UK beef production update: Strong demand continues to drive production and trade

Friday, 18 October 2024

Key points

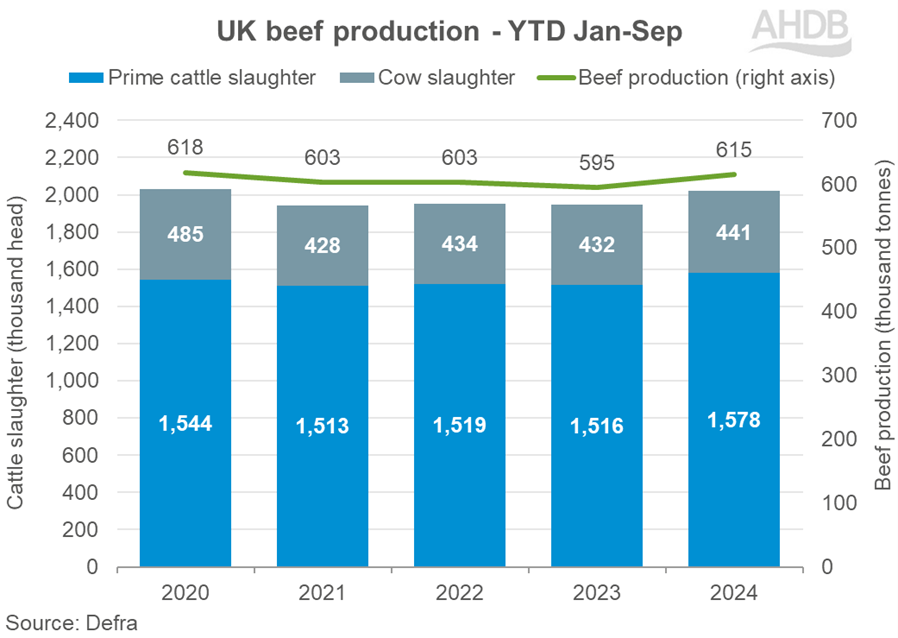

- Production up on the year by 4% Jan-Sep, driven by strong demand and prices.

- Irish beef imports hold strong, amongst widening price differential between UK and Ireland.

- UK beef exports up 10% for the year-to-date versus 2023, with key growth to non-EU markets.

Production

UK beef production totalled 76,600 tonnes in September, up 5% from August. Production was also up compared to last September’s levels by 7% (5,300 tonnes).

Prime cattle slaughter grew in September by 5% to 173,900 head, driving growth in production figures. Prime carcase weights have remained relatively stable this year, sitting 1% above year-on-year figures in September, however fell marginally by 1% from August. Additionally, GB deadweight cattle prices have continued to rise despite an increase in slaughter.

Cull cow slaughter also grew in September, up 11% from August to 52,500 head as we see seasonal rises coming into play. This was 7% above rates seen a year ago, potentially driven by high cull cow prices and wet weather driving cattle indoors sooner.

Industry reports suggest competition for cattle and robust demand for beef is supporting prices. The most recent 12-week GB retail data, ending 1 September 2024, saw spend on beef increase by 4.1% year-on-year, with volumes rising by 1.6%. Prices paid also rose by an average of 2.4% across all beef products.

Trade

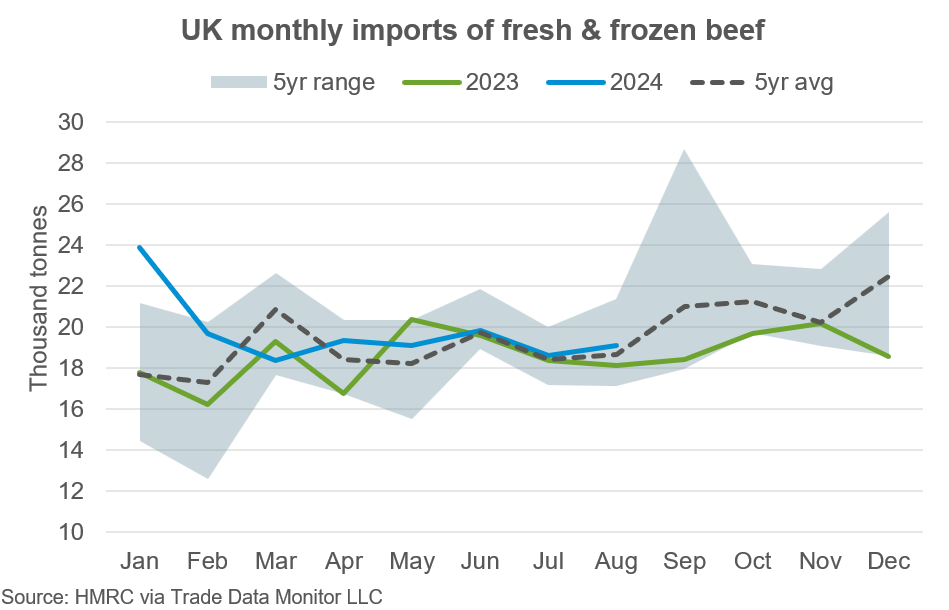

Year to date (Jan-Aug) UK fresh & frozen beef imports totalled 157,830 tonnes, an increase of 5% compared to the same period last year. Imports have risen into August totalling 19,086 tonnes following a drop of 6% in July.

Ireland continues to dominate UK beef imports with a market share of 76.3%, up on the year from 72.7% over the same period in 2023. In total, beef imports from Ireland were up 3% in August from July to 14,300 tonnes. This brought the year-to-date total to 120,500 tonnes, up 13% compared to the same period in 2023. The UK and Irish price differential grew into September, with the Irish R3 steer price sitting 97p/kg below the equivalent GB measure in the week ending the 7 October. Ireland’s competitive pricing position and elevated kill, coupled with the strong UK market has likely facilitated a rise in imports into the UK, with the price differential being a key watchpoint for import levels moving forward.

Imports from Australia also grew in August sitting at 770 tonnes, accounting for 4% of the UK market, compared to 0.2% in August 2023. Meanwhile, imports from key countries including Poland, Netherlands and Germany were in decline, with the largest drop seen in Germany (-56%).

So far in 2024, beef exports are 10% above 2023 export volumes totalling 72,900 tonnes. In August, UK exports totalled 8,300 up 3% year-on-year, but down 4% compared to July. The EU remains the UK’s main destination for beef exports, accounting for 85% of volumes shipped in the year to date. Some headwinds may have hampered export in August; GB cattle prices remain very strong compared to continental values, while sterling has appreciated against the Euro this year. On the other side of the coin, EU beef production is expected to decline marginally in 2024 and again in 2025, which may offer opportunities for UK product.

Non-EU export destinations for UK beef have been a primary driver for trade in 2024. Hong Kong holds the greatest share with 4,100 tonnes exported so far in 2024, up 67% compared to the same period in 2023. Exports have also risen to Canada, the Philippines other smaller non-EU markets, increasing value returned to the domestic market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.