Analyst Insight: La Niña weather event could impact your rapeseed price

Thursday, 29 October 2020

Market commentary

- UK wheat futures (Nov-20) closed yesterday at £187.65/t, down £1.10/t on Tuesday’s close.

- There was pressure across all major wheat contracts; Paris milling wheat futures (Dec-20) closed down €1.75/t yesterday at €204.00/t, and Chicago wheat futures (Dec-20) closed down $2.58/t at $223.65/t.

- Driving this pressure is the wider sell-off on global financial markets. There are on-going concerns over the rise in Covid-19 infections in the US and Europe, which are also causing economical anxieties of what the implications could be of this.

- There is continued pressure in energy markets, which is pressuring agricultural commodities. Brent crude oil futures (nearby) was down 6.3% across the week (since Friday) at yesterday’s close.

La Niña weather event could impact your rapeseed price

As mentioned at our Grain Market Outlook conference a key parameter to observe this year is the impact of a La Niña weather event. The World Metrological Organisation says the chances of a La Niña weather event persisting throughout December to February is 55%.

This will have an impact on key global oilseed producers, which will impact the oilseed complex and filter down to domestic ex-farm rapeseed prices.

What is La Niña and its implications?

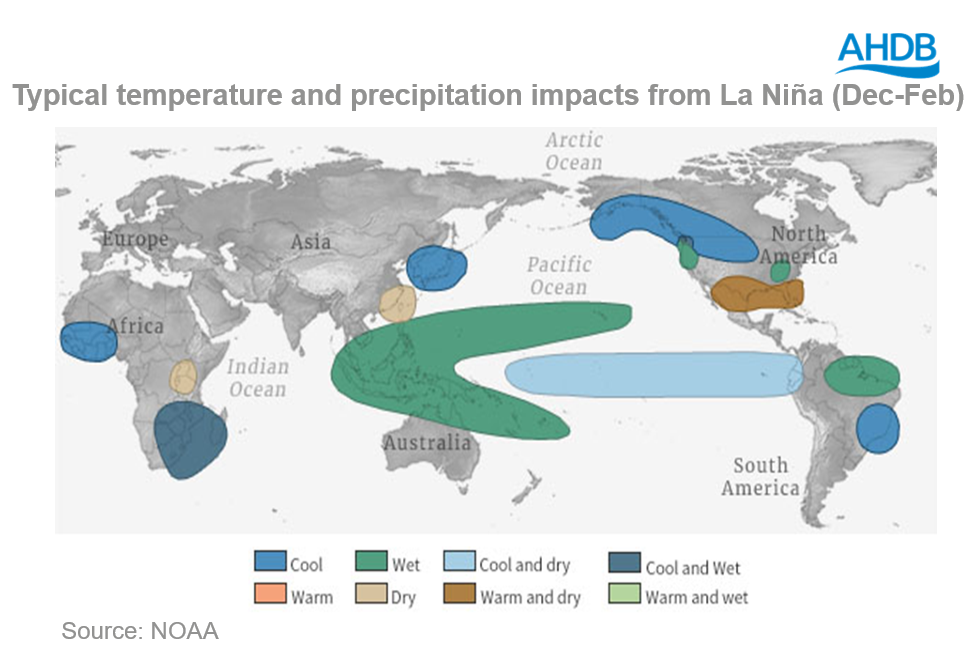

La Niña is a weather event which usually occurs every few years. Trade winds in the tropical pacific move the warm ocean current from the East to West, which causes warmer waters in the western Pacific and colder waters in the eastern Pacific.

Usually this weather event causes increased precipitation in Australasia from December to February, and cool and dry weather in parts of South America.

Its impacts are not bound to the south Pacific as it can cause dryness within southern/central parts of the US, which we are currently seeing at the moment as Helen analysed last week.

Why is it critical to observe these weather patterns?

The La Niña weather event can have differing impacts in each region. The severity of precipitation or dryness can alter from each La Niña event too.

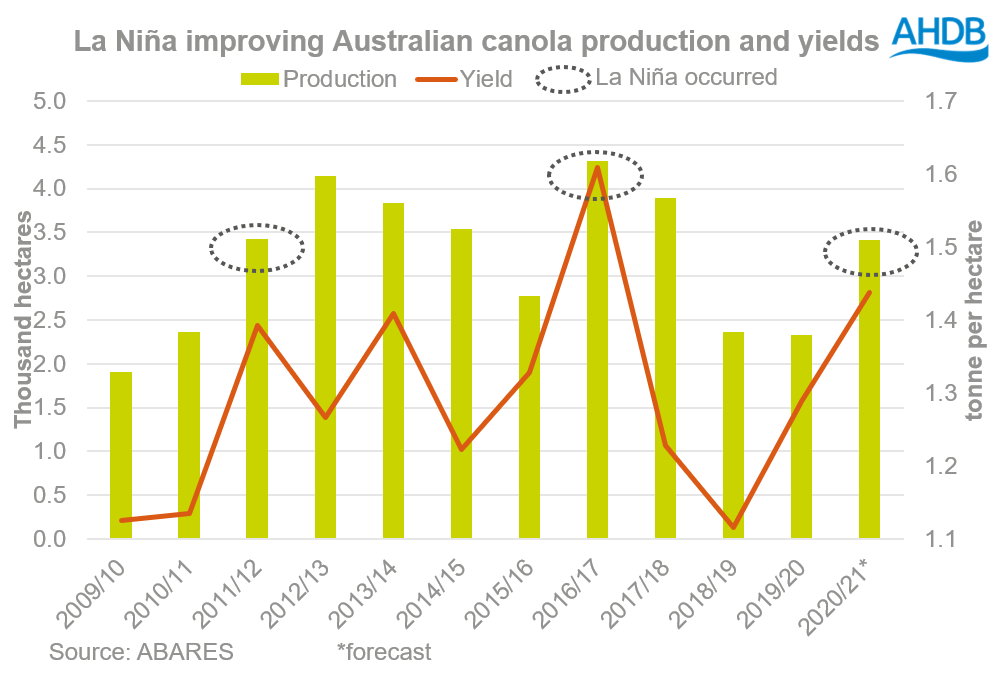

The 2010-12 La Niña event had a significant impact on Australia as there were two back-to-back spells of La Niña, which were some of the strongest on record. 2011 was Australia’s coolest year in a decade (2001-2011) and the second-wettest calendar year, and 2010 was Australia’s third-wettest calendar year on record. This boosted Australian canola (rapeseed) production.

Further to that, this La Niña event also contributed to the 2010-2013 southern US drought that affected agricultural land. The current dryness is the most widespread or intense for late October since 2012.

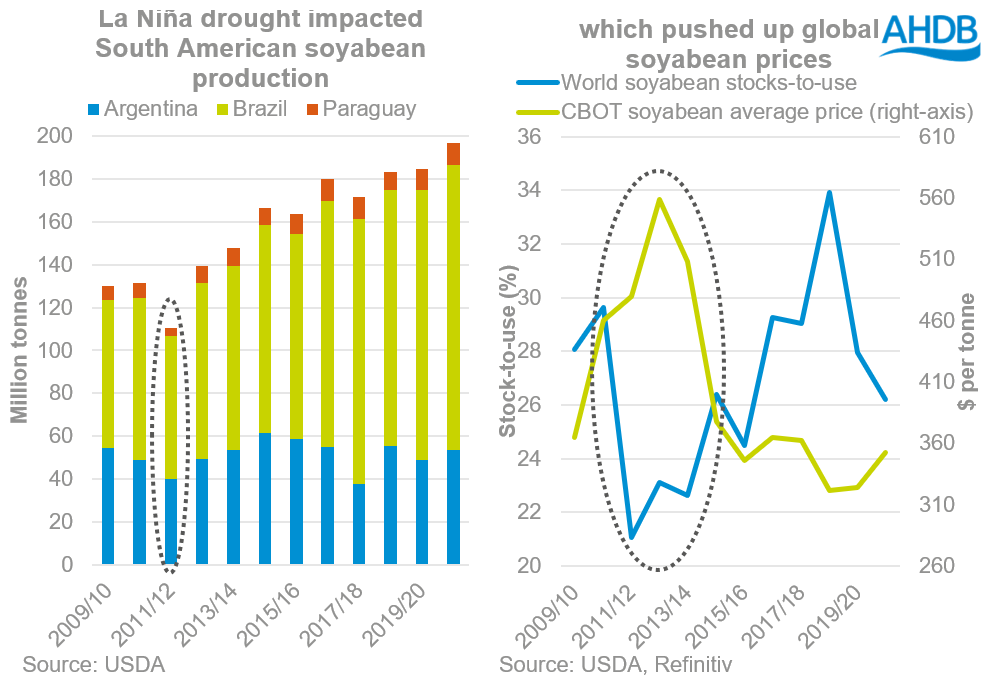

In 2012 South America also encapsulated some impacts from the dryness, as Argentina, Brazil and Paraguay’s soyabean production reduced year-on-year. This caused the world stock-to-use ratio to decrease significantly, which supported soyabean prices.

What do we need to look out for right now?

It is currently advocated that this La Niña will only be moderate in strength if it lasts until February. However, if its impacts intensify, this could alter whole oilseed supply complex by a greater degree.

With a 47% year-on-year production increase, Australia’s canola production is estimated at 3.4Mt this season. Good soil moisture throughout the growing season, and continued rains are proving beneficial for their canola crop.

This large Australian production, although significant, will be at a premium when exported to the European market. This is because Australian canola meets an acceptable life cycle greenhouse gas emission saving towards the EU’s renewable energy directive. Further to that, the meal is not genetically modified, so can be utilised by Europe’s dairy industry.

La Niña is set to happen in the middle of South America’s growing season. Rainfall has been below average for the last few months, especially in the North where conditions have been dry and cold.

It’s estimated that 1-2% of Argentina’s soyabean crop is planted. Currently, the best soil moisture is in the Bueno Aires region, but core producing regions (Cordoba and Santa Fe) still require significant precipitation. Rains are forecast in the coming week, which could help planting. However, if La Niña dryness hits the region in December and January this could hinder the development of the soyabean crop.

Parts of Brazil are also experiencing soil moisture deficits. This is improving across the central states of Brazil, but southern regions (Parana and Rio Grade Do Sul) still require much more precipitation to enable planting, and to ensure germination and stand establishment.

According to AgRural, Brazilian soyabeans are currently 23% planted, down from 32% this time last year. Planting is picking up but in some areas it’s two weeks behind schedule.

Soyabean yields in Brazil could end up being good if weather continues to improve. However, the La Niña may possibly bring drier weather in the central/southern regions during the pod filling window in December and January, which could hinder yields.

Another key area will be the weather in palm kernel producing countries such as Indonesia and Malaysia. The National Meteorology, Climatology and Geophysics Agency (BMKG) in Indonesia has advocated that the low to moderate La Niña will bring significant rainfall in the coming months.

Increased rainfall in the short-term could support prices if mature fields experience flooding, which could constrain supplies.

In the medium-term, a lower to moderate La Niña will likely improve fruit yields, which could pressure prices in 2021.

However, if it proved to be a strong La Niña, which looks unlikely, it could continue to bring excessive rains into 2021. If this occurred, this would result in lower pollination, reducing production and could support the market.

Currently, La Niña is expected to have a greater impact on soyabean production than palm oil, which will inherently dictate the price of crude palm oil into 2021.

Concluding thoughts

The exact impacts of this upcoming La Niña cannot be predicted exactly. However, weather in the coming months will be key for development of oilseed crops that will inherently shape the supply of 2020/21 and alter domestic rapeseed prices:

- We know there is going to be a large Australian crop that will come online at the start of 2021, with yields forecast to be improved year-on-year.

- Brazil and Argentina are both forecast to harvest large soyabean crop; it’s paramount to monitor planting progression in case the dryness alters the planted area and establishment.

- La Niña in Indonesia and Malaysia could momentarily support vegetable oil prices if mature fields are flooded, but into the 2021 could improve the yields of crops, which would pressure prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.