- Home

- News

- Tighter supply and firm demand keep Southern Hemisphere sheep meat prices elevated: Lamb market update

Tighter supply and firm demand keep Southern Hemisphere sheep meat prices elevated: Lamb market update

Thursday, 27 November 2025

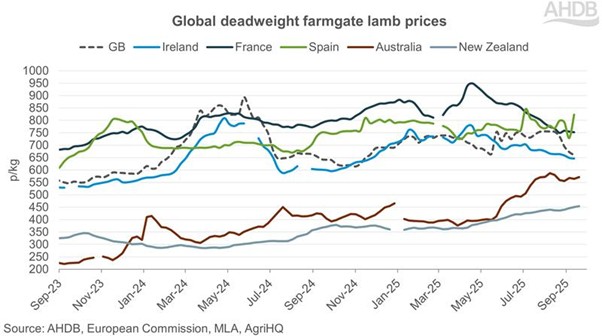

Global sheep meat supply remains subdued as Australia and New Zealand enter a phase of flock rebuilding, sustaining historically high prices across these key export regions.

Key Points

- Australian sheep meat production has eased from record highs in 2024 as drought-led destocking gives way to early flock rebuilding.

- New Zealand sheep meat production continues to decline modestly amid ongoing flock contraction.

- Farm-gate prices remain strong in both countries, supported by tight global supply and robust European demand.

- Combined Australian and New Zealand sheep meat exports (Jan-Sep 2025) totalled around 767kt, down 5% year-on-year, with Australia accounting for 62% of trade.

- China remains their largest export market, while the EU and UK have regained prominence as tight European supply sustains high prices.

Production

Australia

Australia’s national sheep flock was estimated at 74.2 million head in June 2025, down by 6% year-on-year, following two years of poor seasonal conditions which drove heavy liquidation.

This has led Meat and Livestock Australia (MLA) to project lamb slaughter at 24.9 million head (-6%) and sheep slaughter at 9.97 million head (-15%) for the whole of 2025, producing 610,000 tonnes lamb and 256,000 tonnes mutton (cwt). Carcase weights have continued to rise as feed availability improves and grain feeding becomes more common, with lambs averaging 24.5 kg cwt and sheep 25.7 kg cwt in 2025.

Looking further ahead, a modest flock rebuild is expected through 2026 as seasonal conditions improve, but ewe retention will temporarily limit mutton availability.

New Zealand

In New Zealand, the national flock continues to contract, constrained by land conversion to forestry and competitive cattle margins. The 2024-25 season (September to September) saw 326,300t bone-in produced, a reduction of 6% on the season before.

Beef and Lamb New Zealand forecasts 16.7 million lambs will be processed in the 2025-26 season producing 321,500t bone-in. This equates to a 1.5% fall in production volume on the previous year. Mutton production is set to fall by 4% to 84,200t.

Average carcase weights are forecast to remain high for the 25/26 season at 19.3kg/head for lambs and 25.9kg/head for mutton.

Looking further ahead, limited breeding ewe numbers indicate further gradual flock decline through 2026. Factors influencing this include the attractiveness of beef production in comparison to sheep production, with margins stronger in beef, as well as the growing afforestation efforts that are leading to further destocking of New Zealand’s flocks and herds.

Prices

Australian lamb prices have rebounded sharply through mid-2025 as processors compete for shorter supply. Strong demand from the Middle East and Europe, coupled with a weaker Australian dollar, has lifted returns to record levels, up to around 50% higher year-on-year and well above the five-year average.

In New Zealand, lamb and mutton prices remain historically high despite currency appreciation. Average farm-gate prices for 2025-26 are forecast at NZ$9.36/kg CW for lamb and NZ$3.66/kg CW for mutton, 20% and 3% above their five-year averages respectively. Tight European supply and stable US demand are supporting prices, with export values higher, despite a slight fall in volumes.

Exports

Australia

Between January and September 2025, Australian sheep meat (fresh, frozen and offal) exports reached 473,000t, down 7% from the previous year.

China remained Australia’s largest market, taking 117,000t of sheep meat, though volumes were 5% lower year-on-year. Exports to the US also eased, down 7% to 76,000t, while growth in Middle Eastern demand helped to offset these declines, with other markets broadly steady.

Live sheep exports fell 6% to 277,000 head as the Australian Government’s legislated phase-out of live sheep exports by sea by 2028 approaches.

To the UK, Australia shipped 20,000 tonnes of sheep meat from Jan-Sep 2025, up 36% year-on-year as quota access under the UK-Australia FTA expands.

Australian sheep meat exports by destinations (YTD Jan-Sep)

.png)

Source: Trade Data Monitor LLC

New Zealand

New Zealand exported 294,000t of sheep meat (fresh, frozen, offal) in the year to date (Jan-Sep), back 1% year-on-year. China remained New Zealand’s largest market, taking 121,000t (-2% YoY), while shipments to the UK eased to 34,000t (-10% YoY). Softer volumes into other core markets were partly offset by growth in selected EU destinations.

New Zealand sheep meat exports by destinations (YTD Jan-Sep)

.png)

Source: Trade Data Monitor LLC

Implications for the UK

Quota usage

When it comes to sheep meat exports, both Australia and New Zealand have a country specific World Trade Organisation (WTO) agreement with the UK which needs to hit at least 90% utilisation before they can access the quota from the Free Trade Agreement (FTA) made with the UK in 2023.

As of 13 November, Australia had used 95% (12,700t) of its country specific WTO agreement for sheep meat export trade quota with the UK out of a possible 13,300t. Therefore, they have access to the UK-FTA and have used 48% (17,300t) out of a possible 36,100t.

New Zealand has exported 34,000t of sheep meat between January and September of this year which is well below the 90% threshold (at least 102,600t) needed to access the UK-FTA quota, meaning they will likely not access it in 2025.

Conclusion

Southern hemisphere sheep meat supply is likely to tighten heading into 2026 as both Australian and New Zealand flocks are expected to contract. Reduced mutton throughput in Australia and ongoing flock contractions in New Zealand suggest continued constraint on export availability despite robust demand. At the same time, high farm-gate returns, and heavier carcases indicate strong price floors globally.

New Zealand volumes to the UK remain steady and below quota limits, while Australia’s expanding access under the UK-Australia FTA could gradually lift import volumes, though constrained supply and other export partners taking larger volumes may cap growth. UK supply and consumer demand will be key influences on both the domestic price and import requirement for these major suppliers in the coming months.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.