New crop futures now at a premium to old crop: Grain market daily

Tuesday, 28 February 2023

Market commentary

- May-23 UK feed wheat futures followed global markets down yesterday to close at £226.00/t, down £1.00/t from Fridays close. The Nov-23 contract closed at £229.50/t, down £1.50/t over the same period. Expectations that the Black Sea Initiative, aka the Ukraine export corridor, will be extended and cheap Russian wheat continues to pressure global wheat prices.

- Rains have hit parts of the US Plains this week, with more forecast, coming at a critical time to boost crop health. This pressured US markets yesterday, with May-23 Chicago wheat futures closing at $260.85/t yesterday, down $4.32/t from Fridays close and the lowest price for the contract since September 2021.

- Monday’s USDA weekly US export inspections for wheat topped market expectations by totalling 591,725 tonnes, up from 374,427 tonnes a week earlier.

- Paris rapeseed futures prices (May-23) settled at €542.75/t yesterday, up €0.75/t from Friday’s close.

- May-23 Chicago soybean futures closed at a two week low yesterday as export demand shifted to South American suppliers with the harvest progressing in Brazil. As at 23 February, 33% of the Brazilian soyabean area had been harvested, according to AgRural (Refinitiv).

New crop futures now at a premium to old crop

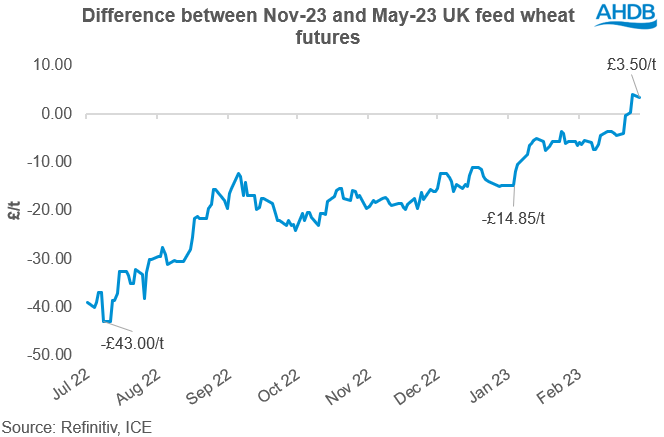

On Thursday, new crop (Nov-23) UK feed wheat futures closed at a premium to old crop (May-23) futures for the first time. As at Friday’s close, the premium grew further, with old crop futures dropping more than new crop. Yesterday, the premium reduced slightly with Nov-23 UK feed wheat futures now £3.50/t higher than the May-23 contract (as at 27 Feb).

So why is there now a new crop price carry? Over recent weeks, if not months, we have seen old crop prices come under more pressure than new crop, rather than new crop prices being particularly supported. Old crop prices have been weighed on by the very competitive supply of Russian wheat which has been ‘flooding’ the export market. Russia’s aggressive export campaign has even been limiting gains that have come from the escalation to the war in Ukraine and the expiring Ukraine corridor deal (Black Sea Initiative).

Looking at next season’s crop and assessing the area planted in the Northern Hemisphere, we could be in for a year of relatively ample supply, with increased plantings expected in Europe and the US, while Ukrainian plantings are expected to be lower. But and this is a big BUT, a lot could happen between now and harvest. An adverse weather event in the spring could hamper production prospects. Furthermore, changes in global demand will also play a big part, with supply and demand expected to be finely balanced next season.

With there currently being a price carry into new crop, that could incentivise some to carry stock over into next season, cashflow dependent. The UK has a large surplus of wheat already forecast for this season, could this be even bigger if we see growers hold onto stock? Or have old crop prices come under too much pressure and could we see them rebound and reverse the inverse? With the extension of the Ukraine export corridor coming up for renewal in a matter of weeks, we could see some volatility in both new and old crop markets in the short term. One thing is more certain, as we approach harvest 2023, sheds will need clearing to make way for new crop and to prevent carrying over substantial stocks into the new season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.