Weather bears on oilseed markets this week: Grain market daily

Wednesday, 28 October 2020

Market Commentary

- May-21 UK feed wheat futures continued its decline this week, closing at £187.75/t yesterday, down £1.40 on the day. New crop feed wheat futures (Nov-21) declined a lesser £0.60/t to close at £159.15/t yesterday. This morning the contract had lost a further £1.15/t by 12pm GMT. Improved precipitation expectations over the short term for the US plains, a key wheat producing region, is a main driver for the declines.

- US crude oil and gasoline stocks were up 4.6 million barrels last week to an estimated 495.2 million barrels, according to data released by the American Petroleum Institute yesterday. This increase was well above the 1.2 million barrels estimated in a pre-release Reuters poll. This increase in stocks combined with rising coronavirus infection rates have pressured crude oil prices this morning.

Weather bears on oilseed markets this week

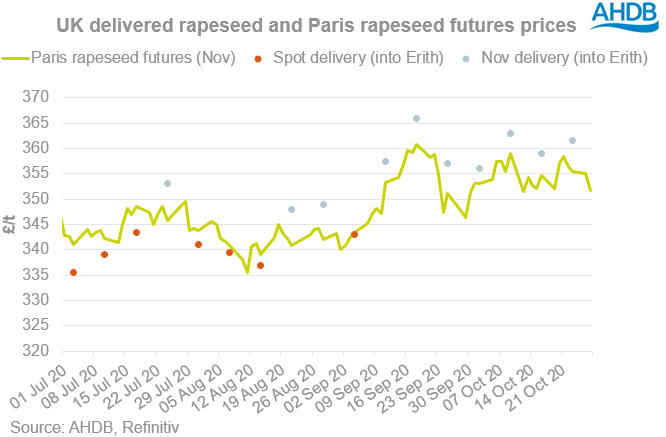

Oilseed markets have seen plenty of gains in recent weeks, with a multitude of factors each lending an arm of support. These include increases in the volume of purchases of US soyabeans by China, dryness concerns for key producers (as explored in yesterday’s GMD), and slight recoveries in crude oil markets amid the ongoing pandemic. Domestic rapeseed markets too have risen off the back of this rally, further pushed by the small domestic production figure. However, this week a level of pressure has returned to markets.

On Monday, nearby Chicago soyabean futures reached the highest price since July 2016, but declined yesterday following improved weather forecasts for Brazil and Ukraine. Latest data from AgRural estimated Brazilian soyabean plantings at 23% complete as at 26 October. While the current pace remains behind the average for this point (34%), plantings over the past week have progressed quicker due to the rainfall (up 15% week on week). My colleague Anthony is taking a closer look at the La Nina weather event and its effects on oilseed markets in tomorrow’s Analyst Insight. Aside from the easing weather concerns, Brent crude oil futures (nearby) slipped back under $40/Bbl on Friday and has remained there since, following renewed concerns for rising coronavirus infection rates.

What does this mean?

Well, with these pressuring factors in mind, one place to look for their effects is on European rapeseed futures contracts. Feb-21 Paris rapeseed futures have fallen €12.50/t from Fridays close to €384.75/t this morning, a low for the month.

As the UK require a greater level of imports this season, domestic rapeseed markets will look to price closer to import parity levels, of which are pressured by the futures contracts. Therefore, the losses in global and European markets may filter through to domestic prices over the short-term. Over the mid to long term, further weather developments will be a key watch point, not just due to effects on plantings, but yields too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.