Prices move higher as USDA slashes global maize stocks: Grain Market Daily

Wednesday, 13 January 2021

Market Commentary

- UK feed wheat futures (May-21) moved higher again yesterday, gaining £4.75/t, to close at £209.75/t. The new crop (Nov-21) contract, gained £1.50/t, to £169.50/t.

- The move higher follows a largely bullish USDA supply and demand estimates report. Global maize and soyabean ending stocks are both lowered, while Chinese stocks are raised. This increases the sensitivity of markets to future shifts in fundamentals.

- The USDA winter wheat acreage report was also published yesterday. Winter wheat area is seen at 12.95Mha, an increase of 5% on last year’s 111 year low.

Prices move higher as USDA slashes global maize stocks

Yesterday evening the latest USDA supply and demand estimates (WASDE) for the 2020/21 season were released. A lot of our focus in recent weeks has been on South America, where dry weather has hampered crop development. Despite the drier weather, forecasts of Brazilian and Argentinian maize production are at relatively high levels.

The latest WASDE forecasts for Brazilian and Argentinian maize production are 109.0Mt and 47.5Mt, respectively. This is a cut of 1.0Mt for Brazil and 1.5Mt for Argentina, on the month. The Argentinian forecast is still ahead of the Buenos Aires Grain exchange forecast of 47.0Mt. Meanwhile, Brazilian agency Conab, currently forecast the nations maize crop 102.6Mt. The Conab figures will be updated later today.

The cuts for South American production are relatively small. As such, we could still see further production and stock revisions during the course of the season. But, this is not where the majority of the production and stock cuts were in the latest WASDE.

The US production figure has been revised down by 8.2Mt. This was driven by reduced yields and small reduction in harvested area. In spite of large cuts to ethanol consumption, US maize ending stocks are forecast to decline by 3.8Mt, to 39.4Mt. This is the lowest level since 2013/14.

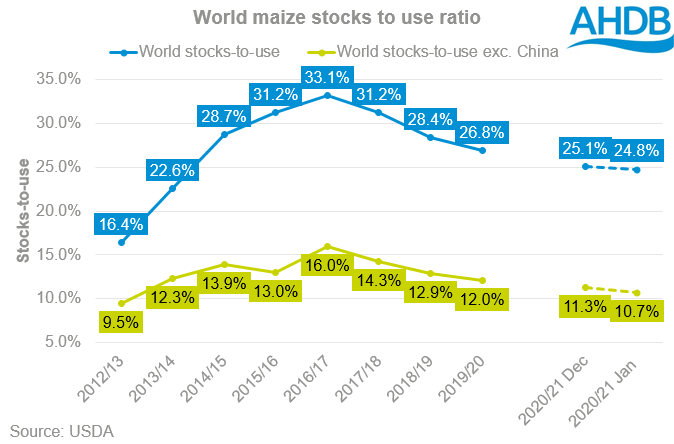

The cuts to global maize ending stocks are largely in line with market expectations. However, the further fall in the stocks-to-use ratio of maize increases the sensitivity of prices to future cuts in production.

In response to the WASDE, Chicago maize futures jumped $16.54/t from Monday to the end of early trading today. Similarly, UK feed wheat futures (May-21) jumped £4.75/t to yesterday’s close, hitting £209.75/t.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.