Are delivered premiums heading North?: Grain Market Daily

Wednesday, 15 January 2020

Market Commentary

- UK feed wheat futures (May-20) closed yesterday at £157.70/t, gaining £1.45/t on the day before. Furthermore, the November contract closed yesterday at £166.25/t, gaining £1.70/t on the day before.

- US wheat futures (Mar-20) closed yesterday at $208.89/t, gaining $2.30/t on the day before. This contract is trading at over a year high.

- Prices have gained sharply as Russia’s Agriculture Ministry is proposing to set a non-tariff quota for grain exports of 20Mt from January to June, this hasn’t been approved by the government yet. The quota would then be lifted towards the most active part of the trading season. Although markets are bullish over this news, there is speculation that Russian exports will not even reach 20Mt in this period.

Are delivered premiums heading North?

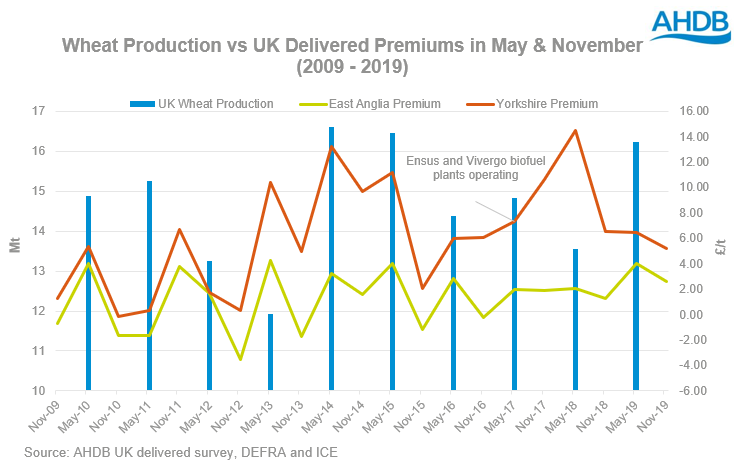

As our domestic wheat market transitions from a large production of 16.2Mt in 2019, to what could be a significantly reduced crop in 2020, there is more to analyse than the diverging spread between old and new crop futures. It’s crucial to understand how this will influence our delivered premiums into different mills throughout the country.

The East of England produces a significant amount of wheat. In 2019, the region produced 26.3% of the UK’s total wheat production. East Anglia’s infrastructure of various mills and some of the biggest ports means that this region can consume what is produced locally and still have a surplus for domestic markets. In years of surplus grain and certainty of a plentiful upcoming harvest, movement to East Anglian ports ensures that a lot of the UK’s grain in the East is available for export.

However, to ensure that wheat produced in the East Midlands moves to the North of the country, mills in the North offer a delivered premium over UK feed wheat futures. This premium is to attract grain to move into the North of the country instead of moving out of the country in deficit years.

The adverse 2019 winter drilling is comparable to conditions experienced in Autumn 2012, which led to a sub-12Mt crop. Based on averages, throughout the 2012/13 season delivered premiums gained £10.05/t in Yorkshire and £7.75/t in East Anglia between November and May. In Yorkshire on average delivered premiums reached £10.42/t over futures in May 2013.

Ensus and Vivergo bioethanol plants operating in 2016/17 increased human and industrial consumption by over 10% which didn’t allow depleted end-season stocks to recover. A combination of this and a reduced production in 2017/18 meant that Yorkshire delivered premiums were greater than £12.00/t over East Anglian premiums in May 2018 on average.

We conventionally see premiums higher towards the end of the season, which is expected. Depending on commercial end-season stocks and production in 2020/21 we could expect to see premiums start to significantly gain from November 2020 as the UK may be faced with a wheat deficit.

The spread between North and South premiums will be dependent on demand from Northern regions and relative supply in Central and East England.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.