Rapeseed price pressure slowing: Grain market daily

Thursday, 22 February 2024

Market commentary

- UK feed wheat futures (May-24) closed at £162.60/t yesterday, down £0.40/t on Tuesday’s close. New crop futures (Nov-24) closed at £181.00/t, down £0.30/t over the same period.

- The domestic market broadly followed pressure from Paris and Chicago markets, as large global supplies continued to weigh.

- Paris rapeseed futures (May-24) closed at €422.25/t yesterday, down €4.00/t on Tuesday’s close. Rapeseed was pressured by Chicago soyabeans, which were down due to demand worries for soyabeans, the ongoing harvest in Brazil and expected rainfall in Argentina, which could boost soyabean output.

Rapeseed price pressure slowing

As South American soyabean crops mature and harvests progress, a record continental crop is set to come to the market. Brazil’s soyabean crop is now 29.4% harvested (to 17 Feb), ahead of the same point last year when this was 23%.

Soyabeans account for 74% of global major oilseeds (sunseed, soyabean & rapeseed) production. Therefore, the price of this commodity is important for where rapeseed prices are going to go.

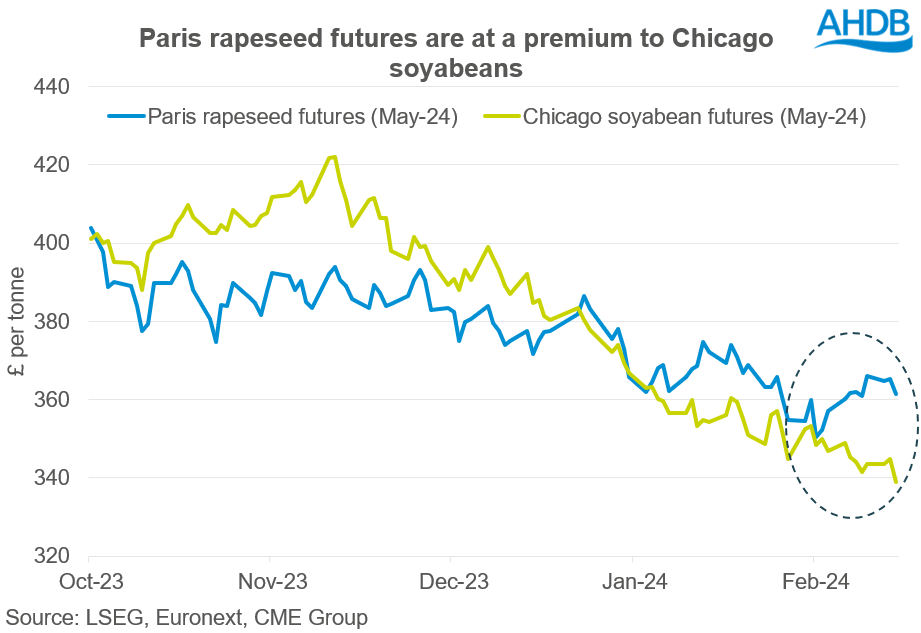

However, over February so far there has been a divergence in the pricing of these two commodities. Rapeseed prices have tracked sideways, while soyabeans have been pressured by the South American harvests commencing, also with higher US areas and stocks for 2024/25 expected.

As displayed in the graph above, going into 2024 rapeseed futures went from trading at a discount to soyabeans futures to a premium. Over the past six weeks, this premium has grown.

Pressure on rapeseed prices is slowing, and for the most part prices have tracked sideways. On 02 February domestic delivered rapeseed prices (into Erith, spot) were quoted at £358.50/t. Last Friday (16 Feb), they were quoted at £356.50/t, only marginally down despite soyabean markets feeling sustained pressure.

This is due to provisional estimates for a reduced rapeseed area in the EU for harvest 2024. In Stratégie Grains latest oilseed report, EU-27 rapeseed production is estimated to drop by 7% year-on-year to 18.4 Mt, reflecting the reduction in area. The reduction in area is mainly from Eastern Europe. The latest report cites that this is likely to result in strong imports for 2023/24 from Australia and Ukraine.

So going into the 2024/25 marketing year, from this reduced supply from Europe rapeseed could continue to command a premium over soyabeans. However, we still do have plantings on the Canadian Prairies and of the Australian crop to come. Both are important for global rapeseed production. It’s worth bearing in mind that the South Pacific could experience a La Niña weather event later in 2024, which could boost global rapeseed supplies going into 2025.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.