UK pig meat production: supplies tighten further in Q1 2024

Wednesday, 17 April 2024

Key points

- UK pig meat production fell 2.5% year on year

- Slaughter numbers at their lowest since 2011

- Average clean pig carcase weights up 1.6kg year on year

- Continued wet weather is adding pressure to future market costs and supplies

Overview

It seems safe to say that the first three months of 2024 have offered some stability for the UK pork industry. Lower slaughter numbers have driven down production volumes, meanwhile pig prices have remained relatively flat.

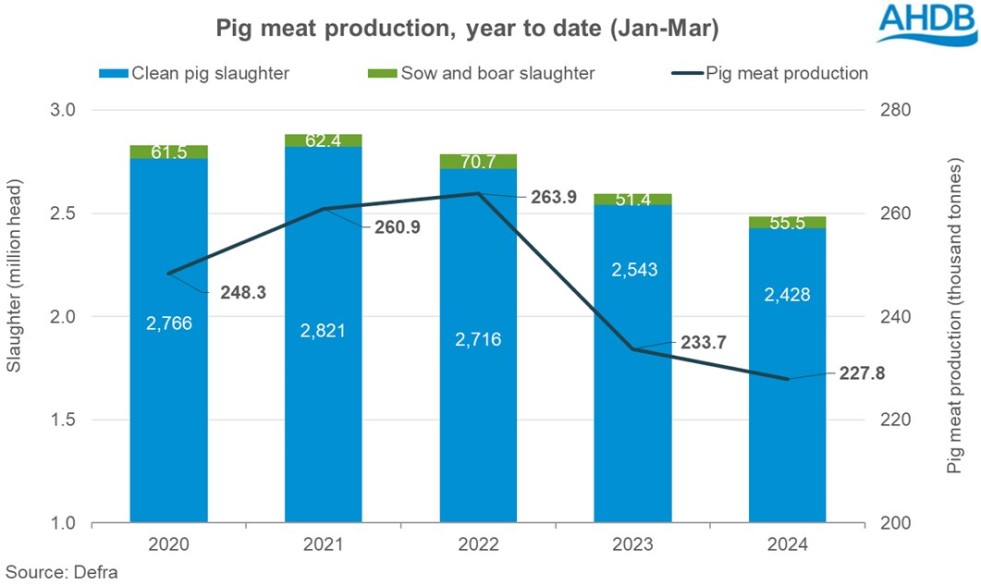

UK pig meat production in the first quarter of 2024 totalled 227,800 tonnes, according to the latest Defra figures. This is a decline of 2.5% compared to the same period last year and the lowest Q1 volume recorded since 2017. Our Agri-market outlook published at the beginning of February forecasted a 2% decline in Q1 with the full year ending 0.6% up.

Although carcase weights have seen an uplift of 1.6kg year on year, averaging at 90.5kg in Q1 2024, reduced numbers of pigs available for slaughter has driven the production decline. Total slaughter (clean pigs + cull sows and boars) for the period stood at 2.48 million head, the lowest Q1 kill recorded since 2011.

Clean pig slaughter totalled 2.43 million head, a year on year loss of almost 116,000 pigs. Meanwhile, cull sows and boars totalled 55,500 head, an increase of just over 4,000 head compared to Q1 2023.

Continued wet weather has been reported to be negatively impacting on farm productivity which could further limit pig supplies later in the year. The weather has also resulted in reduced plantings of arable crops over the autumn and is yet to ease off enough to allow for spring drilling. This is raising some concerns around feed ingredient availability and cost for the back end of the year.

Alongside this, straw prices have been rocketing upwards, with average prices now £40/t higher than last year. The 2023 straw harvest was poor due to a wet summer compounded by the fact that demand for straw has increased, with many cattle being housed for longer due to poor ground conditions limiting turn out. A poor harvest in 2024 is likely to add further flames to the fire.

Despite improved farm margins, these factors suggest that plenty of hesitancy remains among producers and processors. This is likely to result in a continued recovery focused mentality following the challenges of the previous few years, outweighing any significant investment.

We will be re-visiting our Agri-market outlook in the summer to see how these new challenges have impacted our forecasts.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.