Analyst Insight: Is it worth carrying old crop into the new marketing year?

Thursday, 30 January 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £153.00/t, down £0.50/t on the day before. The November contract closed at £161.90/t, down £1.65/t on the day before.

- Prices are slightly down as traders assessed what the impact of the China Coronavirus outbreak. Further pressure for the EU market has come from strikes at the French ports.

- The market will be closely watching the results of the latest tender from Egypt’s state grain buyer GASC when they are released later today. GASC are seeking an unspecified volume of wheat in their latest tender.

- The Russian Agriculture Ministry have estimated the 2020 grain crop at 125.3Mt, this is up from the 2019 preliminary estimates of 120.7Mt.

Is it worth carrying old crop into the new marketing year?

As we draw towards the end of the winter drilling window, it’s becoming more apparent that arable farmers may have to plant alternatives to winter wheat to produce grain for the 2020/21 marketing year.

After producing a huge crop for the 2019/20 marketing year, UK wheat and barley traded at an export parity in order to ensure we were competative with continental markets. The start of the season saw the UK export grain at a substaintial rate to mitigate political uncertianity around Brexit.

From the moment the can was kicked down the road and Brexit uncertainity was delayed until the end of January, we witnessed the most unfavorable conditions to drill winter crops.

Going into the New Year trade expectations of exports to the EU have diminished. This isn’t ideal, as post-harvest 2019 we had and still have a substantial grain surplus. November wheat exports reduced by over 73% from October to just 67,000kt. This could result in a huge carry over into the 2020/21 marketing year.

How might stock impact price spreads

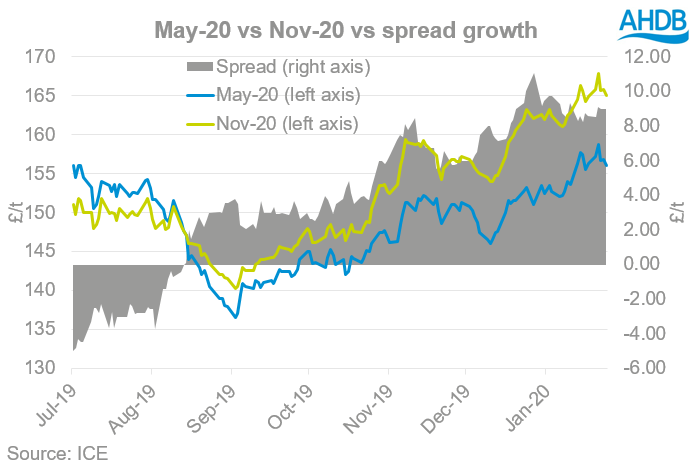

I have discussed previously the spread between old and new crop futures, and how we may see an increased spread between delivered premiums in the North and South. The graph below shows a comparision of the May-20 and November-20 futures prices, you can clearly see the exponential growth of the spread between the two. The spread intensified from the end of October as adverse weather continued.

Current sentiments around the new crop appear to be very bullish. As such the incentive has remained to carry grain into the new marketing year.

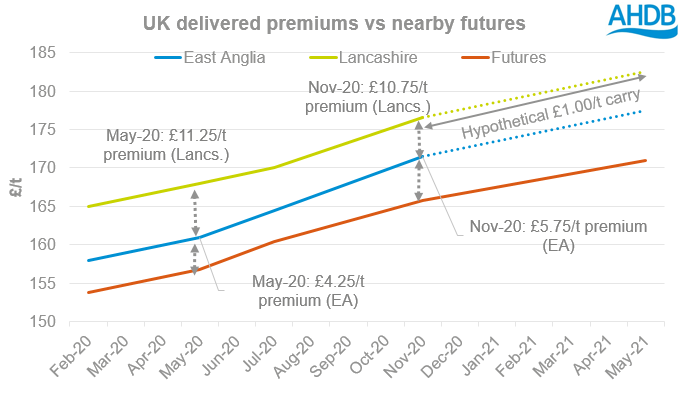

The latest UK Delivered Survey released last Friday quoted delivery of feed wheat into East Anglia in May at a premium of £4.25/t over May-20 futures. Feed wheat delivered into Lancashire was quoted at £11.25/t over futures. For November delivery these premiums are quoted at £5.75/t and £10.75/t over Nov-20 futures. The carry in futures from May-20 to Nov-20 was £9.00/t.

As the graph shows this growth at the moment is set to continue exponentially into the new marketing year. I have hypotectically quoted the May-21 delivered premiums basing it off a £1 per month carry, but this carry could be greater as premiums towards the end of the season are usually higher in years of tight supply.

However, this is all dependant on supply and demand within regions, and 2020/21 production will be the basis to set these premiums.

Is it worth carrying my grain?

Looking into a shed full of wheat, and bags full of seed that are redundant unless sown, the temptation to carry old crop into the new marketing year is so tempting. However, is this an economically viable option?

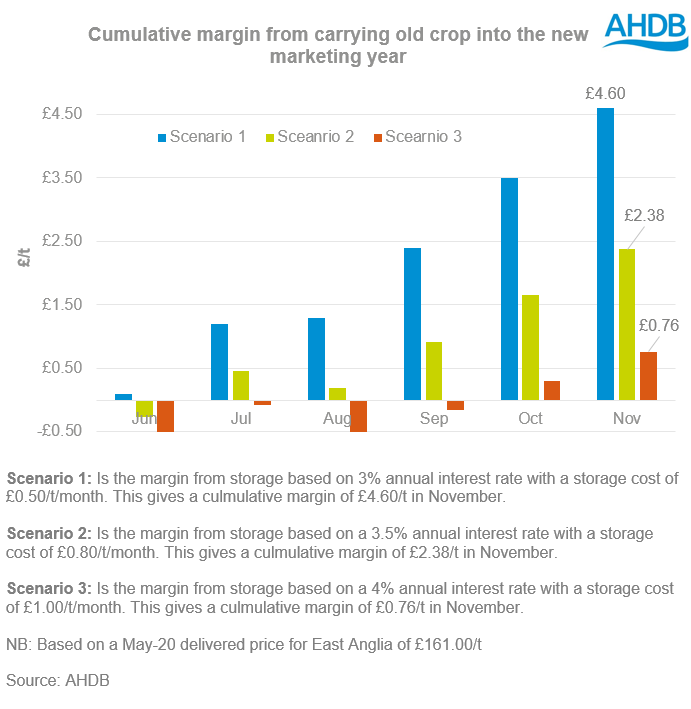

The graph below shows the margin gained from storage if you were to carry grain into November under three different scenarios. This is based on the spot delivered physical premium price into East Anglia. On Thursday 23rd January the carry from May-20 to Nov-20 stood at £10.50/t.

The monthly cost of carrying wheat has been calculated, using storage cost + ((spot price x annual interest rate) / 12). This calculation allows us to take into account both the physical and financial costs of storage. This is then used to work out the margin from store, by taking the monthly storage cost less the cumulative price carry from May-20 to Nov-20 (in this calculation a carry of £10/t is used).

With all of these scenarios there is an incentive to carry grain into the new marketing year, but it’s critical to lock this price in for Nov-20 delivery. Furthermore, these figures are based on the fact that you own the store and are not paying any outstanding rental cost.

Logistical considerations need to also be factured into transporting grain to other stores, as this will erode the cumulative margin.

Moreover, when harvest comes round and storage is finite. This could mean a large proportion of new crop may have to be sold at a discount to make space, which could inturn offset profits that are made from the carry.

Is it worth it?

The key point to take away is to financially consider, it is worth it? It’s undisputed that carrying grain into the new marketing year could be finacially rewarding with a sizeable spread and premiums.

It may be that grain in shed is better than cash in the bank. Even with unfavourable storage costs and interest rates there is still a margin to be made, but that margin is narrow.

Cost of labour time, storage, and logistics need to be assesed. You do not want to be scenario 3 in November wishing you had sold your grain last January.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.