Coronavirus and the value of beef

Tuesday, 7 April 2020

Retail sales data shows that demand for all cuts of beef rose dramatically during March. However, the increase in demand during this period of panic buying, and subsequent shelf restocking has been overwhelmingly for minced beef, as it is familiar and suited to freezing. Reports suggest that stocks of top cuts are building in processors’ cold stores, due to the rapid contraction of the foodservice sector.

What does this mean for carcase balance?

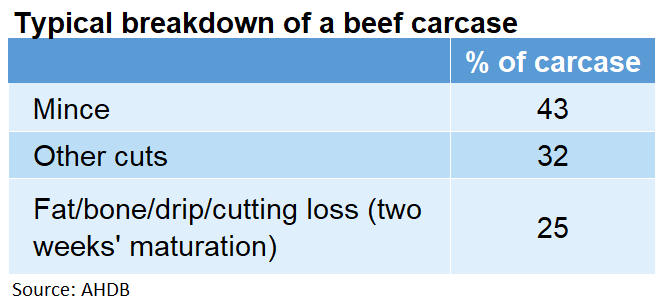

We have already reported that these demand changes might bring challenges for carcase balance. Ordinarily, each processor minces a slightly different proportion of the carcase, according to its own customers’ demand. Prior to the pandemic, at retail, more than 50% of beef was typically sold as mince, while a good number of higher value top cuts would have gone into foodservice. As such, some abattoirs would have routinely minced over half the carcase, but in general, around 43% of the carcase was used to produce mince.

The amount minced does change throughout the year, as product demand changes from summer to winter. The condition of individual animals as they are presented at the abattoir may also play a part in deciding how much is turned into mince. Cows lend themselves to mincing more readily than prime cattle. Some parts of the carcase will regularly find their way into the mincer, such as neck and heel muscles, while others of course will rarely be minced, such as fillets and the striploin. Cuts like flat brisket, or the chuck roll and even silverside, might go either way according to demand.

For example, by looking at AHDB’s supermarket red meat price series, the drop in value of say, flat brisket, when it goes from a braising steak price of nearly £10/kg, to a lean mince price closer to £6/kg is clear. As it makes up about 3.5% of the carcase, mincing this cut in particular is enough to reduce the overall retail value of the carcase by around 14p/kg. Mincing the silverside too, just over 6% of the carcase, reduces the overall retail value by a further 9p/kg.

In this example, we have gone from mincing 43.5% of the carcase to 53.5%. As a result, the overall retail value of the carcase has fallen by around 23p/kg (or £79 per head for an average 345kg carcase).

However, demand for mince at retail has not been typical in recent weeks. If UK processors were to meet all of the increased demand for mince, at the expense of more expensive cuts, without an increase in the price of mince it could significantly degrade the value of the carcase.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.