Southern Hemisphere lamb prices tracking at record highs: Lamb market update

Thursday, 28 August 2025

Finished lamb prices in both Australia and New Zealand have crept up in recent months. This article explores the supply and trade dynamics behind these prices and what they could mean for the UK.

Key points:

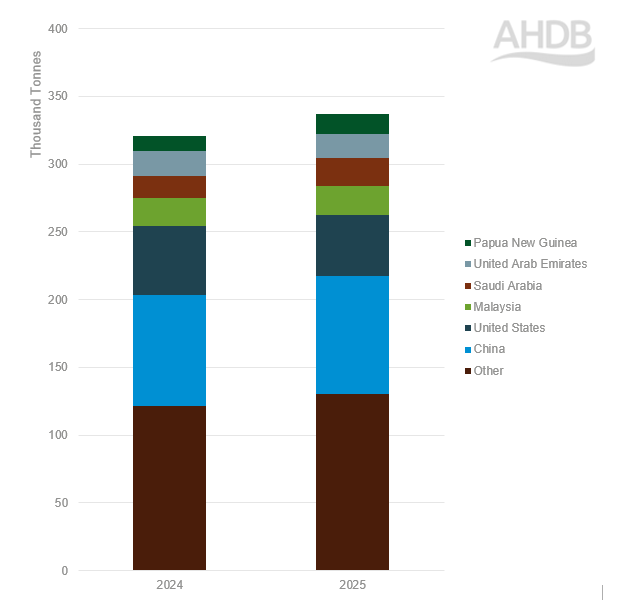

- New Zealand finished lamb prices have levelled off in recent weeks to stand at 437p/kg in the week ending 15 of August (+101p/kg y-o-y).

- Australian finished lamb prices reached 581p/kg in the week of 17 August (+167p/kg y-o-y) as they find themselves in their traditional low supply period.

- Both countries are benefitting from robust international demand driving sheep meat export prices.

- UK total sheep meat imports from Australia and New Zealand are up 45% and 0.6% respectively year-on-year.

Prices and production

New Zealand

Driven by short supply, New Zealand finished lamb prices have continued their upward trajectory since our last update in June, rising by 22% since the start of the year. Prices have levelled in recent weeks to stand at 437p/kg in the week ending the 15th of August (+101p/kg y-o-y).

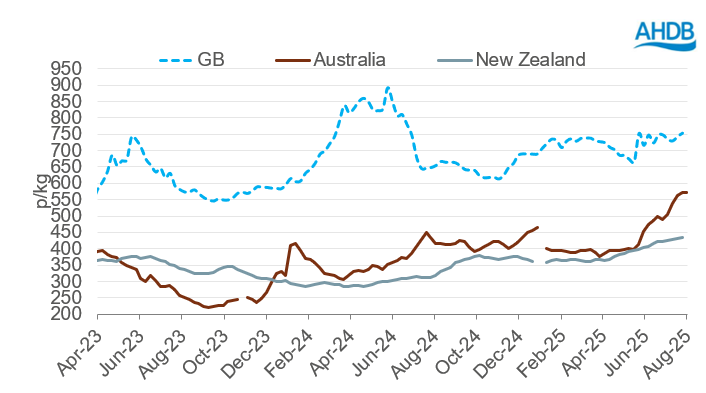

Reduced weekly slaughter rates have been reported by AgriHQ since early April this year, likely supporting this price growth. However, lamb slaughter has returned to more seasonal levels over the last month and in turn the price has levelled.

The pick-up in slaughter has been attributed to North Island lambs that would have been slaughtered in May and June only just starting to come forward in recent weeks. Reports also suggest that wet conditions in the South Island have forced producers to send lambs slightly earlier.

Processor competition for lambs is expected to increase as kill capacity increases in the coming weeks as they move past seasonal shutdowns. This has potential to add renewed upwards pressure to finished lamb prices moving forward.

Global deadweight farmgate lamb prices

Source: AHDB, European Commission, MLA, AgriHQ

Australia

Australia has also seen exceptionally high lamb prices over the last month, reaching 581p/kg in the week of the 17th August (+167p/kg y-o-y) as they find themselves in their traditional low supply period which has been exacerbated by adverse weather conditions.

Drought conditions have widened the supply gap between the last of the old season lambs being processed and the start of the new season lambs coming forwards, putting serious pressure on supply as processors compete over available stock. According to MLA figures lamb slaughter was down -12% m-o-m in June, bringing the H1 total slaughter for 2025 down approximately 3% y-o-y.

Australian monthly lamb slaughter

Source: Meat and Livestock Australia

Trade

These supply side dynamics have impacted on both countries’ sheep meat export behaviours.

New Zealand

In the case of New Zealand, amid shorter supply, the trade data suggests that exporters have focused on prioritising high value products to established trade routes. Indeed, although the export volume of fresh and frozen lamb for the first half (Jan-June) of 2025 was down 1.5% from 2024 volumes, total export value increased by 18% to £1.16 billion. The value of New Zealand lamb imported by the EU and UK in the year to June was up 35% and 24% year-on-year, respectively. This consistent export demand, especially from Europe, is expected to continue to support prices in the coming months.

Australia

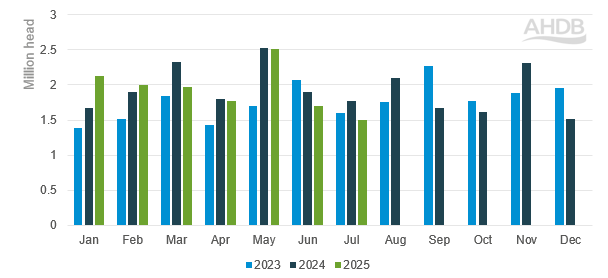

China has remained the primary destination for Australian lamb volumes, receiving 26% of the total 337,000 tonnes of fresh and frozen sheep meat exported from January to June 2025. Additional access to the Chinese market was granted to ten Australian abattoirs in April this year, likely contributing to the 6% y-o-y increase in export volumes.

Moreover, despite the tariffs imposed on Australian lamb, the demand from the USA has remained strong, receiving 13% of Australian lamb exports. However, this has represented a 2.4% decrease of market share from 2024 and a 11% decrease in overall volumes.

YTD (Jan-June) Australia fresh/frozen sheep meat exports

Source: TDM LLC

Australia has also greatly increased volumes to other, slightly smaller markets, including but by no means limited to Papua New Guinea, Saudi Arabia, Qatar and the United Kingdom.

The diversity of this export portfolio, combined with reduced supply is expected to keep Australian prices broadly elevated throughout the rest of the year in comparison to 2024. However, slaughter is expected to pick up in the coming weeks as new season lambs come fit for market, potentially causing the price to ease back towards seasonal averages – further improving the outlook for Australian sheep meat exports as they remain price competitive on the global market.

What could this mean for the UK?

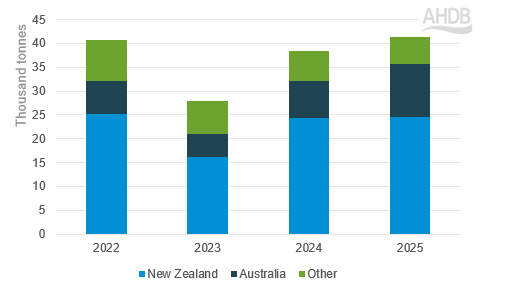

UK total imported sheep meat volumes from both Australia and New Zealand have been higher year-on-year (Jan-June) so far (up by 45% and 0.6% respectively).

UK YTD (Jan-June) Sheep meat imports

Source: TDM LLC

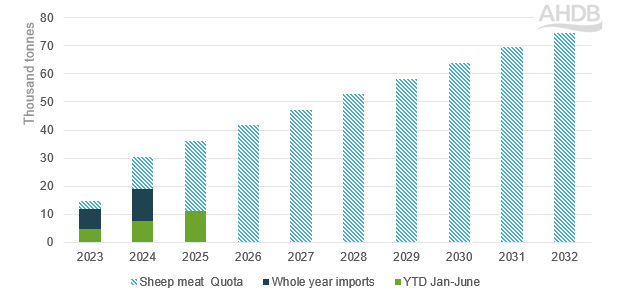

However, both countries are still a long way from exceeding their respective quotas granted under the UK-Aus FTA and the UK-New Zealand FTA. In fact in the year to June, Australia, despite reporting record exports to the United Kingdom, had only fulfilled 31% of its 2025 export quota.

United Kingdom sheep meat imports and quota under the UK-AUS FTA

Source: DAFM and TDM LLC.

Looking forward, we could see more Australian product in the UK as drought conditions translate into potentially lighter carcases, more akin to what the UK consumer is used to, encouraging imports.

However, as described in our recent lamb outlook update, if southern hemisphere prices continue to rise and our own domestic production ‘kicks in’ we could see sheep meat imports ease for the remainder of the year.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.