Analyst Insight: South American weather supporting markets

Thursday, 6 January 2022

Market commentary

- UK feed wheat futures (May-22) dropped back £3.00/t yesterday, to close at £221.00/t. Whereas, the Nov-22 contract only dropped back £0.75/t to close at £194.25/t.

- A lack of ‘new’ news saw UK feed wheat futures follow Chicago and Paris wheat futures down yesterday. A fall in wheat prices also weighed on Chicago maize (May-22) futures yesterday, falling $2.66/t to $237.30/t.

- Chicago soyabean (May-22) futures continued to climb for the 4th consecutive day yesterday. The contract closed at $515.46/t. Gains were on South American weather concerns, more on this below.

- Soyabeans may also be finding support from the wider vegetable oil complex. Malaysian palm oil futures (May-22) also saw gains yesterday for the 4th consecutive day on supply concerns. Gains over 4 days totalled 7%. However, they have been sliding back this morning, likely on a technical correction.

South American weather supporting markets

These concerns are growing due to recent weather in Brazil and Argentina, which has in turn been supporting markets.

On 27 December, Chicago maize (May-22) futures reached $242.81/t the highest price since June 2021 on this contract. Prices have since pulled back slightly, capped by falling wheat prices. Whereas Chicago soyabeans (May-22) futures continue to gain. Yesterday, this contract closed at $515.46/t, the highest close since June 2021.

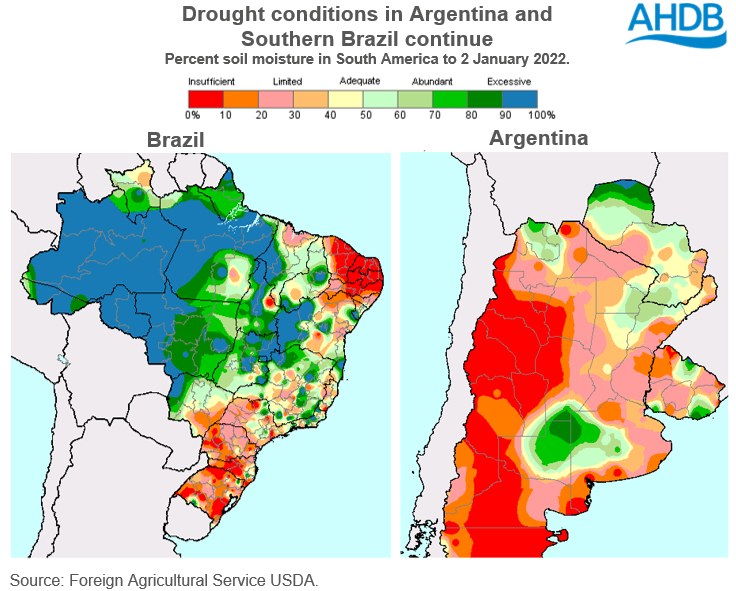

Argentina and Southern Brazil remain very dry, despite recent rains.

In Argentina, the latest Bolsa de Cereales crop condition report to 30 December showed 56% of soyabeans and 58% of maize as rated ‘Excellent/Good’. This is down from 71% and 76% respectively, for the previous week.

In Southern Brazil, the Parana region and Rio Grande do Sul have declared a state of emergency due to prolonged drought. In Parana, 30% of soyabeans are considered in good condition this week (Refinitiv). This is down from 57%, 2 weeks earlier.

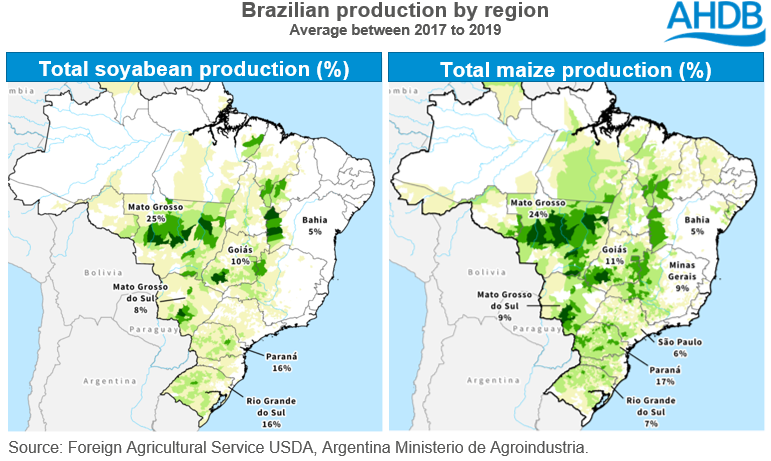

Whereas, in Northeastern and Central Brazil, overcast conditions and heavy rain persist. In Bahia, a state of emergency has been called due to widespread flooding. This rainfall increases the concern for disease pressure. As a key state impacted, Mato Grosso is especially important given it is the largest producing region in Brazil. On average between 2017 to 2019, Mato Grosso produced 25% of Brazilian soyabeans.

Rain looks to be delaying early Brazilian soyabean harvest in the North, though traders await early yield estimates to understand potential production.

What does the forecast look like ahead?

Weather forecasted for the next 10 days looks mixed. Northern and Central Brazil are forecast normal rainfall, with rain heading south. Rio Grande do Sul continues to look dry but slightly cooler this week (Refinitiv).

Argentina is due small amounts of rain in the South, although most areas are expected to stay relatively dry, according to Refinitiv.

How is this impacting on the supply and demand outlook?

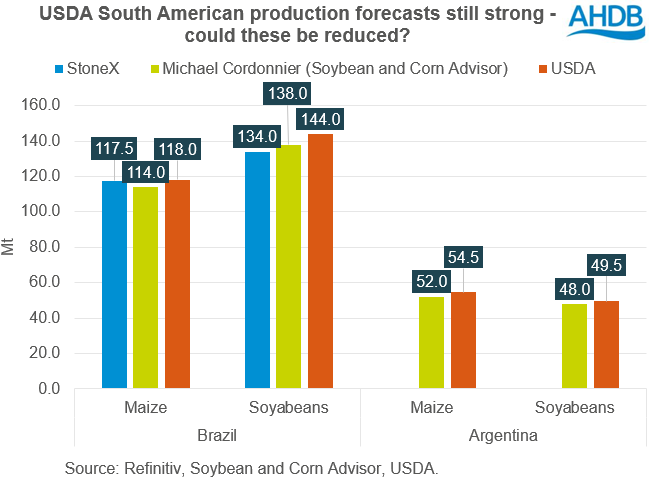

Private forecasters are now starting to scale back production forecasts. On Monday, the StoneX consultancy reduced Brazilian maize (-2.6Mt) and soyabean (-11.1Mt) forecasts for this season.

Forecaster Michael Cordonnier also reduced his Brazilian maize (-1.0Mt) and soyabean (-2.0Mt) production forecasts, at the end of December. This forecaster also reduced Argentinian production estimates for maize (-1.0Mt) and soyabeans (-1.0Mt).

In the December world supply and demand estimates (WASDE) report, the USDA forecast strong Brazilian and Argentinian maize and soyabean crops. However, with recent weather we will be watching to see if there are any trims to these forecasts in the next WASDE on 12 January. In Brazil, soyabeans are especially important given planting is nearing completion. Whereas Brazilian second crop maize should begin planting soon.

Consequently, any trims to forecasts could tighten the global supply and demand picture.

Conclusion

How much rain falls this month, and where, will be key to understand South American maize and soyabean production potential. Early yield indications for Brazilian soyabeans will be awaited closely by trade, to assess production forecasts. Though before then, all eyes will be on the WASDE report due on Wednesday.

Should conditions impact production potential, this could further support both global and domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.