To what extent do exchange rates influence lamb prices in the UK?

Thursday, 12 November 2020

By Charlie Reeve

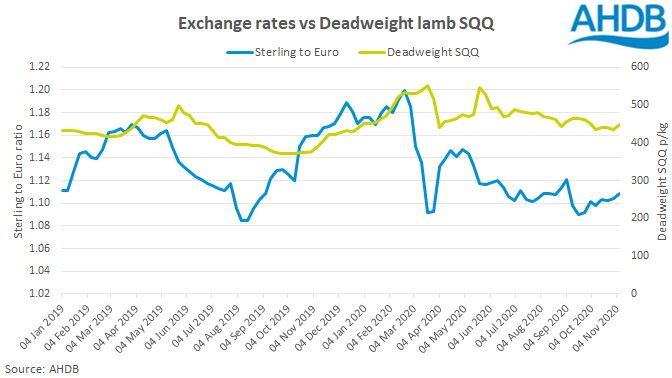

There is a range of different market drivers that influence sheep prices, including supply, consumer demand and international trade to name a few. The exchange rate also plays a role. The EU is the main market for UK sheep meat exports. A weaker sterling compared to the Euro helps make UK sheep meat more price competitive.

In 2019, 32% of total UK sheep meat production was exported and over 90% of these exports went to the EU. The UK is becoming more self sufficient for lamb as production has been growing in the UK, whilst consumption and imports decline, this is in turn likely to lead to a larger exportable surplus.

In 2020, UK lamb prices have also been driven by changes in consumer demand with a major shift to retail purchases during the height of the Coronavirus pandemic. A high proportion of UK lamb exports to the EU would normally end up in the food service sector of the destination countries, with lockdown taking place across Europe due to coronavirus this has also affected demand.

UK exports have benefitted from a favourable exchange rate due to a weak sterling compared to the Euro for most of 2020 so far. This has helped to support UK farmgate prices, although there are other factors also at play, including a strong price in France.

Scenario planning

On 6 November 2020, the exchange rate between UK Sterling and the Euro was at 1:1.1088, the same week in 2019 the exchange rate stood at 1:1.1598. To put this into context let’s take a lamb weighing 20kg deadweight, at 450p/kg. This carcase would be valued at £90, but €99.79 on 6 November 2020, and €104.38 based off 2019’s exchange rate, a difference of €4.59 year-on-year for the same carcase.

It is still to be determined whether negotiations with the EU will lead to a deal being agreed between the UK and EU. In the event of a tariffs having to be imposed, an additional 12.8% would be added to the to the cost of UK sheep meats exports to the EU as well as a further €171.3/100kg (for fresh/chilled lamb carcases/half-carcases) based off the EU tariff rate. It is widely thought that in the event of no deal, sterling would weaken. Although this would help compensate, it is by no means guaranteed.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.