UK lamb self-sufficiency and impacts of Brexit

Thursday, 5 November 2020

By Charlie Reeve

Self sufficiency

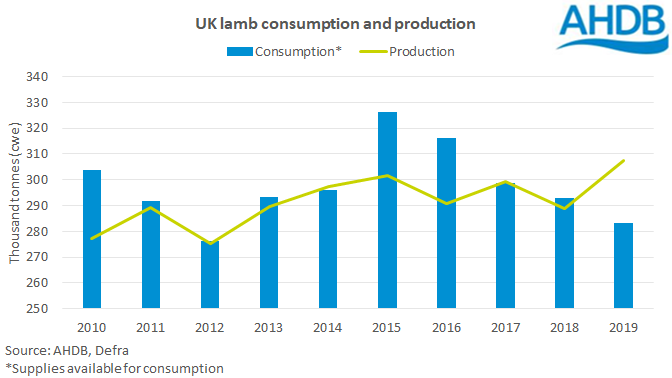

In 2019, the UK was 109% self-sufficient for lamb, up by nearly 10% on the previous year. This increase was due to both a reduction in lamb consumption in the UK year-on-year, and an increase in domestic production. During the same period lamb exports were also notably up and imports were down.

UK lamb self-sufficiency does fluctuate from year to year, although the general trend shows an increase in self-sufficiency. This is due to UK lamb production remaining firm despite a steady decrease in domestic consumption. As domestic consumption continues to drop back year-on-year and the gap between production and consumption widens further, the exportable surplus of lamb is growing. Access to key exports markets such as the EU is crucial.

Imports and exports

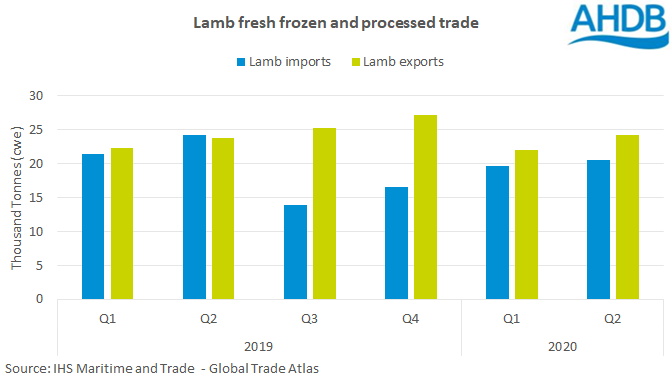

Import volumes of lamb entering the UK market have been declining in recent years. This has been driven by major lamb exporting nations such as New Zealand and Australia focusing on new markets in Asia and sending less product to the UK.

Export volumes of UK lamb have been increasing in recent years, and the vast majority of this trade is with Europe. Exchange rates between the Euro and Sterling have also been favourable in helping UK exports remain price competitive.

When looking and changes in import and export volumes, carcase balance is a very important factor to consider. UK consumers have a higher demand for legs of lamb, and relatively lower demand for some other cuts. Lamb imports tend to come in the form of legs of lamb to match this demand. However, if the UK increased domestic production further to produce more legs of lamb to fill demand, it would also necessarily be producing more of the cuts that would likely need to be exported. This is why so much of UK exports are in the form of whole or half carcases.

There is also an element of seasonality to consider. Peak sheep meat production is around October most years, with the lowest production numbers often taking place around April and May. Therefore, lamb imports are most likely to enter the UK when production is at its lowest in order to help fill demand, particularly at Easter.

Brexit

With the UK’s exportable surplus of lamb likely to be increase in the future, the need for free trade with the EU is becoming even more important.

The UK’s main market for lamb exports continues to be the EU, with over 90% of total UK sheep meat exports going there during 2019. Without access through a free trade agreement, tariffs could undermine the competitiveness of UK product.

Whether or not a deal with EU will be reached is still undetermined at the moment. However, predicted EU and UK import tariff rates should be able to give an insight on likely tariffs in the event of a no deal Brexit.

It is worth noting that even if a deal is reached, there are still likely to be some factors that impact on the UK lamb market, including restrictions and delays at ports slowing down the movement of products. Deal or no deal, the UK will become a third country, and exporting to the UK is different from merely delivering there. Finally, changes in exchange rates as a result of negotiations could also influence domestic prices.

What have lamb markets been doing in 2020?

It is clear 2020, has not been an normal year by any means and lamb markets have felt the effect of this.

Retail demand has remained relatively resilient and Kantar data actually suggests there have been some areas of growth for the sector especially for household lamb purchases. In contrast to this, the closure of food service sector for prolonged periods of the year has restricted demand for the out of home market, although the importance of takeaways for lamb has meant even here the effect of lockdown has been muted to a degree.

It is not just the domestic market that is feeling the effect of coronavirus. Demand on the continent for UK lamb exports will be an important watch point in the coming weeks and months as many countries enter a second lockdown.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.