Ukrainian maize supply contributing to bullish UK grains: Grain Market Daily

Friday, 22 January 2021

Market Commentary

- Old crop futures for May-21 fell a further £2.00/t yesterday, to close at £209.50/t. New crop futures (Nov-21) fell nearly at the same rate, losing £1.90/t to close at £165.85/t.

- Two new strains of African swine fever have been identified in more than 1,000 sows in China, the world’s largest pork producer. The strains are said to reduce litter sizes.

- Chicago soyabean markets are poised for the first weekly drop in more than one month, as rains fall in South America easing dryness concerns.

- As the Brazilian soyabean harvest progresses, private estimates are pegging the crop between the 133-135Mt range, though there are quite a few outliers still.

Ukrainian maize supply contributing to bullish UK grains

Global grain prices have seen some substantial recent gains. Global maize supply and demand is one of the key drivers holding UK wheat prices high.

In the latest monthly report by the USDA, global maize supply and demand tightened further. Global maize ending stocks (outside China) were pushed to the smallest since 2013/14 at 92.2Mt.

Today, I will cover how a reduction in Ukrainian maize production is contributing to increased prices. And ultimately, how this may be pushing up UK grain prices too.

Black sea maize supply is lending support to prices

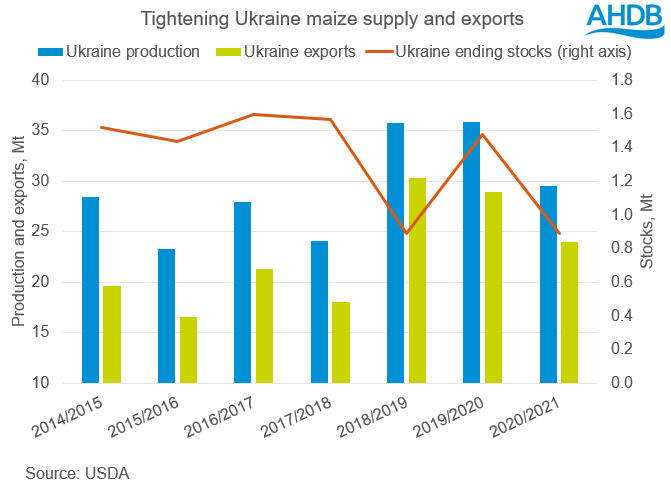

This year Ukraine has seen a significant fall in maize production, -18% year-on-year to 29.5Mt.

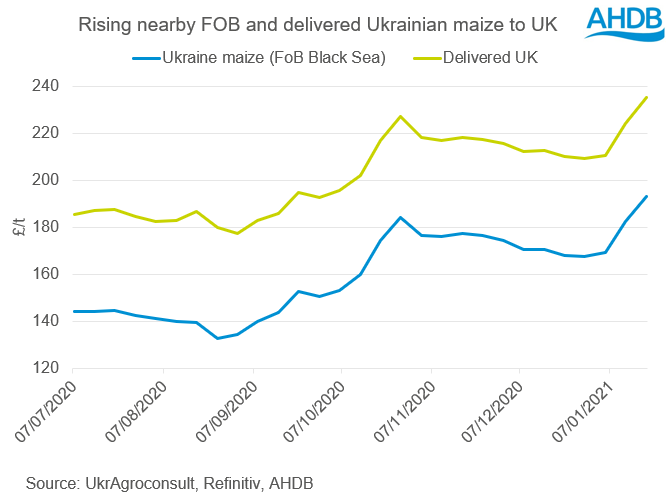

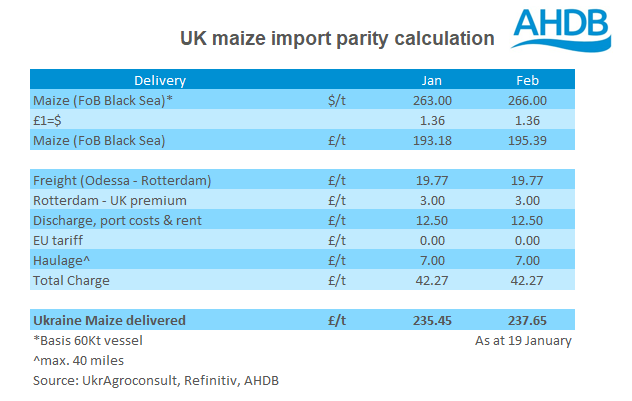

With supply tight, exports are estimated to fall 17% year-on-year and Ukrainian maize prices are rising. Nearby fob prices gained £48.97/t from the start of July to this week. The calculated cost of delivering the grain to UK users gained £50.00/t, in the same period.

How has this impacted on UK imports and what might be expected going forward?

With fob prices rising, it is perhaps unsurprising UK maize imports from Ukraine have fallen. This season-to-date (July-November), imports are down 37% year-on-year to 160.3Kt, according to IHS Maritime & Trade—Global Trade Atlas ® - HMRC.

Instead UK importers are opting for Brazilian maize. Season-to-date, imports from Brazil total 291.3Kt. This figure is already 161.4Kt more than last year’s full season total and 185.7Kt more than the previous full 3-season average (2017/18-2019/20)(IHS Maritime & Trade—Global Trade Atlas ® - HMRC).

Therefore, the Brazilian Safrina crop is of great importance to the UK.

Yesterday, Anthony discussed the concern for 2020/21 Brazilian maize production and how this may impact on global markets. Should production be revised down in the coming months, this could support maize prices further. This would push up costs for UK importers who are now opting for Brazilian origin.

Global wheat markets may gain further from tightening global grain supplies and UK wheat prices may rise on the back of this.

Conversely, good growing conditions in Brazil would likely pressure global maize prices and reduce costs for UK importers.

So, Brazilian weather conditions will be important to UK prices for some time yet.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.