Weather worries remain for South America: Grain market daily

Friday, 8 January 2021

Market commentary

- Most global grain futures prices dipped yesterday as markets took stock ahead of a raft of global data being released next week.

- UK feed wheat futures for May-21 declined £1.80/t to £203.10/t. The Nov-21 contract fell £1.40/t to £165.60/t.

- Oilseed prices also closed lower after new US soy export sales were minimal and Indonesian palm oil stocks were higher than expected.

- Paris rapeseed futures for May-21 closed at €423.50t, down €1.75/t from Wednesday. The Nov-21 contract closed at €75, down €2.00/t.

Weather worries remain for South America

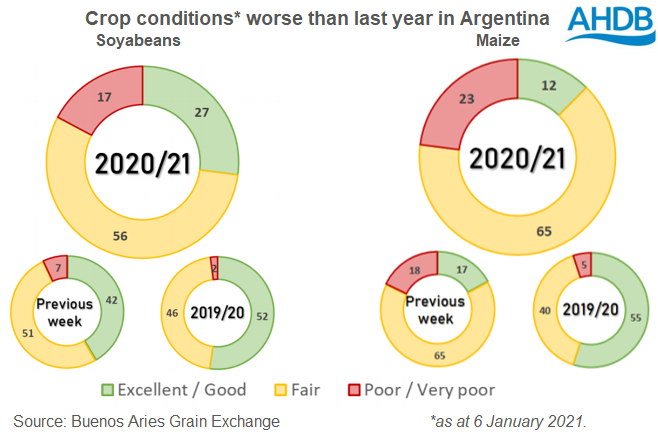

More rain is needed across many of the key maize and soyabean growing areas in South America. Drier than normal weather has hampered the planting and development of crops across the continent since September.

Recent rain has helped but it has not been enough, especially in Argentina. Unless enough rain falls in the coming weeks, yields will suffer. In some areas, reductions to production are already expected.

More rain is forecast next week for both Brazil and Argentina. But, for Argentina, the rain is expected to be of varying amounts, with temperatures also forecast to be higher than normal.

- There are regional differences but the biggest concerns are for both maize and soyabean crops in the key growing areas in the centre of the country.

- Dry weather has slowed planting and now there is a risk that not all of the intended area may be planted. The window for planting maize ends this month and over 0.9Mha of maize remains to be planted. Also, 1.1Mha of soyabeans remain to be planted (Buenos Aries Grain Exchange).

- The Rosario Grain Exchange describes early maize crops as being on ‘red alert’ in the central areas and warn of yield losses. It adds that for soyabeans, ‘if there are no significant rains in the next 10 days, the potential yield will be compromised’.

- Recent rains have helped crops and more is forecast for the coming week. However, the long-range forecasts continue to look drier, so will need to be monitored.

- The local USDA attaché forecast the Brazilian soyabean crop at 131.5Mt, on 31 December, but warned that weather forecasts “herald potential trouble”. This is 1.5Mt less than the official USDA forecast made in December but still almost 6Mt more than last season.

- Last month the Brazilian government forecast its maize crop at 102.6Mt, down 2.3Mt from its November forecast and just 0.1Mt higher than last season.

- Safrinha maize crops won’t be planted until after the soyabean crops are harvested. These crops account for the majority (75%) of Brazilian production.

The impact?

Global demand is already expected to exceed supply of both maize and soyabeans this season. One driver of the higher demand is higher imports by China as the country rebuilds its pig herd after the African swine fever outbreak.

Chinese prices suggest demand will remain high. Yesterday, nearby Chinese maize futures set a new all-time high and nearby Chinese soyameal futures also reached their highest level since October 2018.

Argentina and Brazil are major suppliers of maize and soyabeans to the world so any crop losses would further exacerbate the global situation.

Expectation of some crop loses in the region has pushed prices higher. Between 7 December and 7 January, Chicago maize futures (May-21) and Chicago soyabean futures (May-21) both gained 16%.

This in turn has supported UK prices. UK feed wheat futures (May-21) gained £14.55/t, or 8%, over the past month.

Where next?

There’s a lot of forecasts out next week, which will influence markets. These include monthly global supply and demand forecasts from the USDA on Tuesday night and Brazilian government crop forecasts on Wednesday.

South American crop forecasts and weather will continue to drive global and UK prices for some time yet.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.