- Home

- Beef: international comparisons

Beef: international comparisons

AHDB are part of the agri benchmark international network of 35 member countries who submit data for suckler herd and beef finishing “typical” farms.

This is an internationally standardised method of identifying and analysing typical farms representing typical production systems and their profitability, at farm level, in each country. The results are expressed in US Dollars (USD) as the international comparison base. For more information visit the agri benchmark website.

The UK trades and competes in a global market and is therefore affected by exchange rates as well as any competitive cost of production. The countries in the charts are representative of the UK’s main competitors and the exporting environment for commercial beef.

The farms in these charts are ranked in ascending order of total costs. Cash costs include all paid expenses and non-cash costs include the value of family labour and rental value of owner-occupied land. Depreciation (machinery, equipment and buildings) is shown separately.

Returns do not include decoupled payments typically received by some farms, such as the EU land-based payments, nor the returns from other enterprises on the farm.

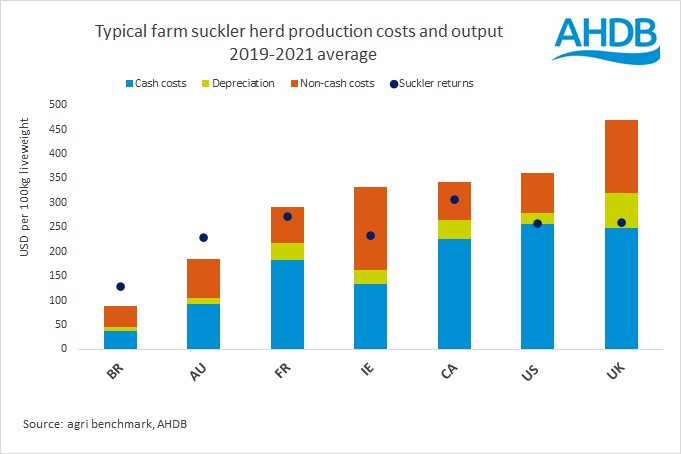

Suckler herds

The UK includes a typical lowland farm in the South West who finishes the weaned calves on farm and a typical upland farm in North Yorkshire that sells the calves at weaning.

Returns will include the value of calves at weaning as well as cull or breeding cow sales.

The main differences are that countries such as Australia, Canada, Brazil and the US manage more cows per labour unit than typical UK farms. They will also have little machinery and equipment investment and rely on grazed grass all year round, with no housing in the winter. Many farms around the world (from Europe; the North and South Americas; South Africa and Namibia; to Australia and New Zealand) typically practice rotational or paddock grazing by measuring and managing forage access and production.

The number of calves weaned per 100 cows put to bull varies but the US, France and Ireland typically achieve over 90 calves per 100 cows put to the bull. Canada, Australia and the UK will typically be weaning 85 to 86 calves per 100 cows put to the bull.

A significant difference between the countries is the age at first calving. In Australia, Canada and the US cows typically first calve at 24 months of age; Ireland 26 months; the UK and France 30-31 months and Brazil 36 months (for Bos Indicus cattle). This will have a significant impact on costs of production and the number of calves a cow produces in her lifetime, particularly where farms first calving at 24 months of age also have low replacement rates.

Replacement rates in the UK are typically 20%, the same as Australia and Brazil, although it should be noted that Australia and Brazil's replacement rates can be driven by drought conditions and the need to destock. France typically has a higher replacement rate at 23% (they have a high demand for cow beef), but the other countries have replacement rates between 13 and 17%, thus keeping replacement costs down and selecting and managing cows to remain productive for longer.

Weaning age varies with Australia and Canada weaning around 200 days of age; US 210 days; the UK typically 226 days; France and Brazil around 240 days and Ireland around 250 days.

However, when weaning weights are adjusted to a consistent 200 days of age most countries are typically achieving 250kgs at 200 days, with the exception of Brazil 145kgs (from Bos Indicus cattle) and Australia at 225kgs. This is not surprising given that all of the countries shown in the chart have breeds that originate from British or continental beef breeds with the exception of Brazil (the typical farms illustrated for Brazil are for Bos Indicus cattle).

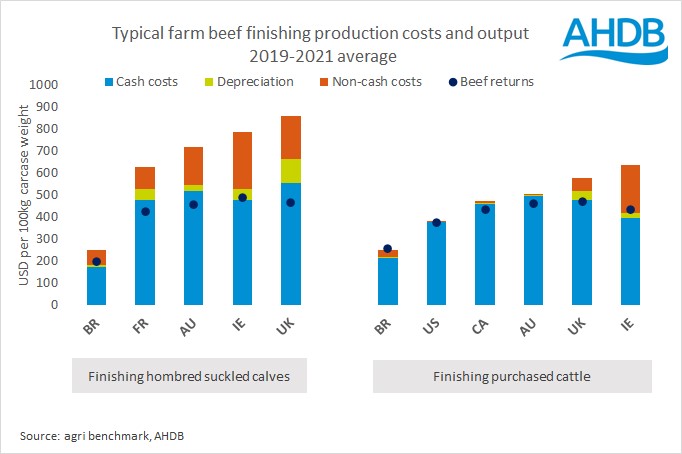

Beef finishing

The left-hand side of the chart shows the finishing enterprises of many of the suckler herds shown in the previous chart because these farms, for various reasons, finish their home-bred calves. These will be finished on grass and/or in yards (open or roofed depending on the climate) and fed home-grown forage (e.g. grass or maize silage) and concentrates (e.g. grain, corn and byproducts) which could be home-grown or purchased (often from local sources).

The right-hand side of the chart shows farms who are finishing purchased animals. These cattle may have been purchased as young calves (from dairy herds), or purchased as stores or backgrounders (from suckler herds). Calves from suckler herds would typically be purchased around 10-12 months of age and would be finished on grazed grass and/or in yards. Many cattle ranchers do not have the facilities or grass quality to finish cattle and therefore they are sold to finishing specialists as stores or backgrounders. In Australia, Brazil, Canada and the US it is typical to finish cattle in specialist open yards (feedlots) where they are fed on locally produced forage (e.g. alfafa hay) and locally-produced grain, corn, or byproducts. However, in Australia there are many farms finishing their home-bred suckler calves on grazed grass and in Brazil over 90% of cattle are finished on grazed grass.

The typical age at slaughter varies between countries and will also vary due to breed, gender and production system. For example, in the UK purebred dairy bulls are often finished in yards at 16 months of age. In the UK as a whole, the typical age at slaughter is 20-24 months of age, and this is similar to Australia (British breeds and composites), although yard finished grain-fed cattle in Australia typically finish around 21 months. In Ireland, the age at slaughter is typically around 24 months of age. In France, a lot of entire male suckler calves are sold at weaning to Italy because the French consumer prefers heifer and cow meat. The typical age at slaughter in France is 16 months and this is the typical age of cattle finished in the US in open yards. In Canada, the slaughter age is typically 19-20 months of age. In Brazil, Bos Indicus cattle tend to be later finishing than cattle with British-breed backgrounds. Grass finished cattle (Bos indicus) are typically finished around 36 months of age but grain-finished cattle are typically finished earlier at 27 months of age.

Typical carcase weights are also affected by breed, gender and production system. In the UK typical carcase weights are now 325-340kgs; in Ireland 350kgs; in France and Canada 370kgs; in the US open yard finishing 380-400kgs. In Brazil the carcase weights are lower with grass finished cattle typically 250-280kgs and grain finished cattle 280-295kgs. In Australia, carcase weights can vary on an annual basis due to production system and the impact of drought conditions. There is a wide variaton in grass finished cattle but typically around 250kgs for British background animals and with grain finished cattle heavier, typically around 340kgs carcase weight.

Around the world, rotational grazing of forage is typical to maximise grass production and animal performance. There are also examples of replanting trees and grasses to increase production from cattle (milk and beef). One of those examples is silvo-pastures (found in many countries including Colombia) where trees, shrubs and grasses are grown for the benefit of the environment and cattle production.

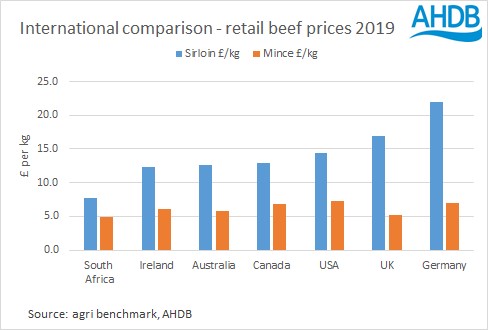

International Sirloin and Mince Retail Price comparisons

The UK retail market currently prices mince and top cuts slightly differently than other countries, including those operating in the global beef market. Among the countries surveyed in the agri benchmark network, only Switzerland had a higher sirloin to mince price ratio.

This begs the question, what will this difference mean as the UK becomes more exposed to the world market? Perhaps the UK will be able to compete with the likes of Australia, Ireland and the US on mince prices, but may find itself priced out of the steak market. An increase in mince exports, without a corresponding rise in steak sales can bring carcase balance challenges. It may well be that the difference between the mince price and the prices of those top cuts, will narrow in the future. That could return value to the producer by way of the carcase price, while at the same time allowing UK steak prices to be competitive.

Consumers in countries such as Australia and the US only have to pay double to 'trade up' from mince to steak - may this be one of the reasons why steak is eaten more often in these countries and their overall beef consumption is greater than the UK?

Consumption in the UK expressed as kg of beef per capita is 18kg - this compares to 20kg in Ireland; and 26kg in both Australia and the US.

The chart below shows the retail price in each country of minced or ground beef and sirloin steak expressed in British pounds. It also illustrates how much extra a kg consumer must pay to trade up to purchase a steak instead of mince as a meal solution.

The mince price is a combination of standard and premium mince where both are found in the comparable countries. This usually reflects the fat content with standard mince having a higher fat content than premium, which is usually around 5% fat.

The impact on carcase value and balance is obvious and compounded when we consider that around 50% of beef in the UK is consumed as minced beef.