Rapeseed’s premium over soyabeans continues: Grain market daily

Thursday, 25 April 2024

Market commentary

- UK feed wheat futures (May-24) closed at £179.95/t yesterday, up £2.05/t from Tuesday’s close. New crop futures (Nov-24) closed at £205.00/t, up £4.05/t over the same period.

- Forecasts of continued dry weather in Caucasus, a key wheat area in southern Russia, support the bullish direction of prices as concerns rise over crop condition. In addition, India is reportedly struggling to replenish national wheat stocks as a result of higher domestic prices and challenging weather. This could require the nation to import wheat from the global market for the first time since 2017.

- Paris rapeseed futures (May-24) closed at €441.75/t yesterday, down €9.00/t from Tuesday’s close. The new crop futures contract (Nov-24) closed at €465.50/t yesterday, down €0.25/t over the same period.

- Weakness in the vegetable oils complex weighed on old crop Paris rapeseed futures (May-24) however pressure on new crop (Nov-24) was limited by expectations of a tighter outlook next season, see below for more on this.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Rapeseed’s premium over soyabeans continues

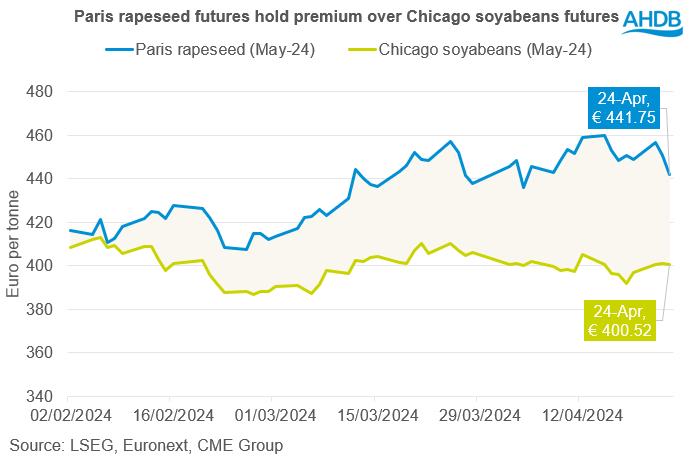

Paris rapeseed futures have continued to hold a strong premium over Chicago soyabeans futures since last discussed in February. As of yesterday’s close, old crop Paris rapeseed (May-24) held a €41.23/t premium over old crop Chicago soybeans (May-24). Also, as at yesterday’s close, new crop Paris rapeseed (Nov-24) held a €62.06/t premium over new crop Chicago soyabeans (Nov-24).

What’s supporting the premium?

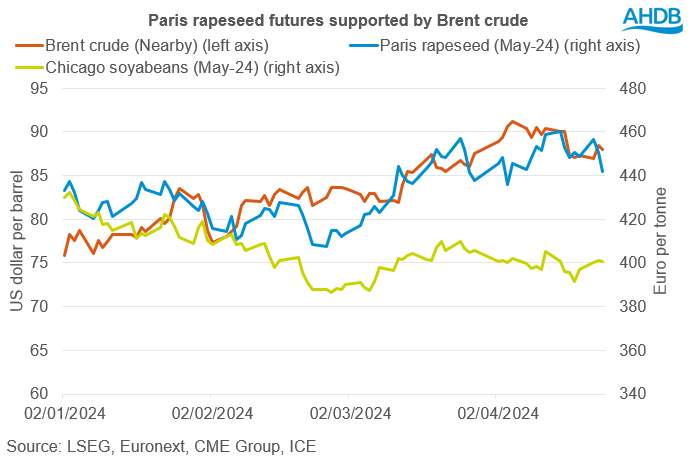

Soyabeans hold the lion’s share of production in regard to the major oilseed complex, accounting for 74% of global production last year. Therefore, soyabean markets usually carry a strong influence over the direction of the complex. However, recently, rapeseed has shown signs of a moderate disconnect as soyabean futures come under pressure from ample supply, while rapeseed is supported by a rise in the oil markets and forecasts of a tightening balance.

Crude oil markets began trading upwards in the New Year and have continued their upward trajectory into March and April. Nearby Brent crude futures surpassed $90/barrel in early April, a price not seen since October 2023. Support came largely from increasing global geopolitical tension as well as an anticipated tighter balance for the remainder of the year. While the oil market has softened slightly since the April high, prices remain firm which is providing some support to the biofuels market.

Furthermore, looking towards the new marketing year for rapeseed, forecasts suggest the balance is tightening. The latest balance sheet from Statistics Canada forecasts a planted area of 8.658 Mha for harvest 2024, a 3% decline from harvest 2023 and 1% decline over the five-year average. Rapeseed planting is also forecast down in the EU due to adverse weather conditions in key producing regions, at 5.975 Mha, down 3.6% on the year (EU commission). For 2023/24, the EU and Canada, the first and second largest global producers of rapeseed, accounted for 44% of global rapeseed production (USDA) so therefore a contraction of planting next year applies notable pressure on the global supply and demand balance.

Chicago soyabean futures initially came under pressure in February due to harvest pressure from South America and higher forecasted US area and stocks for 2024/25. Some short-term support came from uncertainty over the Argentinian crop throughout March. However as of late, soyabean production estimates for Brazil and Argentina have remained firm, pressuring global prices.

What could this mean for the premium going forward?

Tensions in the Middle East have now been factored into the market and limited escalation has seen oil markets pressured, filtering through to the wider vegetable oils market. However, a heavy global soyabean balance, as well as the likelihood of a tighter global rapeseed balance next year will likely continue to offer support to the premium.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.