A diverging spread between old and new crop feed wheat futures: Grain Market Daily

Friday, 3 January 2020

Market Commentary

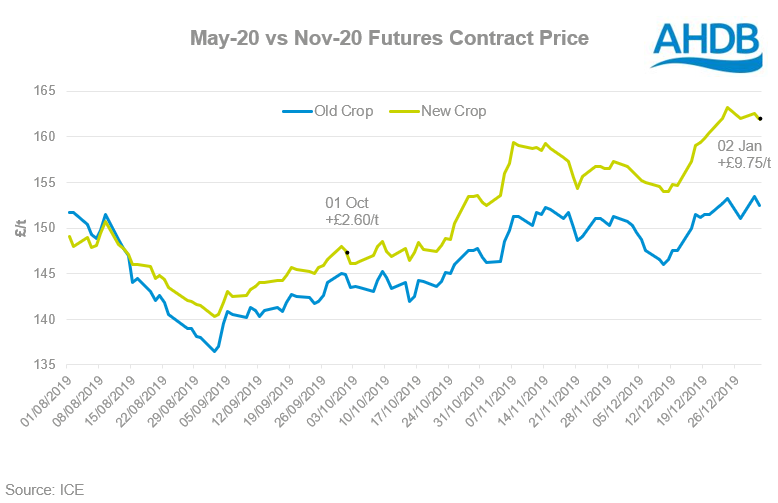

- UK feed wheat futures (May-20) closed yesterday at £153.50/t, gaining £1.00/t into the new year. Furthermore, Nov-20 contract closed at £163.25/t, gaining £1.30/t.

- Nearby Chicago soyabean futures closed at $346.95/t. Gaining over 8% since the start of December. This is from the anticipated increase in demand from China for US exports.

- Chicago wheat futures (Mar-20) closed at $205.86/t, gaining $0.55/t into the new year. The USDA advocated a decline in US winter wheat crop condition.

A diverging spread between old and new crop feed wheat futures

As we progress further into the winter drilling window, we are starting to see an increasing spread between the May and November futures prices.

That spread as at yesterday’s close stands at £9.75/t, the last time old crop prices were at a premium was in the middle of August. As markets have reacted to adverse drilling conditions, we have seen new crop prices change from trading at an export parity to now an import parity. This means that currently the market is anticipating UK to be in a deficit next season.

As the winter is progressing, we are currently seeing that spread grow, but there will be a limitation as the UK will have to stay competitive with imported prices.

This recent gain in new crop prices will offer an incentive for sellers to hold old-crop grain and sell into the new cropping year. This could slow farmer selling for old-crop and potentially lead to the UK having slightly less to export.

Currently, this may be beneficial for relieving pressure from this marketing year. The latest UK Cereals Supply and Demand estimates predicts there is 2.98Mt of wheat to be exported or held as free stock.

Although new crop prices may currently offer an economically viable incentive to hold onto current grain until the next marketing year, it’s crucial to ensure a contractual agreement is in place.

It’s critical to remember; futures markets are only reacting to what is happening as of today. Poor conditions have meant our new crop prices have gained significantly since August. However, it’s important to consider that if weather in the coming weeks improves significantly, we could see that widening price spread reduce.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.