Q1 23 Pork trade roundup

Thursday, 1 June 2023

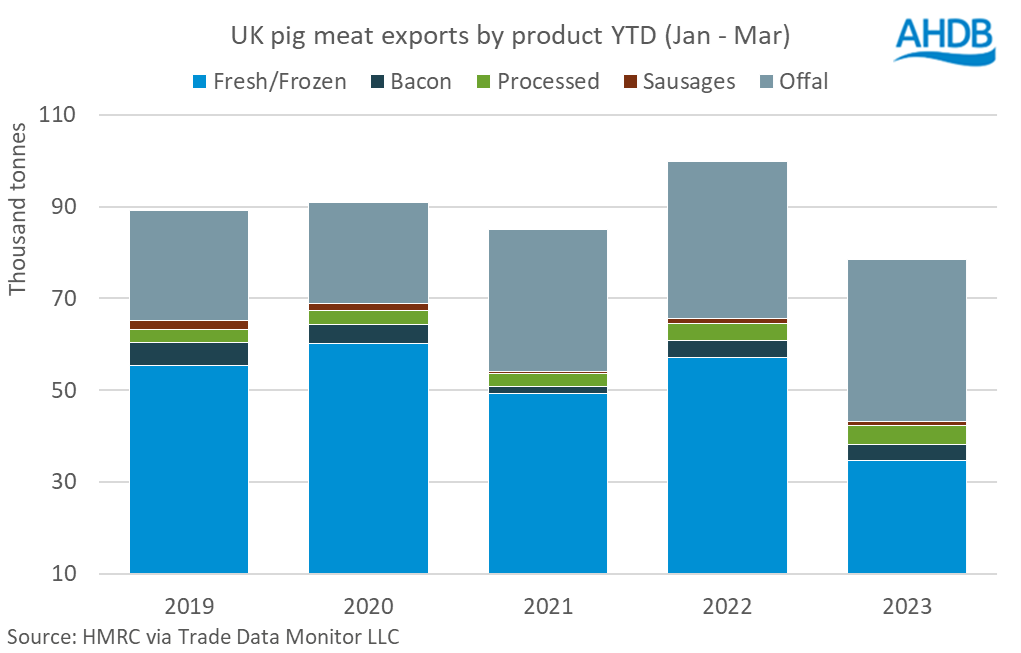

Exports

UK pork production has been severely impacted by the market conditions of the past 2 years, leading to tight domestic supplies. This has had a direct impact on our trading volumes, with less product available for export. In the first quarter of 2023 (Jan-Mar) the UK has exported 78,500 tonnes of pig meat (including offal), a 21% drop year on year. This is the lowest volume shipped in the past 5 years with monthly volumes in February and March significantly behind the monthly 5-year averages (-13% and -24% respectively).

Shipments of fresh and frozen pork have seen the largest declines in volumes, down 39% year on year to 34,700 tonnes. This has resulted in the market share of exports made up of fresh and frozen pork product contracting to 44%, down from 66% 5 years ago. In contrast, shipments of offal have recorded a small increase, with volumes up 3% year on year to 35,300 tonnes. This has led to offal now taking the largest market share of exports at 45%, up from 24% 5 years ago. Although offal remains a low value product, it is positive to see uptake in the market increase as ultimately this adds value to the whole pig carcase by aiding with carcase balance and reducing waste.

Shipments to all major trading partners were down year on year. Volumes sent to the EU and the Philippines were down 10,900 tonnes and 4,600 tonnes respectively, while China saw a smaller decline of 2,100 tonnes. However, they were some small gains in volumes made in the wider East Asia region, demonstrating how important the region is to the pork industry. Shipped volumes to Singapore doubled year on year and volumes to South Korea increased 36%, albeit from low bases.

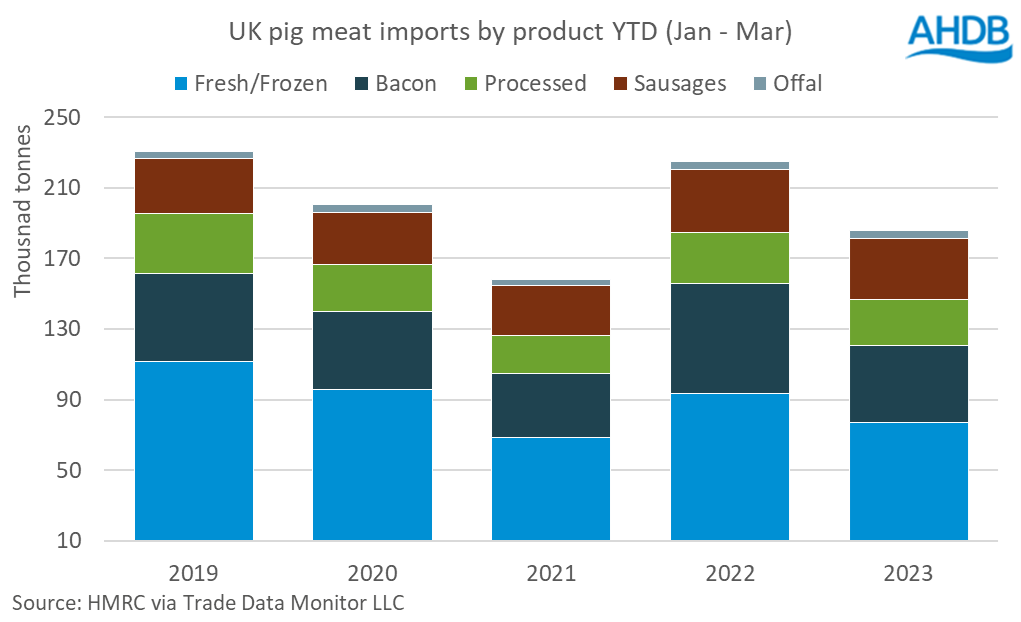

Imports

In normal times, when domestic supplies are tight, we expect to see import volumes grow; however it is clear we are not in normal times. Inflation remains high, despite tentative signs of easing, driving a cost-of-living crisis for consumers which has lead to weakening domestic demand. The latest data (52 weeks ending 14 May) shows volumes of pork purchased in the retail market have fallen by 3%. Added to this, the European pig market is also running on tight supplies, reducing product availability and price competitiveness.

These factors have resulted in UK pig meat imports for the year to date (Jan-Mar) declining 17% year on year to 185,600 tonnes. Although this is not as low as the total volume for the first 3 months of 2021, when our departure from the EU impacted trade flows, it is significantly below the 5 year average (-10%).

All key product categories have recorded import volume declines in 2023 so far. Bacon has seen the largest volume drop, down 29% year on year to 43,900 tonnes. This volume loss has resulted in the market share of bacon in UK imports dropping from 28% in Q1 2022 to 24% in Q1 2023. Fresh and frozen pork retains the largest market share of imported product to the UK at 41% but has also seen a significant fall in volumes, down 18% year on year to 77,000 tonnes. However, the sausage category has only recorded a small dip, down 3% year on year, totalling 34,300 tonnes. This is a 10% increase on the 5 year average for Q1 imported sausage volumes and has resulted in the category increasing its market share of UK imports to 18% in 2023.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.