Wheat markets supported by dry weather in US: Grain market daily

Tuesday, 20 October 2020

Market commentary

- Current season UK feed wheat futures closed higher yesterday. The Nov-20 contract gained £0.30/t to £185.70/t, while the May-21 contract was up £1.80/t to £189.75/t – both new highs for those contracts.

- Meanwhile, UK Nov-21 futures slipped back slightly from the new high for that delivery period of £161.00/t, set on Friday. Yesterday, Nov-21 closed at £160.40/t.

- There were gains across global grain futures yesterday because of continuing dryness in the USA (below), the Black Sea and parts of South America – more in yesterday’s Market Report.

- Chicago soyabean and maize futures prices also recorded gains. Yesterday’s US crop progress report showed the harvest pace for these crops remains ahead of average. Soyabean harvest progress was less than the market had expected (Refinitiv).

Wheat markets supported by dry weather in US

Yesterday’s US crop progress report from the USDA was the latest piece of information to result in gains in global grain futures prices. Nearby Chicago and Paris wheat futures gained $0.64/t and €2.75/t respectively compared to Friday, closing at the highest levels since 23 Dec 2014 and 9 August 2018.

Planting continued amid generally dry weather over the past week and 77% of the planned winter wheat crop for harvest 2021 was planted by 18 October. This is ahead of the 5 year average for the time year (72%) but less than the market had expected according to a poll by Refinitiv, this supported prices yesterday.

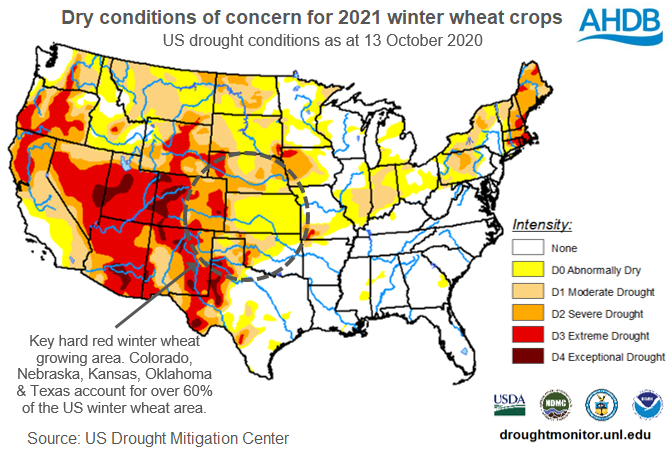

However, in general it is the dry conditions that are supporting global wheat prices. In the winter wheat growing states, the dryness is now the most widespread and intense for mid-October, since 2012.

Yields in the six states that account for over 60% of the winter wheat area and half of winter wheat production were all sharply lower in 2013, with Colorado 40% lower year-on-year. However, total US winter wheat production in 2013 was only 5% below 2012 because of higher production in the north-western, mid-west and eastern areas.

There is still ample time for the crop to perform well but rainfall will need to be regular and timely through this growing season to support 2021 yields. The three-month outlook suggests a dry start to winter. Unless rainfall is sufficient, US winter wheat yields could be down in 2021 – putting more reliance on spring wheat areas and yields.

These concerns about possible lower US winter wheat supplies in the 2021/22 come at the same time as concerns about winter wheat crops in the Black Sea for the 2021/22 season. Together the US, Russia and Ukraine account for 42% of global wheat exports (2015/16-2019/20).

Usually at this time of year, prices take more lead from current season factors, with new crop conditions getting more important as we move towards spring. However, currently these early concerns about 2021/22 supplies from some of the top exporters are supporting both old and new crop wheat prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.