Rains on the Plains pressures prices: Grain market daily

Tuesday, 24 January 2023

Market commentary

- UK feed wheat futures prices followed US markets down yesterday (read more below), with the May-23 contract losing £3.50/t from Friday's close, settling at £223.25/t. The Nov-23 contract also lost ground, closing at £217.50/t, down £3.60/t over the same period.

- Paris rapeseed futures prices (May-23) closed at €525.75/t yesterday, down €10.50/t from Friday's close. EU rapeseed markets followed the direction of Canadian canola markets, which fell yesterday on the back of weak export demand. Rapeseed markets were also pressured by falls in soyabean prices, following much needed rains in Argentina.

Rains on the Plains pressures prices

May-23 Chicago wheat prices fell to a near 16-month low yesterday, closing at $267.47/t. US wheat markets were pressured by a storm front which has brought much needed moisture, in the form of snow and rain, across parts of the Plains, which has been impacted by drought of late. EU and UK futures markets were pressured by this too, with May-23 UK feed wheat futures losing £3.50/t from Friday's close, to settle at an 11-month low yesterday of £223.25/t.

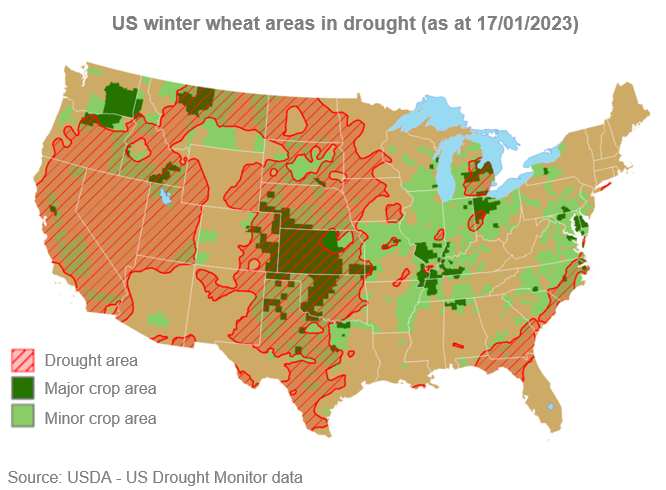

This latest bout of rain and snow fall seems to have alleviated market concerns for now, over the impact of drought on the 2023 crop. However, we are some way off being able to assess the actual damage of these conditions. As at 17 January, 59% of the US winter wheat area was located in drought, according to latest USDA data. This is unchanged from the previous week, but down from 63% as at 3 January.

While the overall percentage of the winter wheat area in drought has shrunk, the proportion in exceptional drought has remained at around 15% since the start of November. If we look at the data for the US’s top wheat producing state, Kansas, 88% of its winter wheat area is in drought. Furthermore, the proportion of area in exceptional drought has been steadily rising since November, and now sits at c.50% (as at 17 January). It will be interesting to see what impact this recent moisture will have on the area effected by drought, when the USDA release its next US drought monitor report on Thursday (26 January).

While the US winter wheat area for harvest 2023 is expected to be 11% up on the year, at the highest in eight years, the impact of the drought on the crop is yet to be fully known. The USDA weekly crop condition reports aren’t due to start up again until March. However, the next monthly reports for key growing states will be released at the end of January and will assess crop conditions up to 29 January. This will shed some more light on what impact the US drought and extreme cold conditions over the Christmas period has had on the winter wheat crop.

With the UK having a substantial exportable surplus of grains this season, UK prices are tracking global market movements closely. With that in mind, any developments with US weather and crop conditions will impact UK price movements too. US weather and crop conditions remain a key watch point as we move towards a new season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.