- Home

- News

- UK lamb exports increase in July while imports fall, but could more imports be on the horizon?

UK lamb exports increase in July while imports fall, but could more imports be on the horizon?

Thursday, 17 September 2020

By Rebecca Wright

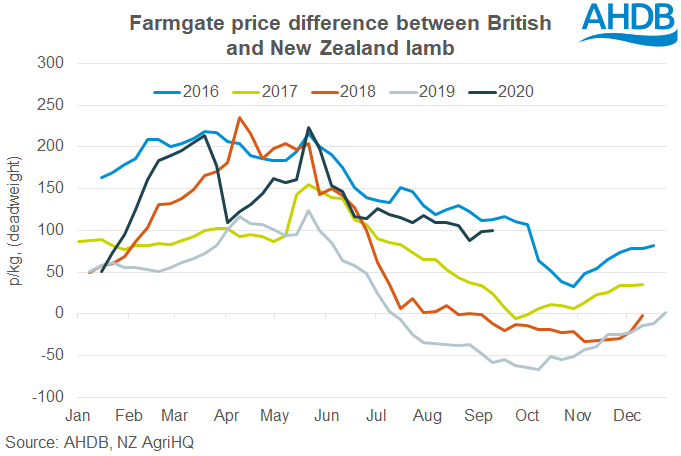

Trade flows have been disrupted so far this year due to coronavirus. Export volumes have been under pressure, although have recovered in recent months. Import volumes had been suppressed for several years and 2020 was no different. However, the farmgate price difference between British and New Zealand lamb has widened to the widest level for this time of year since 2016. This could mean that more New Zealand product is attracted onto the UK market.

Exports

During July UK exports of sheep meat increase 27% (1,700 tonnes) year-on-year, to 8,200 tonnes, according to the latest HMRC data. Just over half of the increase was sent to France, which received 3,400 tonnes during the month. Italy and Belgium both recorded increases of 400 tonnes.

Exports were exceptionally low during the spring and early summer due to the COVID-19 pandemic. This means year-to-July export volumes total 46,800 tonnes, down from 51,000 tonnes in the same period of 2019. Volumes to all key markets, especially France and Germany, have recorded year-on-year declines; volumes are in line with 2018 levels.

Imports

UK imports of sheep meat in July totalled 3,900 tonnes, down 19% (900 tonnes) on-the-year. Imports from New Zealand remained subdued at 2,600 tonnes. Shipments from Ireland were also back on-the-year at just over 400 tonnes.

In the year-to July UK imports are down 11% (4,700 tonnes), to 38,200 tonnes. The entire decline can be attributed to a decline in New Zealand and Irish product. There was an uplift in product arriving from Australia earlier in the year.

Based on New Zealand export data, it appears during August there may have been a rise on-the-year in the volume of New Zealand lamb on the market in Europe. Although in September reports suggest imports from New Zealand to Europe may again be subdued.

Farmgate prices in both New Zealand and Australia are currently on a general downwards trajectory. The exchange rate fluctuations have muted some of the declines in sterling terms. Should the price gap between British and New Zealand lamb continue be at this wider level, we may see an increase in imports from New Zealand, and GB prices coming under pressure. The price difference now, is more like the one seen between 2011 and 2016, and is being driven by both high GB prices as well as lower New Zealand prices. This will be a key watch point for the British lamb industry this autumn. It is also during this period when many supply contracts are signed for the following spring.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.