La Niña weather event could impact your domestic grain prices: Grain Market Daily

Wednesday, 4 November 2020

Market commentary

- Both the Nov-20 and May-21 UK wheat contracts closed up £0.25/t yesterday, at £188.25/t and £187.55/t, respectively.

- Maize markets helped to support their wheat counterparts, despite the latest USDA crop condition report edging up U.S. winter wheat crops in good to excellent condition to 43% (up from 41% last week).

- Paris rapeseed futures closed yesterday at €389.25/t, gaining €6.25/t on Monday’s close. Energy markets have helped drive these gains; Brent crude oil (nearby) gained 1.9% yesterday, to close trading at $39.71/barrel.

La Niña weather event could impact your domestic grain prices

This week I am going to provide a whistle stop tour of global grain producers that could be impacted by the La Niña weather event, and what to look out for going forward. If you missed last week’s analysis on oilseeds, read it here to catch up on what the La Niña weather event is.

What key global wheat producers could be affected by La Niña?

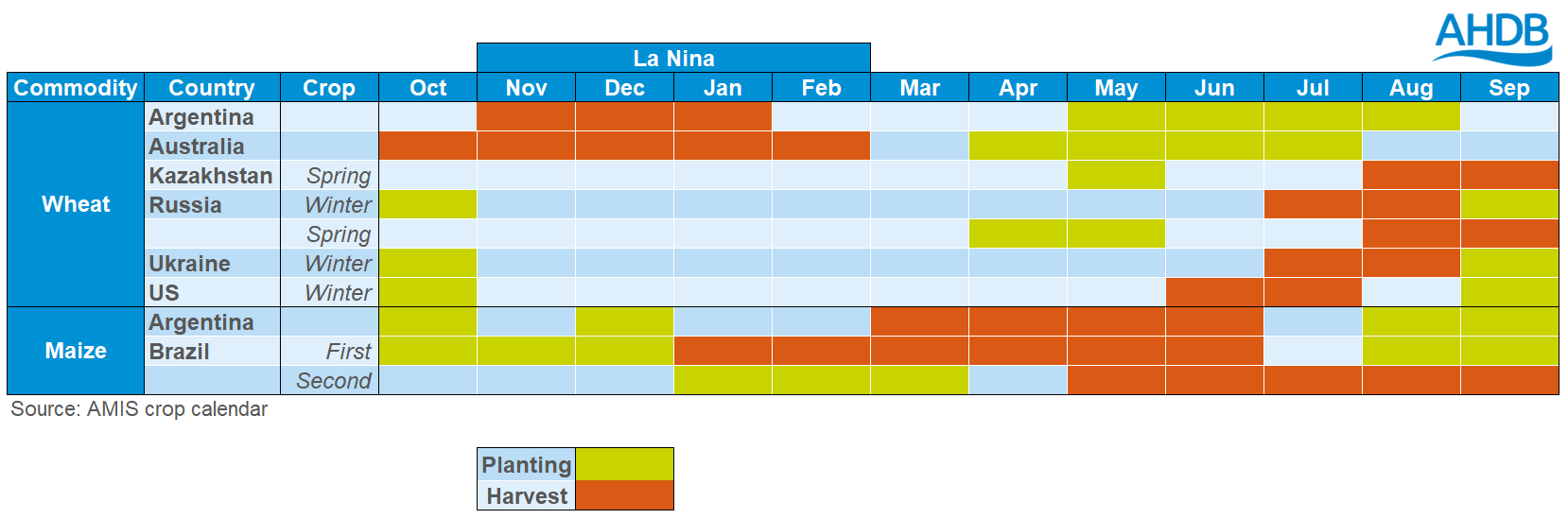

Should La Niña weather event come into cycle throughout November to February, it could have significant impact on some key global grain producers, depending on the severity.

Above is the crop cycle of large grain producers and even though La Niña is largely from November to February, it could have lasting implications into 2021 for the Northern Hemisphere despite seemingly not coinciding with major windows of Northern Hemisphere activity.

Meteorological studies link La Niña dominant years to how dry it can be in the Black Sea region. The timing of the phenomenon would mainly affect later sown spring wheat production in Kazakhstan and Russia.

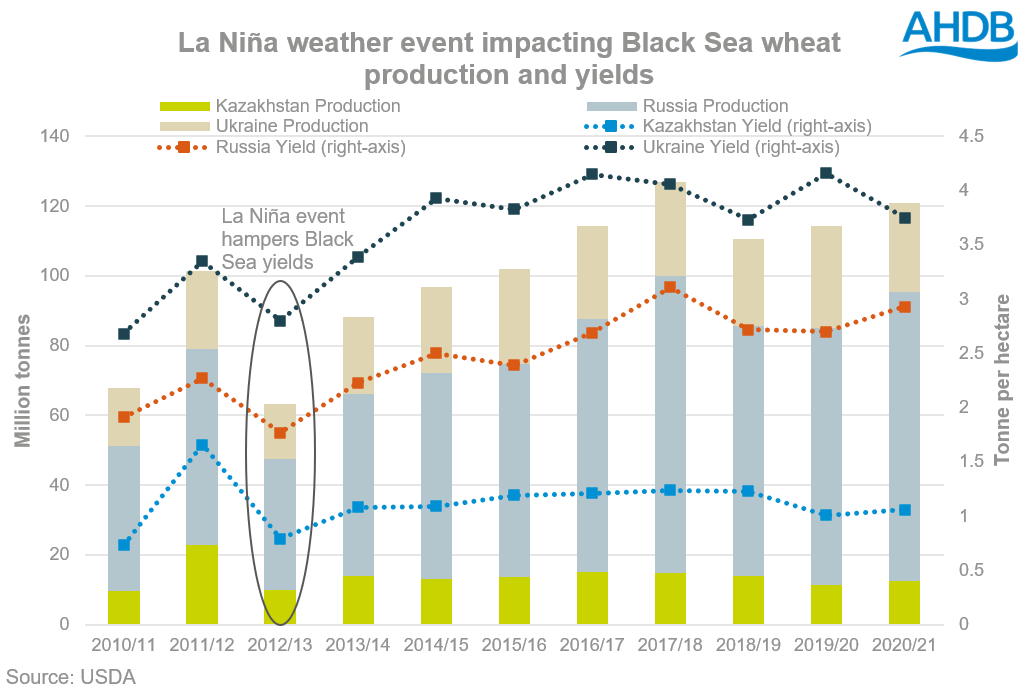

During La Niña droughts in 2011-12, yields in the Black Sea were significantly affected. There have been some tempered concerns over the last couple of months of dryness within the Black Sea region. There is a risk that a moderate-severe La Niña could extend this dryness into the key crop development periods.

For scale on how significant this region is for the supply of wheat, for this marketing year they produced collectively 121Mt and will account for 33% of exports to the global market (USDA).

Substantial rain through August improved soil moistures in Australia, supporting the final stages of wheat development. Wheat production this year is expected to resurge to 28.9Mt, up 91% from last year according to ABARES.

It’s anticipated that 2020 spring rainfall will be around the seasonal median, providing a good finish to the 2020 winter growing season.

Currently in Australia, the ongoing La Niña is enhancing the probabilities of a wetter then average late spring and early summer, currently the case in the East of Australia.

This is also expected throughout harvest, which would make it very stop-start. This is a watch point as this could affect quality of the crop and delay when exports come online at the start of 2021.

Previous La Niña’s have proved to cause excessive dry weather in the South of the US, as was shown in between 2011-2013. Like the Black Sea region, if this plays out this season, it could have an impact on winter wheat areas for 2021 US wheat production.

US states that will be most affected are Colorado, Nebraska, Kansas, Oklahoma and Texas. These six states account for over 60% of winter wheat area, and droughts in 2013 caused a significant reduction in production. Be sure to read Helen’s analysis from a couple of weeks back for a comprehensive overview.

Wheat

Successive months of ongoing dryness within Argentina brought on by La Niña meant unfavourable conditions hit productive wheat regions in the midseason growing stages.

There have been downward revisions to their wheat crop for this season. Currently their crop is estimated at 16.8Mt, down 11% from last year, even though the planted area was down only 2%.

Maize

Recent rains have provided some improvement to planting conditions in Argentina, with optimum / favourable conditions at 93%, up from 85% last week. Current planting progress stands at 29.8%, behind this time last year when it was at 40%.

Ongoing watchpoints for Argentina will be that conditions do not become too dry when their maize crop goes through growth development in January.

Currently there is dryness in southern parts of Brazil, causing moisture stress for their full-season maize crop (first maize crop). Harvesting of the first crop will start in January, and only accounts for one quarter of the countries maize crop.

Greater concerns are for the Safrinha (second maize crop) crop, which will be planted after the soyabean crop predominately in the Mato Grosso and Goiás region.

However, as I explained last week, elements of La Niña dryness are delaying Brazil’s soyabean plantings. This could knock on to the Safrinha planting window, a delay to which could impact yield potential. Ongoing planting progression and development of the crop will be a watchpoint.

Why is this so important?

Although these producers may seem so far away from the farm gate, potential weather concerns could have implications on the continued supply of grain throughout 2020/21 marketing year, and also supply for 2021 harvest. As well as the realisation of any physical effects, the sentiment of what these impacts might drive can swing wheat markets either way.

With the tight UK wheat crop this season largely capping out at import parity, global prices have an increased influence on the domestic price this season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.