How is the weather driving global markets? Grain Market Daily

Tuesday, 27 October 2020

Market Commentary

- London Nov-20 wheat futures ran out of steam yesterday, closing £0.75/t lower at £188.50/t. May-21 and Nov-21 also lost ground yesterday, closing down £1.35/t and £1.85/t to £189.15/t and £159.75/t respectively. These losses have mainly been attributed to forecast rains in the US.

- In the latest US crop progress report, maize harvested is at 72%, well above the 5-year average of 56% and soyabeans harvested is at 83%, also ahead of the 5-year average at 73%.

How is the weather driving global markets?

Global grain markets have been well supported recently. In addition to strong demand from importing countries, dry weather concerns in key producing regions, such as US, South America and Europe, have added to the bullish tone.

But with recent rains in some areas, and rain in the forecast for others, could this end the price support that we have seen?

South America

Recent rains in Argentina’s main wheat producing Pampas region have not been enough to save the crop. Production has been cut a further 0.8Mt this month, to 16.8Mt. With La Nina developing, Argentina is forecast dry for the foreseeable.

However, rains are in the forecast for Central and Northern South America, which may help the delayed planting of Brazilian soyabeans.

Last week, Brazil’s Department of Rural Economics (Deral) reported soyabean plantings in Parana were at 32%, well behind the 45% in 2019 and 59% in 2018. Delays in summer rains have led to inadequate soil moisture, impacting germination and establishment. There are now concerns this delay could affect the planting of the Safrinha (the second maize) crop, planted after the soyabean harvest.

US

Following recent dryness, timely rains in key producing regions have replenished soil moisture levels. However, while more rain is forecast, this looks likely to miss key producing regions, which may see soil moisture levels fall again.

The moisture replenishment should go some way towards alleviating concerns around winter wheat condition, reported yesterday in the US crop progress report at 41% good to excellent versus 56% last year.

Europe

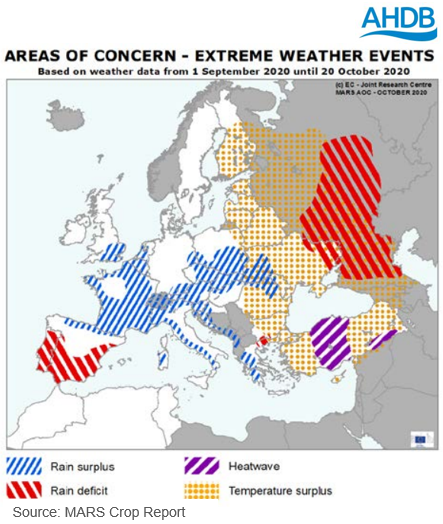

As well as a distinct lack of rain, September was the warmest on record. This led to a soil moisture deficit across many European key producing regions. October has brought abundant rains across most of Central and Western Europe. This delayed the completion of harvest and put a halt to autumn drilling in many regions. Western Russia is yet to see rain and the continuing drought is a watch point as we move through the sowing window.

Winter cereal drilling in Northern Europe has mostly been completed now. However, in Eastern, Central and Western regions it has been delayed, with the very dry soil condition throughout September and then overly wet October conditions causing this. Nevertheless, completion of autumn sowing is still possible, dependant on weather conditions in the coming weeks. Baltic regions have recorded favourable autumn drilling conditions and the arrival of timely rains created optimum conditions for early growth.

So what is the price impact? While rains have alleviated some concern, weather worries in many regions could still support global markets in the short term. However, a change to more favourable conditions, or factors being priced in as they become more certain, could temper this. With UK wheat likely to cap at import parity this season, and the direction of travel for soyabean prices ever more driving the entire oilseed complex, global weather could have a significant effect on UK prices this season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.