Support for rapeseed from tight soyabean global balance: Grain market daily

Tuesday, 18 January 2022

Market commentary

- UK feed wheat (May-22) futures climbed £1.00/t yesterday, to close at £211.75/t. New crop contract Nov-22 contract gained £1.15/t, to close at £192.20/t. Volumes traded were low yesterday.

- This followed a rise on the Paris milling wheat contract (May-22), but Chicago markets yesterday were closed for a holiday.

- China’s maize imports stood at 28.35Mt in 2021 according to Refinitiv, up 152% from the previous record level in 2020. Imports of wheat totalled 9.77Mt in 2021, up 16.6% from 2020.

- In response to Indonesia’s announcement yesterday to test biofuels with a palm oil-based content of 40% in February, Malaysian palm oil (May-22) futures gained 2%.

Support for rapeseed from tight soyabean global balance

After the USDA world agricultural supply and demand estimates (WASDE) released last week, the global soyabean balance looks very tight. This tight picture can be expected to support the wider oilseed complex, including rapeseed prices, this season.

Soyabean consumption ahead of production for 2021/22

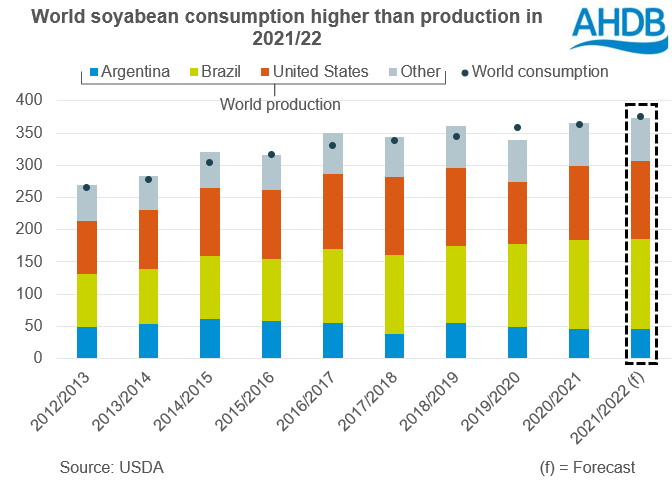

In the latest WASDE, the USDA trimmed its Brazilian and Argentinian soyabean production estimates for this season (2021/22) by 5.0Mt and 3.0Mt respectively. These cuts were larger than average trade expectations but, did not go as far as some private forecasts. The cuts follow dry weather in South America.

As a result, total world soyabean production forecast for 2021/22 is down 9.2Mt from December’s report, to 372.6Mt.

World consumption too was reduced in January’s WASDE. However, this was only by 2.1Mt to 374.9Mt. Consumption now exceeds this season’s estimated world production by 2.4Mt.

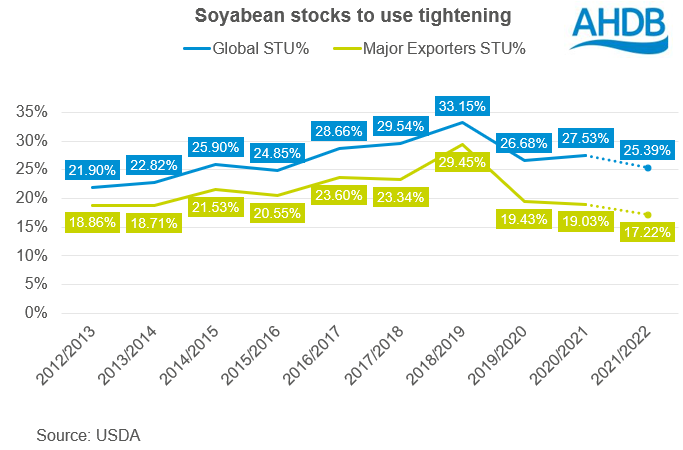

As a result, the global stocks to use estimate for soyabeans (2021/22) reduced from 27.1% in December 2021, to 25.4% this month. This presents a very tight picture for soyabeans for the remainder of the season, even if production estimates take no further cuts.

What can tighten this picture further?

With such tight stocks, the market will remain sensitive to new ‘news’ on South American production, whether this be bullish or bearish news. This is because South American crops are set to make up a large proportion (54%) of global soyabean production this season (2021/22). Further cuts to production may tighten the soyabean supply picture further, lending price support to rapeseed also.

Last week, we saw the Bolsa de Cereales cut crop condition scores for Argentinian soyabeans. The proportion of soyabeans rated ‘excellent/good’ fell 17 percentage points (pp) from the previous week, to 31% as at 12 January. Meanwhile, soyabeans rated ‘poor/very poor’ increased 16pp to 29%.

Rains arrived in Argentina over the weekend, bringing relief to soyabean and late-planted maize crops. The weather forecast looks mixed this week. Argentina is due rain in most areas, but the heaviest rain is due towards the end of the week (Refinitiv).

Southern Brazil looks to remain relatively dry, but continued rain in the North and central areas disrupts early harvest. The trade now awaits more news on initial yields, as 1.7% of the soyabean area is now harvested (Refinitiv).

China too is one to watch in the supply and demand balance. Soyabean imports are reportedly down year-on-year, though pork output is understood to be almost back in line with pre-African Swine Fever. Something to watch going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.