UK intended wheat area down 17%: Feed market report

Friday, 28 February 2020

By Alex Cook

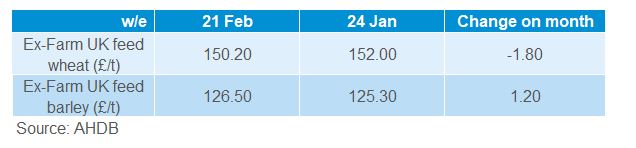

Grains

Global grain markets were relatively stable in the first three weeks of February, after recording declines at the end of January. Trade was generally dull on the back of the coronavirus limiting demand in the short-term and no major new weather stories became apparent on a global level.

In the UK, the weather continued to be challenging and new information shows the impact of the difficult planting season so far. Our updated Early Bird Survey results highlighted a 17% decline in the intended UK wheat area for harvest 2020. This is a greater decline than farmers had intended before Christmas.

We used this information to create UK grain production estimates for the coming season (2020/21). The report details a range between the ‘worst-case’, ‘mid-range*’ and ‘best-case’ scenarios.

- Wheat production is estimated at 10.74Mt, using the “mid-range” forecast of area and yield.

- Barley production is estimated at 6.40Mt, using the “mid-range” estimates. The degree of spring barley planting may cause production figures increases.

These mid-range scenarios would be sharply lower than the 16.3Mt of wheat and 8.2Mt of barley harvested in 2019. As such UK grain prices could remain somewhat support and continue at import parity levels.

Domestic barley will continue to compete against imported maize which will likely cap prices. Currently this season we have seen high imports of maize. The latest HMRC data shows July-December imports of maize sit just 49Kt below the same point last season at 1.24Mt. At the beginning of 2018/19 domestic feed prices were really high which made imported maize very competitive and pushed the usage higher. Although this season to Dec, has seen a drop in maize usage in animal feed production (including integrated poultry units) (-24.1% YoY) and a rise in barley usage (13.1% YoY), if maize continues at competitive prices we could see further increases in maize usage.

*Mid-range scenario: This scenario takes a percentage of the EBS area figure and multiplies the area by a best/worst average yield to get a mid-range production figure. For oats, OSR and winter barley, this area figure is 90% of the EBS. This is different for some crops and is explained in detail below.

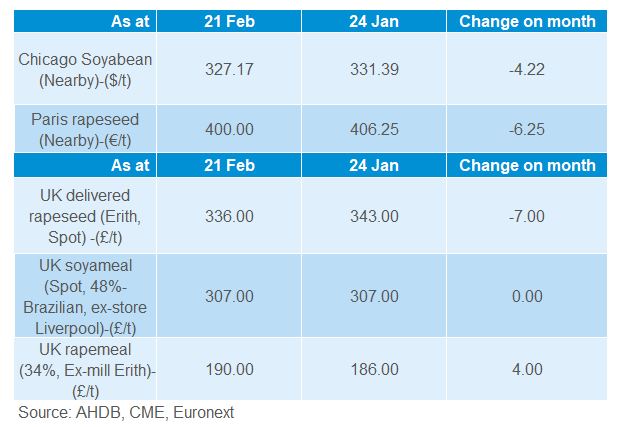

Proteins

Globally, oilseeds have continued to be under some pressure from the continued concerns surrounding coronavirus and the demand from key users such as China. This pressure has fed into the oils markets too. There has also been reports of increased palm oil supply, which met with muted demand, could continue to keep palm oil prices down.

Within the EU, imports of oilseeds have continued to be strong throughout February. Imports of oilseed rape have flattened out slightly, as the question arises as to where more would be able to come from. Having reportedly exhausted Black Sea supplies and reaching the limits of Canadian supply due to GM constraints it is likely that other oilseeds will be imported in rapeseeds place. Sunflower seed has been imported at decent pace and this is likely to continue.

Similar to UK grains moving towards harvest 2020, there has been some further drops to OSR plantings. The latest Early Bird Survey implies a loss of 38Kha from November to mid-February, further reducing the potential supply. Our best case scenario estimate, working with the current area (no further losses) and the five-year average yield, is 1.26Mt for the 2020/21 season. This highlights a continued requirement for imports of oilseeds going forward.

Subdued trade between the US and China could lead to surplus supplies of soyabeans, pressuring prices further. Currently imports of soyameal into the EU are above the same time last year and if prices remain under pressure this could continue.

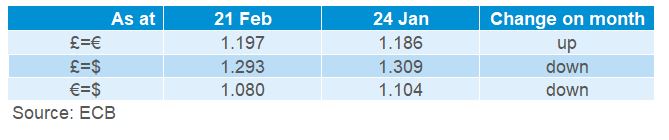

Currency

Sterling has been quite erratic throughout February. The ongoing coronavirus outbreak has caused concerns surrounding European trade with China, particularly in the manufacturing sector which has subsequently knocked the euro. This has allowed sterling to strengthen against the euro which generally pushes physical domestic prices lower. UK grains are competing with imported maize in the feed markets and stronger sterling can make imports a cheaper option.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.