Is barley still at risk from cheap maize? Grain Market Daily

Wednesday, 12 February 2020

Market Commentary

- The May-20 UK feed wheat futures contract lost £1.65/t, to close at £153.60/t. Global wheat markets have lost ground in the past couple of days with a run of North African wheat tenders (Egypt and Algeria).

- The UK May contract ended yesterday hovering just £0.01/t above its 50-day rolling average, breaking below it today. This could signal some technical support.

- The USDA supply and demand estimates came and went last night without any major surprises. With the exception of soyabeans, the balances of most major crops were largely unchanged. For soyabeans there was a 3Mt pick up in imports, reflecting January’s trade deal between the US and China.

Is barley at risk from cheap maize?

GMD in brief

Today’s extended GMD is focusing on the large volume of UK maize imports, large South American maize supplies and a big export campaign for Black Sea maize. It is likely that these factors will contribute to increased pressure for UK barley prices over the remainder of this season, with barley prices already fighting to stay competitive.

Is barley still at risk from cheap maize?

During the wet winter, and into the New Year, a lot of the price risk for barley we’ve been discussing has come from increased threat of a large spring barley crop. This remains a very prevalent threat. However, another factor comparatively flying under the radar is the continually high level of maize imports coming into the UK.

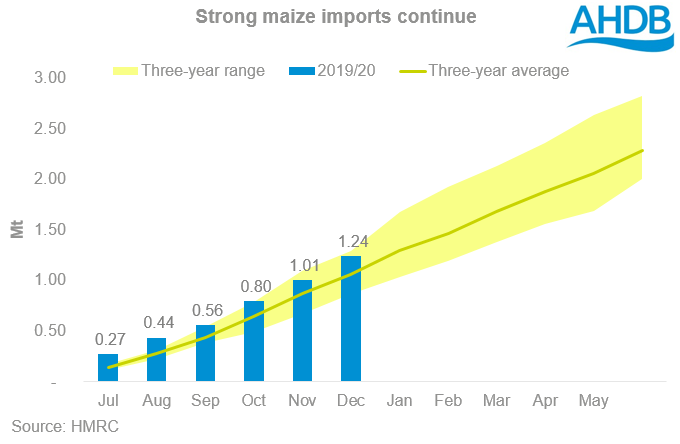

December trade data, released by HMRC yesterday, shows that the UK imported 238Kt of maize, taking the total volume for the season-to-date to 1.24Mt. Current season maize imports are just 49Kt below the same point last season.

Last season’s imports were financially justified, with barley prices astronomical through the early part of 2018/19. However, with an 8.05Mt barley crop in 2019/20 pricing very competitively at a discount of £24/t to wheat (ex-farm East Anglia, Spot), a high volume of maize imports poses a significant price risk if they continue.

So what is the likelihood of this trend increasing?

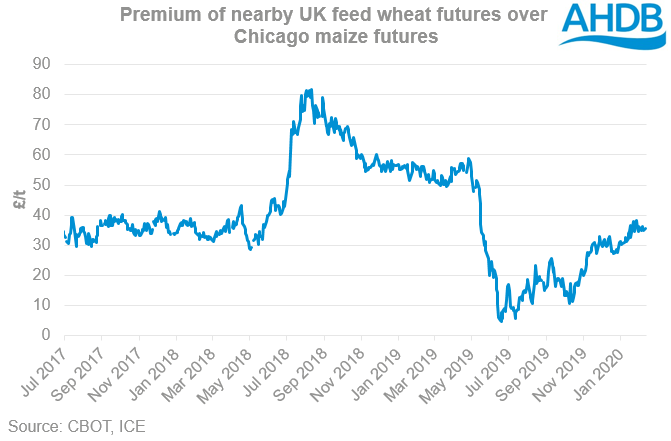

Global maize prices remain very cheap, Chicago maize futures (nearby) are currently pricing £35/t under UK feed wheat futures (nearby). While this discount is not as big as it was this time last season, it remains at a level which is likely to continue incentivising maize imports.

Will maize prices stay low?

There are a number of important points to consider in maize markets at the moment. The first of these is the size of the Brazilian maize crop. We’ve covered the weather challenges for maize quite a lot in recent weeks, but despite the potential for delays in planting of the safrinha crop, this week’s Conab production forecast upped the estimate for the second crop by 2.3Mt. Last season the UK imported 10% of its maize from Brazil, so it’s definitely a crop worth keeping an eye on.

Elsewhere, FranceAgriMer has upped its expectations of maize stocks by 0.1Mt, to 2.2Mt. Meanwhile, Stratégie Grains are currently forecasting an increase in maize production in the EU in 2019/20, further pressuring the maize market.

Finally, Ukrainian exports are still going strong. So far this season 349Kt of domestic maize imports have come from Ukraine, a trend that could well continue. In July to February, Ukraine has shipped 16Mt of maize, with UkrAgroConsult forecasting total season exports at 29.8Mt.

There could yet be more pressure for global and Black Sea maize prices, with 14Mt of Ukrainian maize to be exported in the remaining 5 months of the season. Additionally, there could be potentially large supplies to come out of South America also.

This potential pressure for maize prices will likely continue to weigh on domestic barley prices to remain competitive.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.