South American beef trade update

Friday, 2 December 2022

Following earlier analysis on trends in the South American beef market How much beef did South America export in 2021? | AHDB, we take an updated look at the South American beef export trade and the likely impacts in the short to medium term.

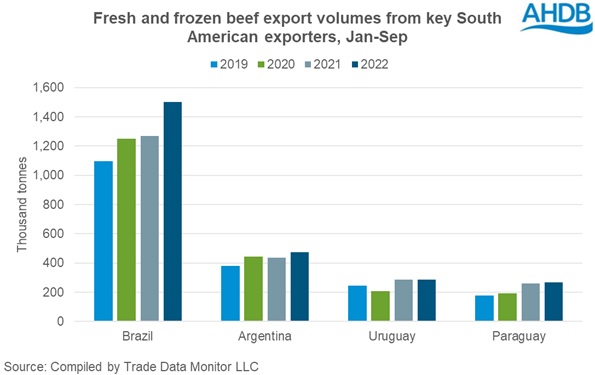

Beef exports from the Mercosur bloc continue to be dominated by Brazil, with an article from June 2022 illustrating the detailed outlook for this trade - Brazilian beef production increases as exports continue to flourish | AHDB. The latest data (January to September) continues to highlight the significance of Brazilian exports to the bloc’s overall trade volumes in beef. Looking into 2023, the USDA is forecasting this trend to continue, with Brazil anticipated to increase total exports by 1%, while other key South American nations are expected to record declines of up to 3% in total export (Argentina, Paraguay, Uruguay).

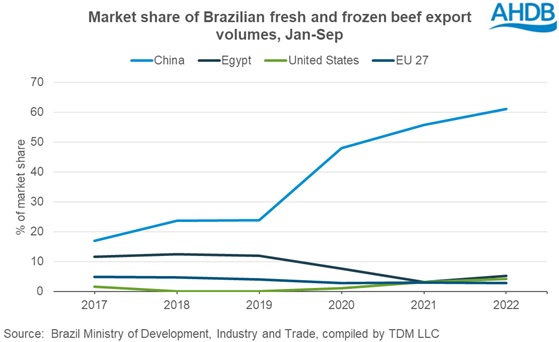

When looking into the changing dynamics in trade flows, recent trends continue to be cemented, with Brazil’s export to China up 30% for total fresh and frozen beef product on a year to date basis, when compared to the same time period in 2021 (where well-documented disruptions to trade from the Mercosur block prevented year-on-year growth). While China’s demand for beef is expected to soften slightly through 2023, Brazil is still expected to gain market share because of slight declines in North American production.

Our recent international cost of production work demonstrates the competitiveness of Brazil’s domestic production on the international stage, with Agri benchmark data defining Brazil as one of the lowest-cost producers internationally Beef: international comparisons | AHDB.

Impact on the UK marketplace

Closer to home, the UK’s imported beef volumes (total fresh/frozen) from South America have demonstrated a recent increase, most notably from Brazil. While some substantial increases have occurred since 2017, this period has been very turbulent for beef imports from South America with both Brexit and more recently the COVID-19 pandemic having an impact on the levels of imports. Taking a longer-term view, fresh and frozen beef imports from Brazil are returning to levels almost identical to those seen in 2013 and 2014. When looking at wider product categories, processed beef (including corned beef) has fallen in the last year, down 1,200 tonnes.

One key domestic market for South American fresh/frozen beef is the UK’s foodservice market, which has been hit particularly hard throughout the pandemic. While we continue to see some positive increases for total beef consumption within food service (up 26.3% year on year) GB beef foodservice purchases | AHDB, current impacts as a result of the cost of living crisis, combined with labour issues and continued supply chain disruption, risks further disturbance, which could result in further changes in the marketplace Cost of living crisis is the focus of two AHDB webinars | AHDB.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.