Analyst Insight: What could the potential carryover look like?

Thursday, 13 February 2020

Market Commentary

- UK feed wheat futures (May-20) fell £0.15/t yesterday to close at £152.45/t, pressured by stronger currency. Sterling has continued to strengthen this week, with better than expected year on year preliminary UK GDP figures for Q4 2019. Sterling closed yesterday at £1 = €1.1916.

- The International Energy Agency (IEA) today announced an expected decline in oil demand for Q1 of this year, a first since 2009, as the coronavirus (Covid-19) outbreak continues. Crude oil futures (nearby) had declined $0.69/bbl to $55.13/bbl by 9:30AM GMT this morning.

A closer look at the carryover

Now that we have passed the halfway point for this current marketing year, it is worth taking a look at how exports have fared this season so far, and theoretically examining what the degree of carryover could be. A large cereal surplus this season has placed greater emphasis on the UK’s export ability, October’s export figures for barley were the highest in over twenty years. However, with the UK facing a new crop production figure below this season, the incentive to carry old-crop into the new season is likely attractive for some.

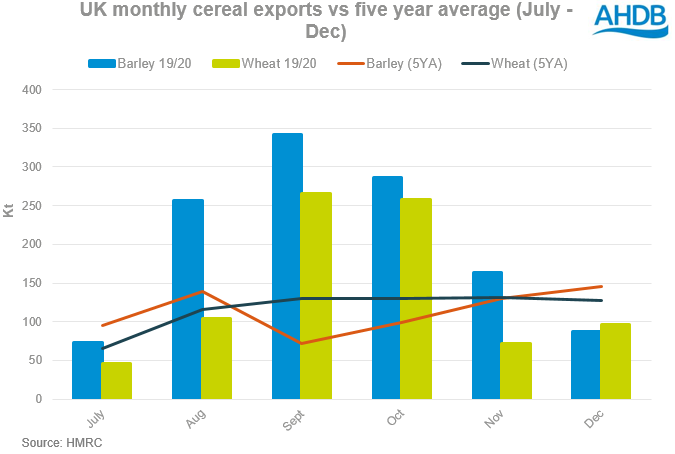

Taking a look at exports, the latest UK HMRC figures released earlier this week detail trade data for the month of December. This update now officially puts UK exports at 1.2Mt for barley and 841.4Kt for wheat for July - December.

Against the AHDB balance sheet figures, subtracting this season-to-Dec wheat figure from the 2019/20 balance of 4.52Mt, means a figure of 3.68Mt of wheat was theoretically available from the start of January. If we take the average for Nov-Dec-19 UK wheat exports at 83.78Kt and multiply this by the remaining months of the season including January, it totals 502.68Kt. Therefore if the UK maintains the Nov-Dec export pace, we are theoretically looking at 3.18Mt of wheat left available at the end of this season for carryover into next. The 1.55Mt operating stock requirement is included in this.

If this is the case, the level of old-crop carryover plus the anticipated 10Mt - 12Mt wheat crop, could see domestic wheat availability open near to the 2018/19 season. The UK is likely to switch to a net-importer scenario next season and with cereal imports in demand, grain availability could further rise.

For barley the supply picture is heavily dependent on the degree of spring barley planting. Our December planting intentions estimates point towards a 23% increase in the area planted. These figures will be updated next week to give a more up-to-date picture.

If this is the case, then a potentially consecutive 8.0Mt+ barley crop would meet the carryover from this season, likely resulting in barley prices sustaining further pressure to remain at export parity for the foreseeable future. The balance sheet estimate for barley trade balance this season was estimated at 3.18Mt, subtracting total July-Dec exports of 1.20Mt gives a figure of 1.98Mt. Applying the Nov-Dec average export pace of 125.2Kt puts Jan-June barley exports at 751.2Kt, leaving 1.23Mt available at the end of the season. Again, the 790Kt barley operating stock is included this this figure. A second 8.0Mt crop would result in barley availability around the 9.2Mt mark. For reference, the availability at the start of the 19/20 season was 9.3Mt.

With imported maize a now constant presence in EU feed trade, any price increases that arise from low wheat availability may not immediately filter through to barley markets.

With the new crop planting difficulties, the incentive to carry over old crop into the new season is certainly a watch point. Anthony’s analyst insight in January examined the potential margins available associated with this which still stand at the current wheat price.

It must be noted that both the wheat and barley calculation uses a flat monthly export figure as a proxy, therefore these calculations act as a theoretical estimate rather than actual figures.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.