How much beef did South America export in 2021?

Thursday, 3 March 2022

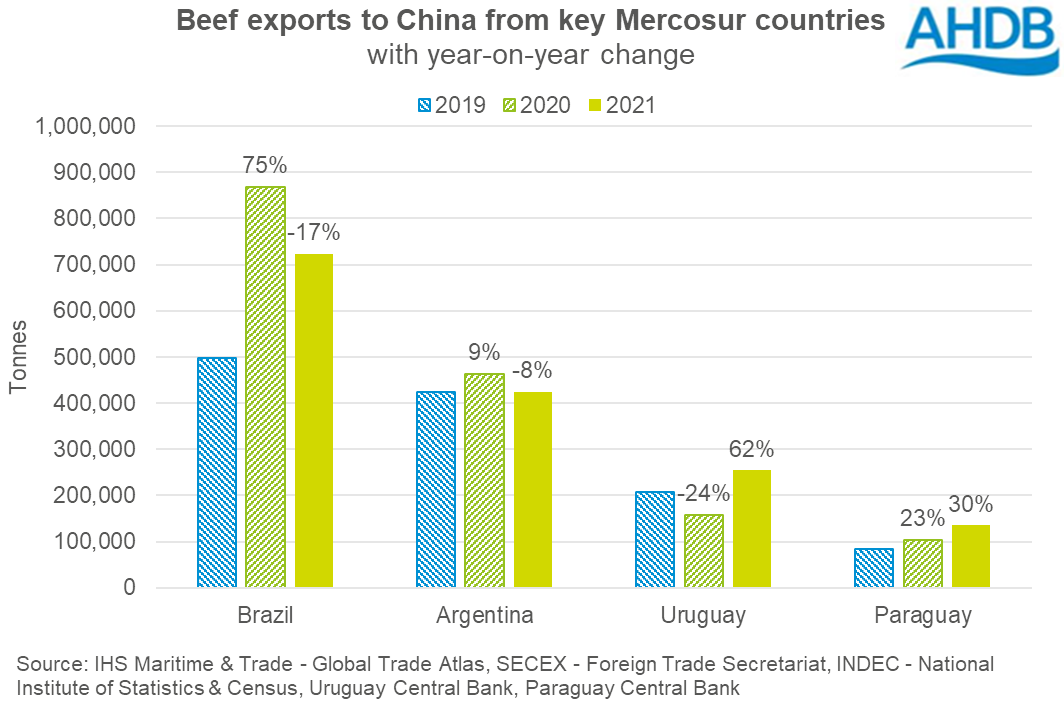

Unsurprisingly, China remained a key influence on South American beef trade in 2021. Brazil and Argentina saw their exports fall, particularly in the second half of the year. This was a result of a three-month suspension from September of Brazilian beef into China due to BSE concerns. For Argentina, exports have been disrupted by a series of government interventions, including bans on exports in an attempt to manage domestic supplies and beef price inflation.

USDA data shows that both Brazilian and Argentinian beef production fell in 2021. For Brazil, this was due to the Chinese ban, which led to fewer cattle being fattened in quarter four. For Argentina, the industry has reportedly struggled with poor margins due to higher costs of inputs and freight for exports. Disruption to exports will also probably have contributed.

For some headline figures, Brazil exported 1.6 million tonnes of beef in 2021, down 10% year-on-year. Argentina shipped 559.8 thousand tonnes, down 8%. However, Uruguay (data to November) and Paraguay grew exports by 39% and 17% respectively, benefitting from the trade disruption of their neighbours into China.

Thinking ahead, the USDA forecasts that Brazil’s beef production and exports will grow in 2022, spurred on by a resumption in Chinese shipments and demand growth. Industry analysts expect China to import more beef in 2022, however this will depend on international prices, and how the Chinese eating-out market recovers from the pandemic.

Argentina is forecast to record steady production and exports in 2022. Reports suggest that a ban will remain in place on the export of several beef cuts from Argentina (including carcases) until the end of 2023. This is expected to further reduce Argentina’s market share in China, likely benefitting neighbouring Mercosur countries further.

Indeed, the USDA also forecast that Uruguayan beef exports will increase again in 2022, boosted by strong export demand and increased domestic production. Paraguay on the other hand is expected to see lower production and exports, as high cattle prices there have meant producers have marketed cattle earlier, in 2021 rather than in 2022.

What could this mean for the UK?

The UK imports a relatively small amount of beef and beef products from South America; around 24,000 tonnes in 2021 (including fresh and frozen, offal and processed beef). For context, this was 8% of the UK’s total beef imports for the year. Product is mostly corned beef from Brazil destined for retail, but smaller quantities of higher-value fresh and frozen beef also come in from Uruguay, Argentina, Paraguay and Chile for the restaurant trade.

We are forecasting a slight recovery in UK beef imports in 2022 as foodservice demand grows. This could mean increased demand from restaurants for the higher-value South American beef, however overall volumes are very small compared to the quantity that comes in from Ireland, for example. Besides, UK foodservice demand is not expected to recover to pre-pandemic levels due to longer-term economic uncertainty.

With Brazil (and indeed probably the rest of South America) focused on China, the UK is unlikely to experience any major impact from higher Brazilian production either, especially as we expect lower demand for beef at retail.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.