UK pork trade: imports continue upward momentum in November

Wednesday, 17 January 2024

Key trends

- Imports of pig meat continue the uptrend on the month and year.

- Demand for side drivers on the continent, coupled with lower domestic production and competitive prices in the EU, is supporting imports.

- Higher imports volumes continue to dampen market sentiment.

- Fresh/frozen pork dominates the export basket.

Imports

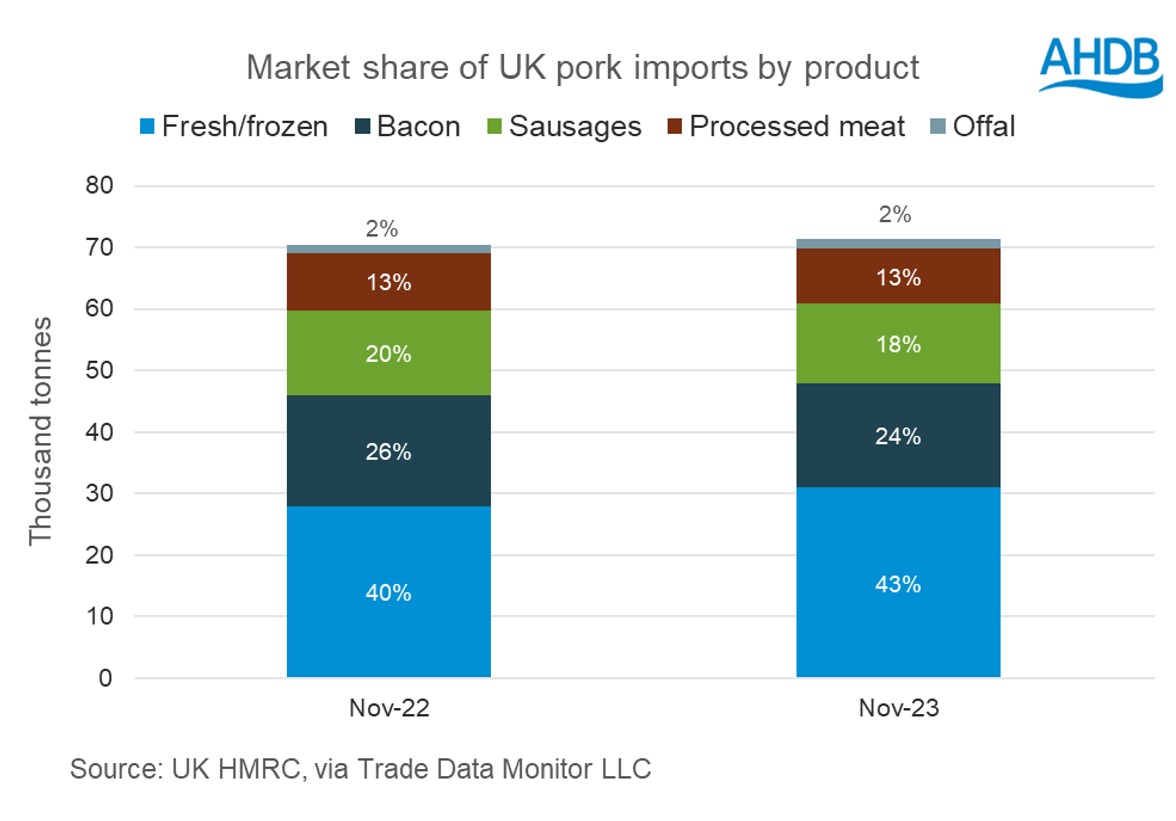

Imports of pig meat to the UK totalled 71,300 t in November, up by 1,200 t compared to the volumes recorded in October, the fourth month in a row to record month-on-month growth. When comparing year-on-year, there is an increase of 1,000 t. For the year to date (January–November), UK pig meat imports totalled 720,100 t, which is down 2% (-18,100 t) compared to the same period in 2022.

Looking into product categories, imports of fresh/frozen pork have recorded the largest increases totalling 3,000 t (11%) for the month of November. Sausages have seen volumes down by 1,000 t (-7%) followed by lower volumes of bacon -900 t (-5%). Processed meat has seen the smallest decline: back 3% compared to last year.

Multiple factors are contributing to the increase in import volumes, and lower production in the domestic market remains central (the UK’s pig population remains at its lowest in over a decade). Lower European pig reference prices, which have been declining over the last few months, also remain key. The price differentials between UK and EU prices continue to support EU imports to the UK. In addition to this, demand factors have also played a key role. Retail volume purchases remain suppressed by 2.2% for the 12 weeks ending 26 November 2023. However, volumes in the food service sector have gone up by 7.2%, thereby uplifting demand in a category with greater exposure to imported product.

Exports

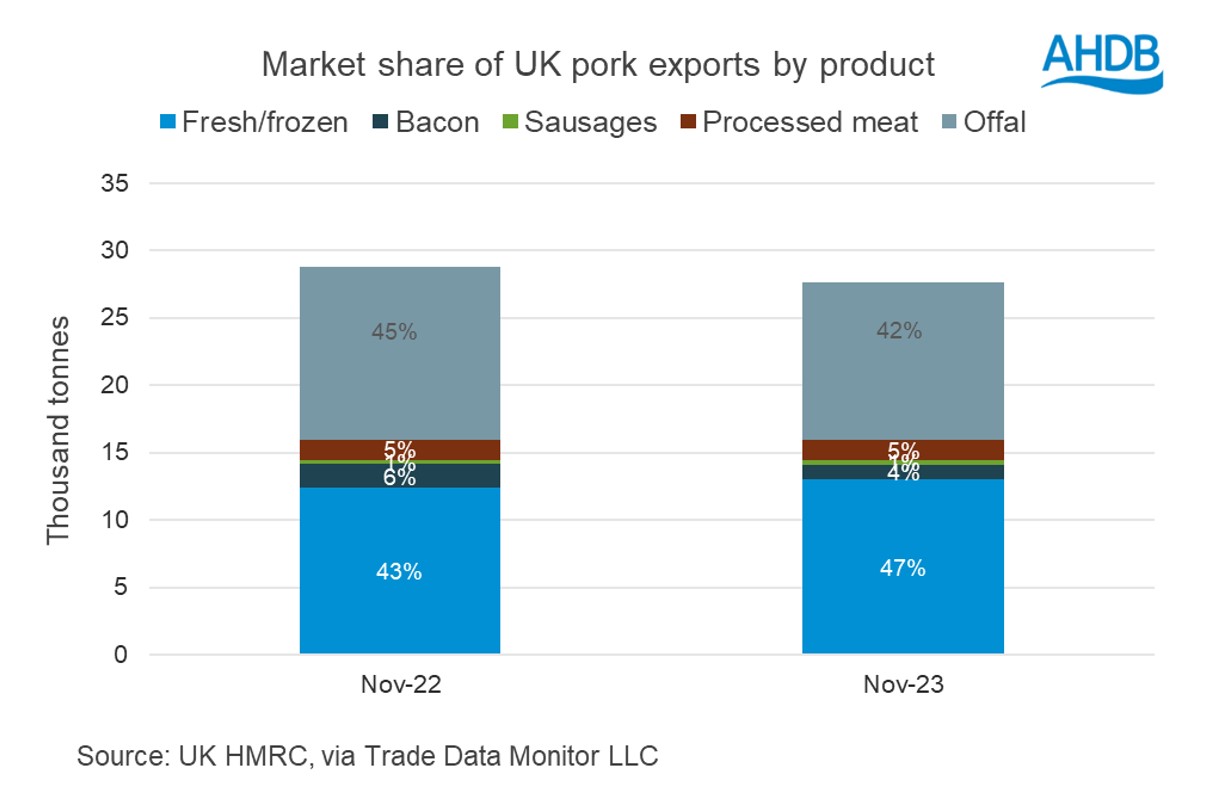

UK pig meat exports totalled 27,600 t in November, which was down 4% (-1,200 t) compared to the same month last year. Total pig meat exports year to date (January–November) totalled 275,900 t, one of the lowest volumes in the last eight years and 19% lower (-65,700 t) compared to the same period last year.

In the month of November, all product categories saw year-on-year declines – except for fresh/frozen pork, where volumes have increased by 600 t. Shipments of offal have seen the largest volume declines, down 9% year-on-year to 11,700 t. Exports of bacon have recorded a decline of 600 t (36%), while exports of sausages and processed meat recorded small changes. China is one of the major buyers of offal. Though the exports to China have developed in the last two months, it continues to trend well below previous years.

Total exports to China are recorded at 10,800 t in November, representing 39% of the total export volumes. Exports to China have declined by nearly 300 t (2%) from levels from a year ago. Shipments to EU-27 destinations declined by 1,100 t to 12,000 t in November compared to a year ago. The largest declines within the EU have been seen in shipments to Netherlands and France.

The significant reduction in domestic production as mentioned above will be a factor behind this change. The gap between UK and EU pricing continues to make UK product less competitive on the EU market. Demand remains challenged with consumers taking a cautious approach. Supplies available in the major exporting regions, domestic production and price points will be key as we look out across 2024. We’ll be exploring these trends in greater detail in our upcoming Agri-Market Outlook, due for release on Thursday 8 February.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.