Rapeseed prices could be helped higher by sunflowers: Grain Market Daily

Tuesday, 17 November 2020

Market Commentary

- May-21 UK feed wheat futures closed at £190.65/t yesterday, a fall of £0.15/t from Friday’s close. The UK market followed Paris milling wheat (May-21) futures lower, in spite of support for Chicago futures (May-21).

-

Both sterling and the euro made gains against the dollar which prevented gains in Chicago futures from filtering into European markets. Chicago feed wheat futures were supported by continued export demand, with Japan’s 102Kt tender for US and Canadian food wheat.

-

The Chinese 80.5% tariff on Australian barley is causing concern for Australian producers. On average over the past five years (Jan-Dec), 4Mt of Australian barley has been exported to China (IHS Maritime & Trade – Global Trade Atlas® - Australian Bureau of Statistics). The tariff is proposed to continue for 5 years, with China reportedly seeking alternative supplies from France, Ukraine, Argentina, and Canada.

Rapeseed prices could be helped higher by sunflowers

Last week, UK prices for rapeseed delivered to Erith, within the next month, were the highest they had been since early 2017. Furthermore, on Friday, prices were more than £30/t higher than at the start of August. The reasons for this rise include tight domestic and EU rapeseed availability, worries about the developing soyabean crops in South America due to a La Niña weather event and high demand for soyabeans from China.

Alongside this sunflower seed prices have also been rising rapidly, and this could help to push rapeseed prices higher again.

Why are sunflower prices rising?

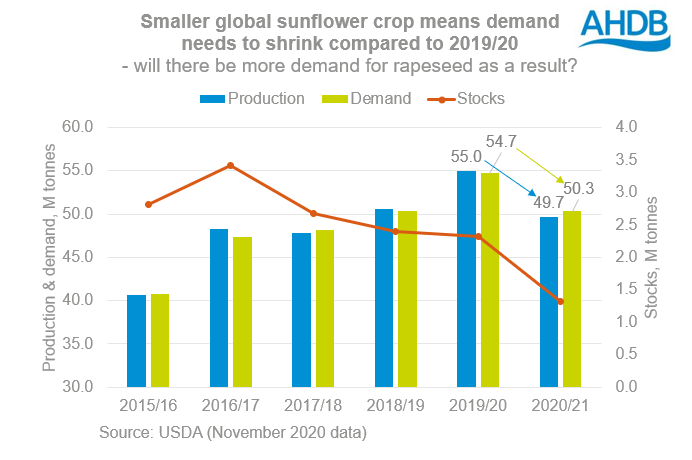

This year, sunflower yields in some key countries are much lower than last year. As a result, sunflower prices are rising.

Together, Ukraine, Russia and the EU account for nearly three-quarters of all sunflower seed produced around the world (USDA). Harvesting of the 2020/21 sunflower crops in these countries is nearly complete.

So far, sunflower yields in Ukraine are down 18% from 2019 (UkrAgroConsult). Furthermore, in the EU, yields are estimated by the EU Commission to be 16% lower than last year.

This has led to a global sunflower crop that is expected be 5.3Mt smaller than last year, at 49.7Mt (USDA). As a result, demand will also need to fall. This excess demand will filter into other oilseeds, tightening the whole vegetable oil complex and supporting prices.

Impact on rapeseed

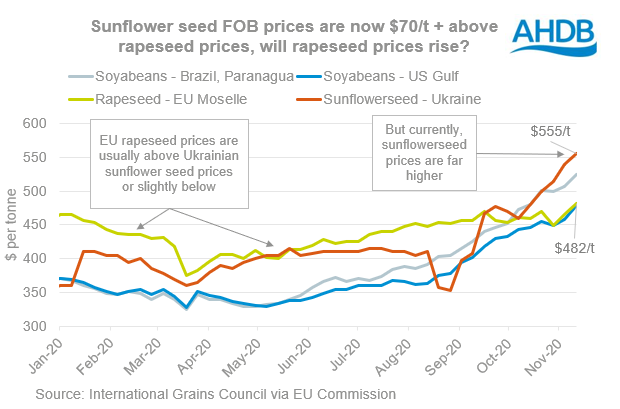

Sunflower seed prices are higher than rapeseed prices at present and the gap is the largest it has been since November 2010 (www.oilworld.biz). Global rapeseed demand is already expected to exceed production, so rapeseed prices need to remain firm in order to limit any excess demand filtering through from sunflower seed.

One factor which may cap the gains in rapeseed prices is the size of the Australian canola (rapeseed) crop. However, I feel European rapeseed prices could still narrow the gap to sunflower prices. This is because there are limitations on how Australian rapeseed can be used in Europe because of its GM status.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.