Analyst Insight: The Brazilian Safrinha crop could drive global grain markets

Thursday, 21 January 2021

Market Commentary

- UK wheat futures (May-21) closed yesterday at £211.50/t down, £2.25/t on Tuesday’s close. New crop (Nov-21) values closed down by the same amount at £167.75/t.

- Grain prices dropped yesterday globally as improved weather in South America combined with expected rains across the U.S. Great Plains. This offers improvement to US winter wheat conditions.

- Due to this improved weather in productive regions of South America, Chicago soyabean futures (May-21) closed yesterday at $502.33/t. This is down $5.88/t from Tuesday’s close.

The Brazilian Safrinha crop could drive global grain markets

Our domestic market trades at import parity this season, so your ex-farm values is sensitive to global fundamentals.

Globally we are forecast the have some of the highest global wheat ending stocks ever, but prices are still supported.

This is due to continued demand for cereals and oilseeds combined with political intervention, on-going dryness in South America and the lowest US maize ending stocks since 2013/14.

This has meant that the start of 2021 has continued to be as bullish as 2020 ended. UK feed wheat futures (May-21) are feeling this support, closing yesterday at £211.50/t.

Despite all of this support, there is still a crucial supply of maize that could further add to this bullish market or temper gains. This is the second Brazilian maize crop (Safrinha).

Brazilian maize situation

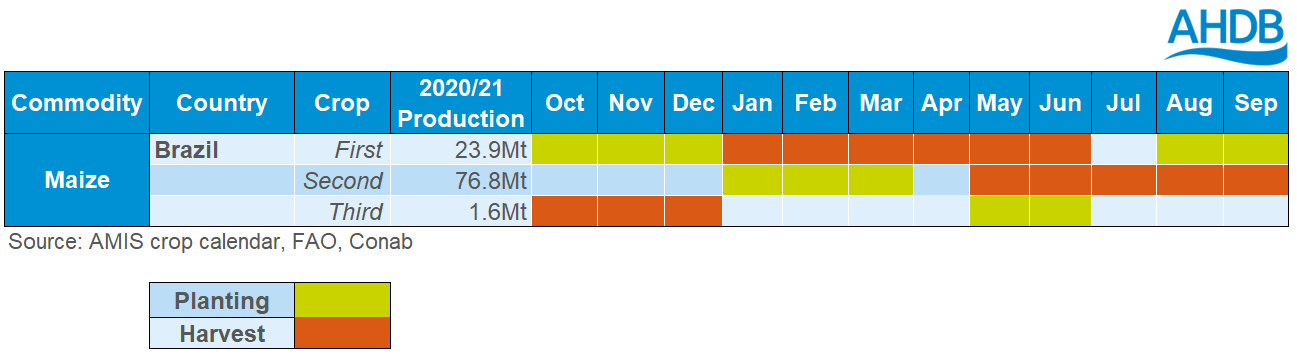

Brazil is one of the largest maize growers and exporters in the world. Latest reports from Conab advocate that they will supply 102.3Mt of maize for the 2020/21 marketing year. Due to the climate in Brazil they are able to grow this production over three different cropping cycles.

The largest crop is the Safrinha crop, which is sown in January to March and harvested May to September. Because of its scale, this crop is vital to the amount of maize Brazil exports.

Why is the Safrina crop so important?

Usually, Brazil is planting its Safrinha crop now. However, the South Pacific is experiencing a moderate La Niña at the moment. This has meant the majority of South America has experienced widespread dryness.

This dryness occurred when Brazil was planting its soyabean crop. This delayed planting and crop development means harvest this year is delayed. For example, in the Mato Grosso region only 1% of soyabeans have been harvested (as of 15 Jan), below 6% at the same time last year.

This soyabean harvest delay will have a knock-on effect delaying the planting of the Safrinha crop, as traditional this crop follows soyabeans in the crop cycle.

Delaying the planting could have multiple implications such as, reduced yields (and overall exportable production), or extending the time in which this crop will be available for export.

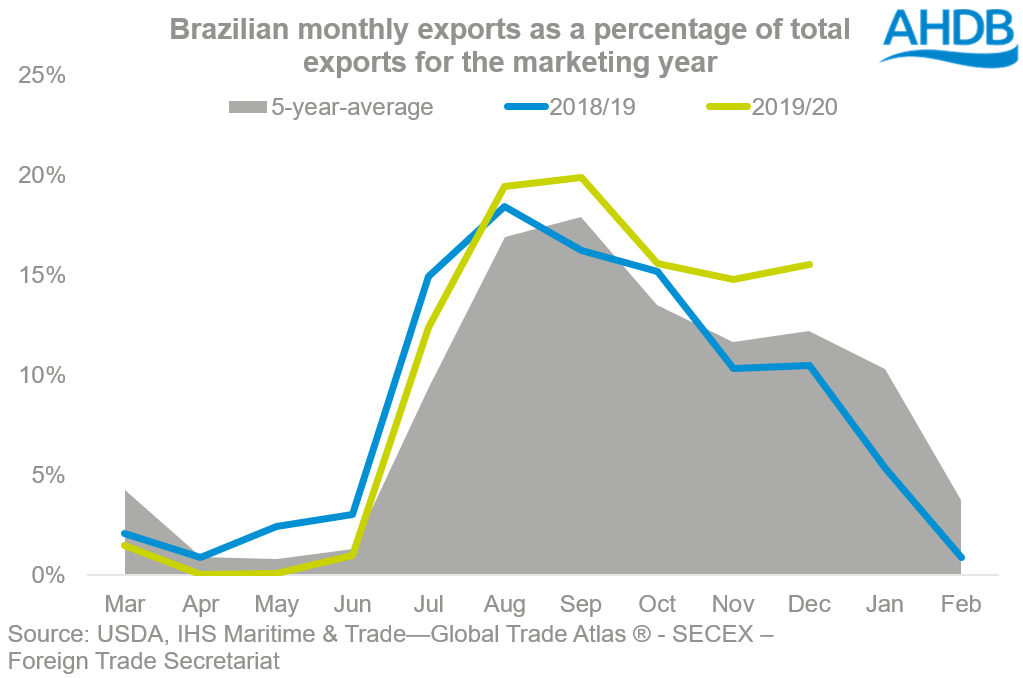

The Brazilian maize marketing year traditional runs from March to February. Its export campaign usually starts in July, increases throughout August and September and then tails off. Based on five-year averages the busiest month for exports is September, with 17.9% of total exports.

A key watch point for Brazil

The latest Conab report states that the area for the Safrinha maize crop is 13.8Mha, with 76.8Mt expected to be produced. Based on 5-year-averages, over 80% of exports happen between July and December 2021, after the Safrinha crop is harvested.

Although there has been scattered rains throughout Brazil, which has helped development of soyabean crops, the delayed harvest could see the area of the Safrinha crop reduce.

Why does this matter to me?

As explained at the start, our domestic prices at the moment are more sensitive to global fundamentals. Therefore, in the coming months if the Brazilian maize production were revised down, it would fuel the bullish sentiment in global markets.

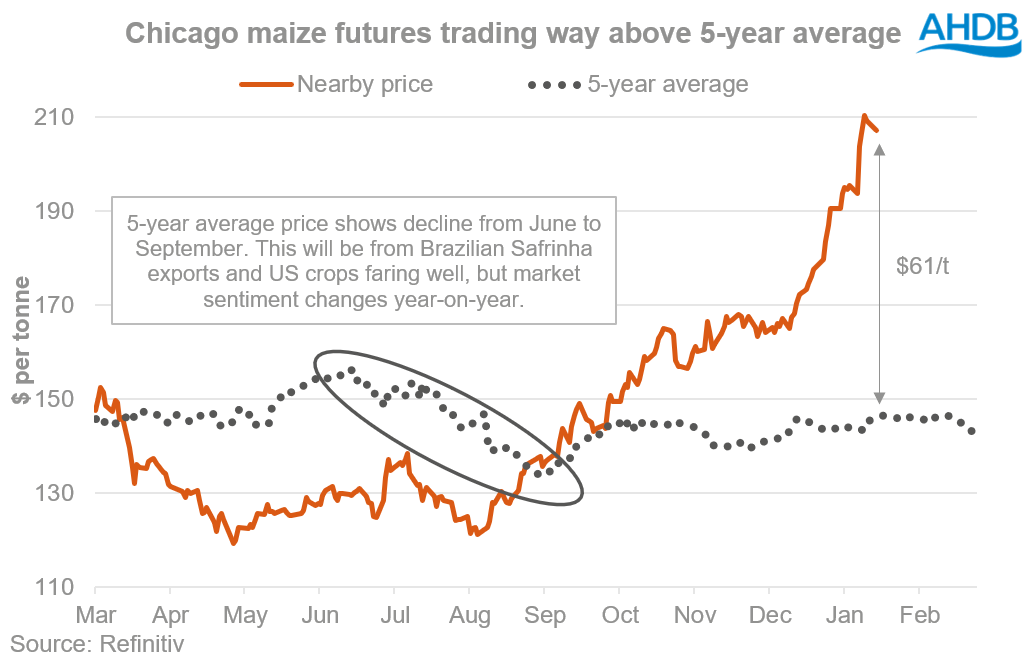

A rise in maize prices will likely push up global wheat markets, which would support your domestic price this marketing year. Chicago maize (May-21) closed yesterday at $206.29/t. This is way above the 5-year-average for the time of year, as displayed in the graph.

On the flip side, if the Safrinha crop is planted and harvested in full, we could see pressure on maize markets in the middle of the year. To what extent this pressure is seen will depend on the soy/maize planting intentions in the US come spring.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.