La Niña in 2024 could drive grain prices: Grain market daily

Thursday, 8 February 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £171.25/t, down £2.75/t on Tuesday’s close. New crop futures (Nov-24) closed at £190.00/t, down £1.50/t over the same period

- Chicago wheat futures were supported yesterday on positioning ahead of the USDA World Agricultural Supply and Demand Estimates (WASDE), which is released this evening

- Despite technical support for Chicago, there was pressure on the Paris market, which filtered into our domestic market. Large Russian supplies, combined with favourable prospects for Russian 2024 crops, continue to weigh on the broader outlooks of grain markets. European markets need to remain competitive to meet export expectations for the 2023/24 marketing year and avoid a build-up in stocks

- Paris rapeseed futures (May-24) closed at €410.75/t, down €10.50/t on Tuesday’s close. Broad pressure on Chicago soya beans ahead of the WASDE report filtered into rapeseed prices. Also, there are projected rains in both Brazil and Argentina, which will aid their soya bean crop development

La Niña in 2024 could drive grain prices

For the 2023/24 marketing year, apart from the second Brazilian maize crop, most of the global grain supply is accounted for. Therefore, nearby prices are probably not going to see any significant increase unless this second maize crop is substantially smaller than currently forecast. However, based on the latest data, Conab estimates that 19.8% of this respective crop is planted (to 3 Feb), ahead of last year when this was 10.7%. The fast pace of planting will likely support the planted area, and so, potentially, production.

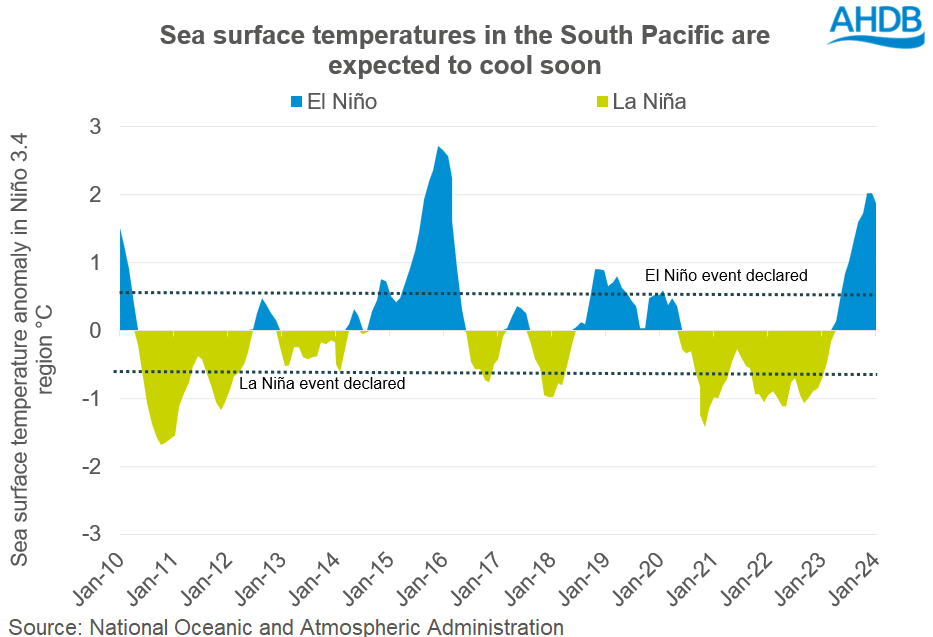

The El Niño weather event, currently in action, is a key risk to the Brazilian yields. It’s characterised by abnormally warm sea surface temperatures (SST) in the South Pacific, bringing uneven rainfall and higher temperatures to South America.

However, the abnormally warm SST in the South Pacific are starting to reduce. There’s a 73% likelihood that SST go back to a neutral phase between April to June 2024 (US National Oceanic and Atmospheric Administration). This could reduce the weather risks to the 2023/24 Brazilian maize yields; harvesting of the crop usually starts in June.

Looking further ahead, the latest models are now predicting that after this brief period of neutral conditions, there could be a transition to La Niña around July to September 2024. This weather phenomenon occurred between 2020 to 2023, when we saw Australia’s grain production grow to record levels. But the period also saw shortfalls in production at times from South America. This includes the drop in Brazil’s second maize crop in 2020/21 and the decimation of Argentina’s soya bean and maize crops in 2022/23 after the worst drought in 60 years.

The El Niño and La Niña weather phenomena also have links with altered weather patterns in other parts of the globe too. But in broad terms this pending La Niña weather event at the end of 2024 will mean South East Asia, India and Australia will likely be wetter, while the Americas will be drier.

All of this has the potential to drive global grain and oilseed markets, which will inherently filter into what prices are achieved at the farm gate. There could be pressure on prices going into 2025 from surpluses of Australian grains and oilseeds. That said, a drought in South America has the potential to put a bullish spur into the market at the end of 2024.

It is far too early to tell what exactly will happen, but as the year progresses, there will be clearer predictions of what this weather event could bring.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.