the Malaysian Palm Oil Council (MPOC) estimates indicate palm oil prices will remain supported around current levels in 2023, with prices set to average $920-$970/t. Also, in February, Indonesia is expected to increase their biodiesel admixture from 30% to 35%, so therefore a supported floor to the vegetable oil complex could continue going forward. However, there are questions around palm oil demand from the EU, with laws that could create a trade barrier to palm oil shipments.

Rape oil in the EU has been trading within the middle of the vegetable oil complex at a marginal discount to sun oil. With a recovery in rapeseed production for this marketing year combined with increased imports (of rapeseed). The EU’s crush is expected to increase by 9% year-on-year and exports of rape oil are going to increase and compete on the export market with sun oil out of the EU and Black Sea.

Two key watch points over the next few months which could drive vegetable oil prices:

- Establishing the damage to Argentina’s soyabean crop – their crop has been revised down recently, but recent rains combined with Brazil’s record soyabean crop at 152.7Mt (Conab) could still mean total production out of South America is strong. Brazilian harvest too has started. Which could weigh on oilseed and vegetable oil prices as we progress through the end of the 2022/23 marketing year – but it’s expected that soyabean oil premium will remain due to biodiesel demand mentioned above. However, should soyabean oil see pressure going forward, this could bring down the ceiling to the vegetable oil complex.

- Also, Chinese demand for ag commodities will be a key watch point over the next few months given the easing of their COVID-19 restrictions. With prices of vegetable oil reducing recently, Chinese appetite for vegetable oils has increased. Total ending stocks of oils for December was pegged at 1.7Mt, a 17-month high (MPOC). If we see Chinese purchasing increase exponentially, that could keep prices elevated for palm oil despite EU demand concerns. This could keep some support to the floor of the vegetable oil complex.

Overall, from this, we could see a further tightening in the price range of the vegetable oil complex. This could mean other vegetable oils could be more closely linked to driving rape oil prices going forward, which will filter into rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.