Firming global oilseeds support the domestic rapeseed price: Grain Market Daily

Friday, 6 November 2020

Market Commentary

- London wheat futures (May-21) found more support yesterday, briefly trading back up at £190/t before closing at £189.80/t, an increase of £1.20/t from Wednesday’s close. New crop prices (Nov-21) remained unchanged on the day, at £158.20/t.

- As of 02 November, French soft wheat plantings were at 76% complete, ahead of last year’s 63%. Heavy rains held up some field work last week, but progress has been good on the whole and the trade are reported to be generally optimistic about France’s drilling campaign.

- A USDA attaché report released yesterday estimated China’s maize imports this season at 22Mt, well above the official USDA estimate of 7Mt.

Firming global oilseeds support the domestic rapeseed price

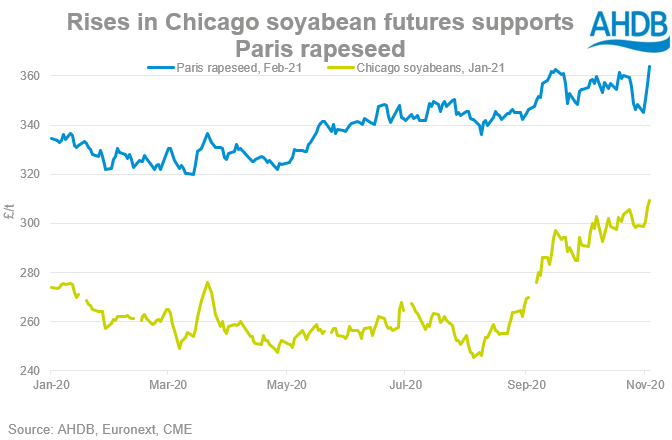

Global oilseed markets have seen a turnaround since Alex’s article last Wednesday, with multi-month and even multi-year highs being achieved on some futures contracts. This has mainly been led by a rally in Chicago soyabeans, and also helped by firming Malaysian palm oil prices, and has been favourable to the UK rapeseed price.

Soyabeans

Yesterday, Chicago soyabean futures firmed for a third consecutive session, reaching nearly 4-year highs. The Jan-21 contract closed at $405.52/t, an increase of $18.92/t since Monday’s close. The contract is currently on track for its largest weekly gain since August.

This has been caused by an array of different factors. Firstly, the ongoing drought in South America linked to the La Niña weather event. Dryness across Brazil has severely delayed the soyabean planting campaign and in the key state of Mato Grosso, the start of planting was about 30 days behind schedule. In some northern areas, planting commenced this year later than it normally would have been completed.

The strong import demand from China over the past few months has also helped the price rally. China bought another 1.5Mt on US soyabeans last week, bringing the total for this season up to 48.5Mt. Markets are now looking towards the next USDA report on 10 November, where some anticipate there will be cuts to US soyabean yields and increased exports.

Palm oil

Malaysian palm oil prices have also been on the rise recently. The Jan-21 contract closed yesterday at 3,208 MYR/t (Malaysian Ringgit), this is a new high for the Jan-21 contract which has been trading since early 2018.

This support has come from industry expectations that Malaysia’s palm oil stockpiles fell to a 3-year low in October (Refinitiv). The actual data will be released on Tuesday. There are also reports that production also fell to a 5-month low. Production has been hampered by both rainy weather and coronavirus restrictions. Exports are projected to rise by 5.6% in 2020 by the Malaysian government, due to increased demand from China, India and the Netherlands, as well as an exemption on export duties.

Rapeseed

These bullish factors have meant that Paris rapeseed futures have also seen support this week. The Feb-21 contract closed at €402.25/t yesterday, an increase of €19.25/t since Monday’s close. And in turn this has lifted the domestic price, according to AHDB’s delivered oilseeds survey, prices are up about £14/t on the week. UK prices have not increased as much as Paris due to changes in the value of the sterling.

While these factors may see domestic process remain supported in the short term, it is important to remember that sufficient rains in the right places or reducing export demand could take the steam out of this market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.