Taking a look at UK crop production 2020/21

Friday, 21 February 2020

Market Commentary

- UK feed wheat futures (May-20) saw a slight recovery yesterday, closing at £153.5/t, up £0.25/t from Wednesday. This rise extended to new crop UK wheat futures (Nov-20) which increased by £0.35/t to £161.75/t. However, on opening this morning, prices for both months have fallen. Weekly French crop conditions were unchanged at 65% of soft wheat rated at good/excellent. French spring barley plantings were reportedly at 20% planted, up 4% on the week.

- The USDA announced planting intentions for the upcoming season yesterday. US farmers intend to plant 38.04Mha of maize, up 1.74Mha from last year, which if realised would be the largest maize area since 2016. US farmers intend to plant 34.39Mha of soyabeans, up 3.60Mha, on last year as farmers seek to recover from weather affected plantings last year.

Taking a look at UK crop production 2020/21

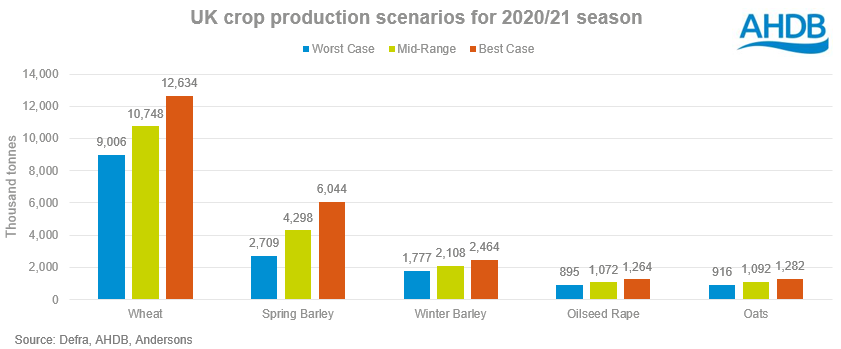

This season is already one of the most challenging for growers in recent times and will be a memorable season for many years in the future. Now that our updated Early Bird Survey (EBS) has been released, it gives us the opportunity to take a look at crop production figures with the use of three different scenarios. Our ‘worst case’ scenario is a measurable instance, rather than trying to pin a figure on a figurative ‘total crop failure’.

The three scenarios and the workings behind them are as follows:

- Best case scenario: Taking the full Early Bird Survey area figure, assuming no further crop area losses and multiplying by a five year average yield to get a best case production figure.

- Mid-range scenario: This scenario takes a percentage of the EBS area figure and multiplies the area by an average of the best and worst yield, to get a mid-range production figure. For oats, OSR and winter barley, this area figure is 90% of the EBS. This is different for some crops and is explained in detail below.

- Worst measurable case scenario: This scenario takes a significant cut to the EBS figures and multiplies that by a five year low yield. This is different for some crops and is explained further below.

Wheat

Taking a look at wheat first, our estimates for the 2020/21 season have production at a worst measurable case scenario of 9.01Mt and a best case scenario of 12.63Mt. The mid-range scenario is a production figure of 10.74Mt, which would be the lowest wheat production season in the last twenty years by over 840kt. Either way, the production figure will have a considerable old-crop carryover added to the balance.

The worst case scenario makes use of the total wheat area planted by February 14th, not including any further spring intentions. This figure is 1,217KHa, and is multiplied by the average wheat yield from the wet 2012/13 season which was 7.4t/ha. This then gives a production figure of 9.01Mt.

The best case scenario makes use of the full EBS wheat figure assuming the intentions are met. This is a figure is 1,504KHa and is multiplied the five year average wheat yield of 8.4t/ha. This then gives a best case production figure of 12.63Mt.

Barley

Our estimates for barley have production at a worst measurable case of 4.48Mt, and a best case scenario of 8.50Mt. This wide range is largely due to the degree of spring barley planting which if intentions are fully met, could be at a 47% increase on last year. Given the later plantings dates for spring barley, there is the possibility that production could reach the higher end of this range.

Spring barley seems the likely choice for many who are intending to increase spring cropping area. A mid-range estimate has the total barley production at 6.40Mt. The production figure will meet a large carryover of barley which could turn this season into a consecutive year of a large barley surplus.

The worst measurable case production figure for spring barley is 2.7Mt, whilst the best case scenario would be 6.0Mt. The best case scenario makes use of the full intended EBS area of 1,042Kha with the five year average yield of 5.8t/ha. The worst case scenario assumes 50% of the intended EBS spring area gets planted, with a five year low yield of 5.2t/ha.

As winter barley requires a vernalisation period, it is very unlikely any further winter barley will be planted so the EBS figure used for the different scenarios accounts for crop area losses rather than intentions not being met. Therefore, the worst case scenario assumes a 20% crop loss of what is planted. A yield of 6.4t/ha is used in this scenario, this figure was the UK yield achieved in the 2012/13 season. The worst measureable production figure is then 1.77Mt.

The best case winter barley scenario would be a production figure of 2.46Mt. This is assuming that the EBS figure of 347Kha is unaffected by any area losses and is multiplied by a five year average yield of 7.1t/ha.

Oilseed rape

Our estimates for oilseed rape have a best case scenario production figure of 1.26Mt, and a worst case production figure of 895Kt, with a mid-range estimate of 1.07Mt. The best case figure is still a year on year decline of 489Kt, which alone paints a worrying outlook for the future of the UK rapeseed crop.

The best case scenario assumes the published EBS area of 361KHa is unaffected by any further crop reductions and is multiplied by the five year average yield of 3.5t/ha. The EBS figure included an assumption of the scale of winter area losses from crop establishment failure and cabbage stem flea beetle damage. The rapeseed area and yield figures may be affected by further pest damage and disease pressure moving into warmer spring temperatures.

The mid-range scenario assumes a 10% loss to our EBS area figures making the area at 324.9Kha, multiplying this by an average yield of 3.3t/ha gives a production figure at 1072.17Kt. The UK’s import demand for rapeseed going forward, will be large either way given the reduction on an already low production figure last year.

Oats

One spring option which is likely to see an increase in area is oats. Our EBS figures detail intentions to plant increasing 26% on last year. The UK oat area has seen a resurgence in recent years, especially as the crop is a viable option for combating blackgrass.

Our estimates for oat production detail a mid-range scenario figure at 1,092Kt, an increase of 20Kt on production last year. The best case scenario has an estimate of 1.28Mt, providing the full intended EBS figure is planted with a five year average yield. The worst case scenario assumes a 20% loss to the EBS intended area, multiplied by the five year low yield of 5.0t/ha, giving a production figure of 916Kt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.