The cost of higher mincing

Thursday, 9 April 2020

By Rebecca Wright

In £/kg the price of mince is the cheapest commonly purchased cut of beef. In recent weeks retail demand for mince has risen sharply. There is some product available from foodservice that could be diverted into retail, however this is unlikely to be enough to cover the increase in demand for mince at retail level. While initially, more cattle could be processed to meet the mince demand, this leads to an over-supply of other cuts, such as roasting joints and steaks. The concept of killing more cattle may sound straightforward. However, there is plant capacity to consider as well as current workforce availability. Industry reports also suggest that frozen storage is now very near or at capacity.

AHDB analysis has already shown that if we mince an extra 10% of the carcase to 53%, then the average retail price of the carcase would decreases by around £79/head.

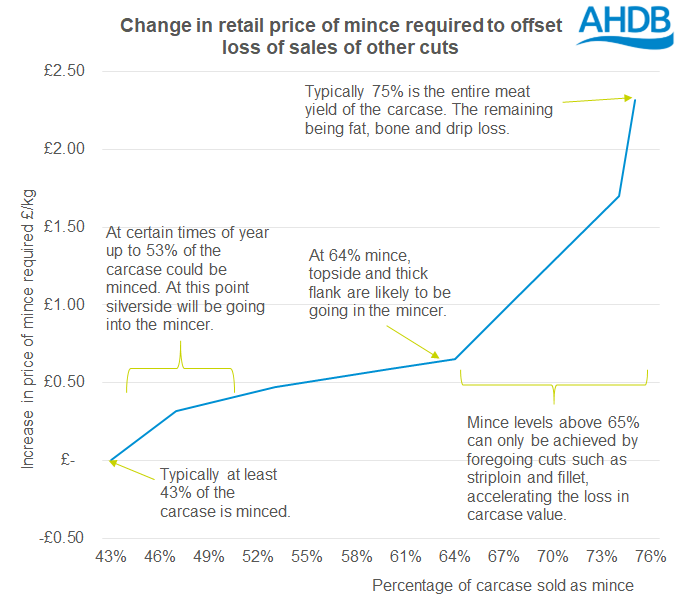

However, what would the average retail price of mince need to do, in order to offset the lost revenue from higher end cuts? The chart below shows the increase required at retail level in mince as the proportion of the carcase being minced increases.

At a mince level of 64%, for example, the average retail price of mince would need to rise by £0.65 per kg to offset the loss of higher end cuts.

Realistically it is uneconomic to include all the meat as mince. If the whole carcase, steaks and all, were minced the average retail price of mince would need to rise by more than £2 per kg compared with the 43% mince level. The key for the industry is to find an equilibrium where consumer demand is satisfied at prices that mean the most valuable parts of the carcase are not lost into the mincer.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: