Strong export demand expected for EU-27 dairy products

Thursday, 22 October 2020

By Bronwyn Magee

The autumn EU short-term outlook for 2020/21 highlights the impact of changes to dairy demand as a result of the coronavirus pandemic. This outlook is for the EU-27 and so excludes the UK.

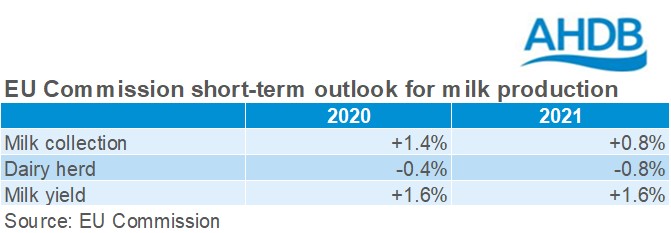

Overall EU milk production is expected to increase by 1.4% in 2020. This is an upward revision from their previous summer forecast of 0.7%. This increase is driven by growth in milk yield (+1.6%), aided by competitive feed prices and favourable pasture conditions earlier in the year.

Milk production growth is expected to slow towards the end of the year. This is a result of mixed weather conditions across the continent during the summer, which may impact hay and silage availability in coming months. While the dairy herd is expected to continue to decline by -0.4%, milk production is expected to remain positive in Q3 (1%), and relatively stable against 2019 in Q4.

While the global milk supply has increased, export demand has grown in line with production, which has provided a degree of stability to EU dairy markets.

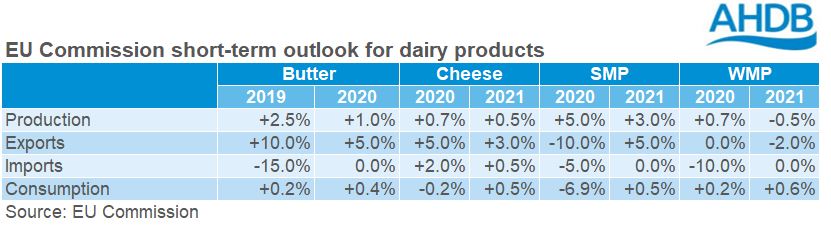

Butter production is forecast to increase by 1% in 2020 in line with export demand growth. EU butter exports are forecast to reach a record high in 2020 (+5%) at an estimated 320,000 tonnes. Looking ahead to 2021, increased retail sales and further foodservice adjustments (e.g. takeaways and e-commence) following the coronavirus outbreak are expected to increase consumption by 0.4%.

Higher skimmed milk powder (SMP) production is forecast (+5%) on the back of strong export demand, supported by competitive prices. Although exports are expected to decline by 10% on the year, it should be noted SMP exports were particularly high in 2019. As such, SMP exports are forecast to reach the second highest level seen historically at 850,000 tonnes in 2020. Exports are expected to increase by a further 5% in 2021, supported by continued competitive prices and growing demand.

Whole milk powder (WMP) exports are expected to remain steady for the rest of the year, again supported by competitive prices. While demand is forecast to remain relatively stable (+0.2%), EU production is expected to increase by 0.7%. Due to the increased global availability of WMP, EU exports are likely to be negatively impacted in 2021 (-2%), and production is expected to decline by 0.5%.

The loss of demand for foodservice outlets due to the COVID-19 outbreak continues to negatively impact EU cheese consumption. As a result, the EU consumption of cheese is expected to fall by 0.2% on the year. This is a slight upward revision on the Commission’s summer outlook (-0.4%), suggesting the rise in the consumption of cheese at retail and manufacturing sectors could compensate for more foodservice loss than initially thought. Further adjustments in foodservice are expected to help EU cheese consumption grow by 0.5% in 2021.

Overall, the global demand for EU cheese has remained positive, and exports are forecast to increase by 5% by the end of the year. Production is expected to increase in line with this, up 0.7% on the year, and an additional 0.5% in 2021.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.