Pig prices continue to soften: Pork market update

Thursday, 19 February 2026

Key points

- The EU spec SPP stood at 188.03p/kg for the week ending 14 February, putting the measure down 14.79p on the year

- Defra clean pig slaughter fell by 3% in January 2026 year-on-year, however production was propped up by carcase weight growth

- Meanwhile, the price gap between the EU and UK has narrowed marginally as European prices have stabilised. Despite the price disparity, UK pig meat import volumes remained subdued in December

- More recently, new cases of ASF have been detected in wild boar outside the original containment zone in Spain. This remains a fluid situation and a crucial watchpoint for markets

SPP

The EU spec SPP stood at 188.03p/kg for the week ending 14 February, down 0.77p from the previous week. Prices are now 14.79p/kg lower than a year ago and at the lowest level since June 2022.

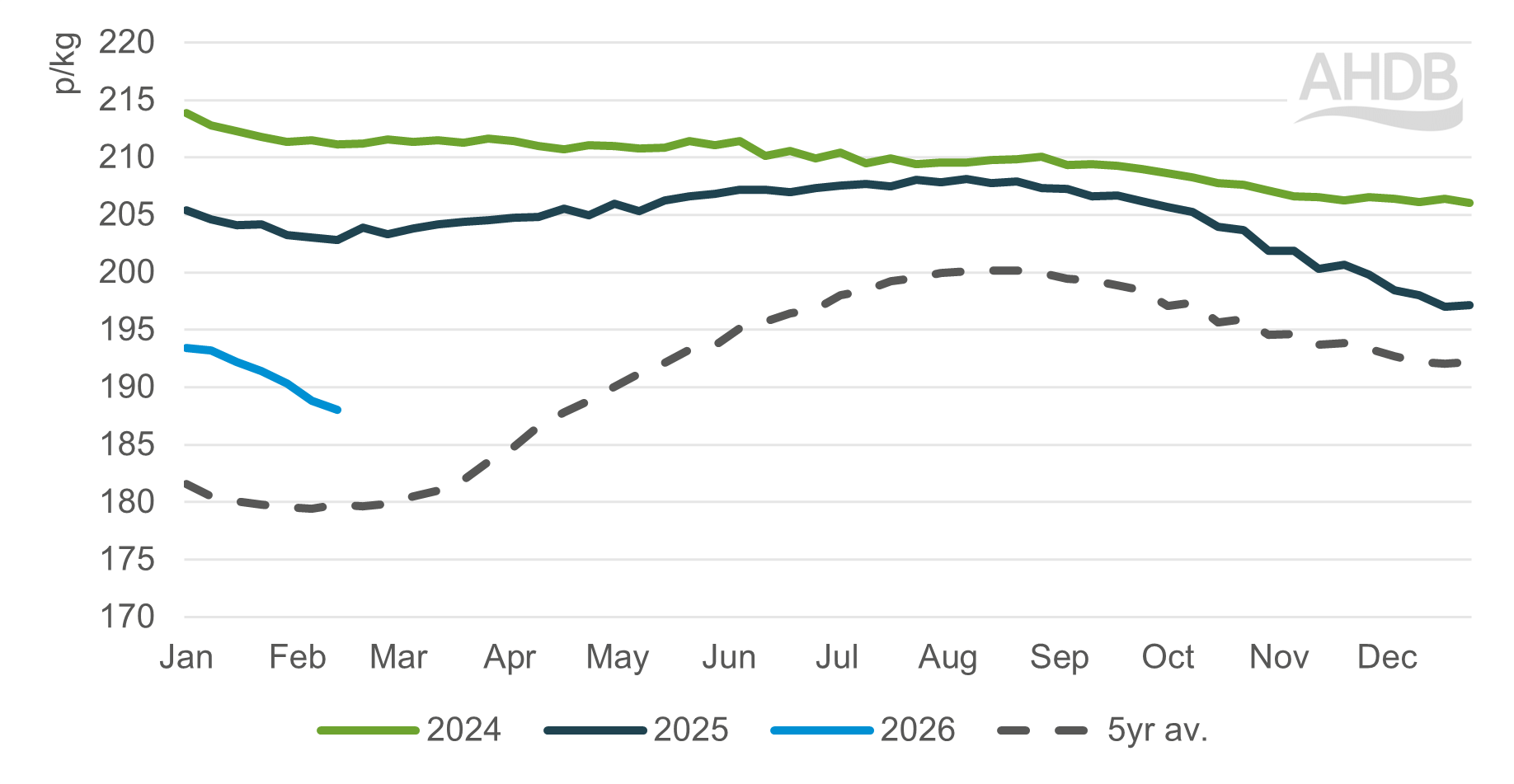

Figure 1: Trends in the GB standard pig price (SPP – EU spec)

Source: AHDB

The line chart in Figure 1 shows trends in the GB standard pig price (SPP – EU spec) for the past three years (2024 in green, 2025 in dark blue, 2026 in light blue). The chart also shows a five-year average comparison in the hashed grey bar.

Throughput

Defra’s latest figures put UK clean pig slaughter at 872,000 head, steady on the month but down 3% versus January 2025. January 2026 had one fewer working day than January 2025.

More recently, AHDB estimated clean pig slaughter fell back from the uplift noted in the week ending 7 February to 162,700 head in the latest reporting week.

Market reports describe a surplus of pigs in the market and on farm currently, with extra kill days having been implemented in some cases to work through supplies.

Pressure on the market is compounded by carcase weights, which averaged 95.28kg in the week ending 14 February, down slightly from the previous week but still up over 3kg on the year, and above 2022 levels.

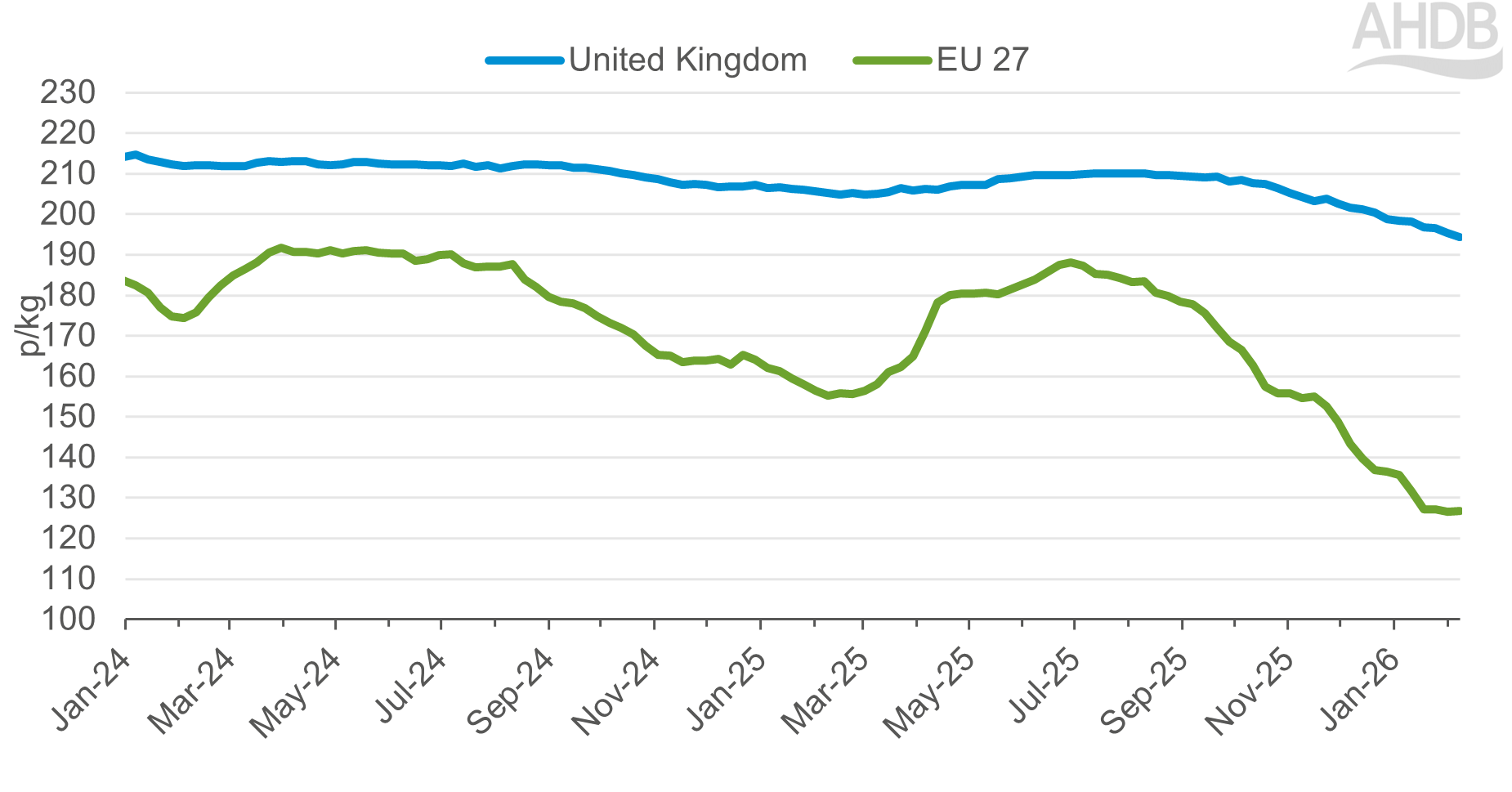

EU reference prices

EU pig prices continued to ease through January, but since the week ending 25 January, the declines have appeared to stall.

The EU reference price averaged 126.66p/kg equivalent in the week ending 8 February, up 0.11p from the week previous and down just 0.44p/kg from two weeks ago.

Despite this marginal uplift, the price remains significantly lower than last year, by 28.58p.

The gap between average EU and UK reference prices peaked at 69.56p for the week ending 18 January. By the week ending 8 February, this had narrowed to 67.73p.

Figure 2. UK and EU weekly grade S reference pig prices

Source: Eurostat

The line chart in Figure 2 shows the evolution of weekly UK (blue line) and EU (green line) reference pig prices for grade S pigs.

UK imports subdued in December

Despite the widening price differential UK imports of pig meat remained subdued in December, with volume losses from most suppliers. Total volumes (including offal) totalled 58,500 tonnes, down 8,700 tonnes (-13%) from December and down 5,800 tonnes (-9%) on the year.

ASF situation

Meanwhile, new ASF cases continue to be detected in Spain outside of the original containment zone. At time of writing (18 Feb), there have been 31 reported outbreaks spanning 162 positive cases in wild boars in 7 municipalities.

Spanish authorities have responded with further restrictions on the movement of people and livestock, increasing the size of the high-risk zone, pushing prevention efforts and farm surveillance. Importantly, the virus is still (at time of writing) only in wild boar. A further 1,112 captured / found boar have tested negative for the virus in the region.

Reports suggest that the export situation regarding open / closed markets remains unchanged. This situation and market impact remains critical to monitor.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: